October 22, 2009

Global Market Comments

October 22, 2009

Featured Trades: (XOM), (DBA),

(USO), (RJI), (AFRICA), (AFK), (GAF), (EWH, (FXI)

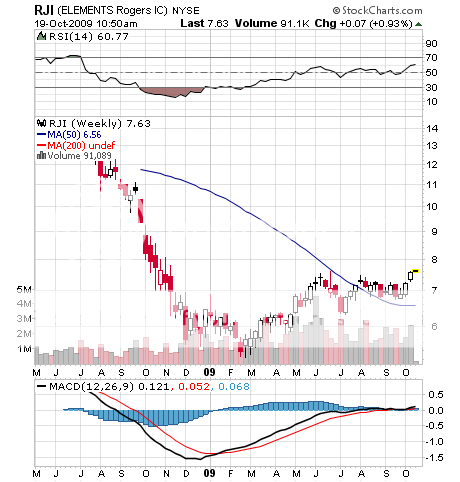

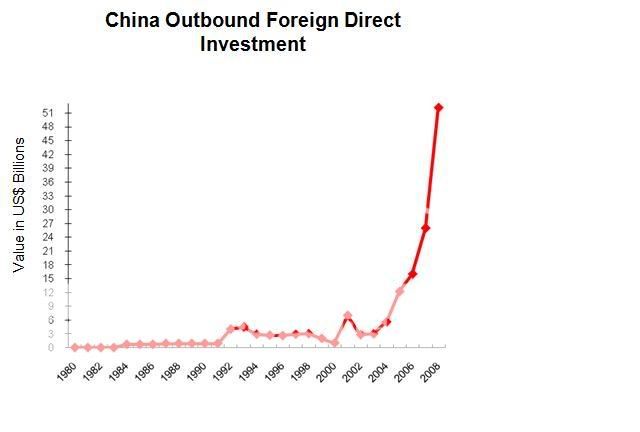

1) Those of you searching for the 'new normal' better take a close look at the China National Offshore Oil Company's (CNOC) efforts to top Exxon Mobil's (XOM) $4 billion bid for development rights to a giant new field off West Africa. This is only the latest chapter in a global bidding war for essential resources they, and we, need. Long gone is the day when the Standard Oil Company only needed to deliver King Saud a new Cadillac every year to assure rights to his kingdom's oil supplies, even though it often had to be towed by teams of camels, as there was no refining capacity yet on the peninsula. Decades later, I was part of a SWAT team at Morgan Stanley whose schmoozing kept the crude flowing and the cash surpluses recycling. Having grown up in the desert near Indio, California, I was the only one in the company who actually liked caravanning out into the desert to scoop up cooked rice with my fingers off of giant brass platters, and guzzle illicit Johnny Walker Red, said to be smuggled in by a wayward member of the royal family. I never did get used to the sheep brains, though. But I digress. To the current generation of oil traders, I might as well be talking about the Pax Romana than the Pax Americana, which is now equally ancient history. The hard truth is that they are out there bidding against the new 800 pound gorilla in the market, as are others for coal, iron ore, copper, gold, silver, wheat, corn, soybeans, and myriad other essentials. If you have any doubts about China's acquisitive determination, look at the chart below showing that the Middle Kingdom's outbound direct investment is outstripping inbound investment for the first time. Will the Pebble Beach Golf Course next? For you and I, this means we can count on the price of everything to go up in the future, a lot. Keep food, commodity, and energy ETF's permanently on your radar, like the PowerShares agricultural (DBA), the Rogers International Commodities (RJI), and the Oil Trust (USO). Jim Rogers, are you listening?

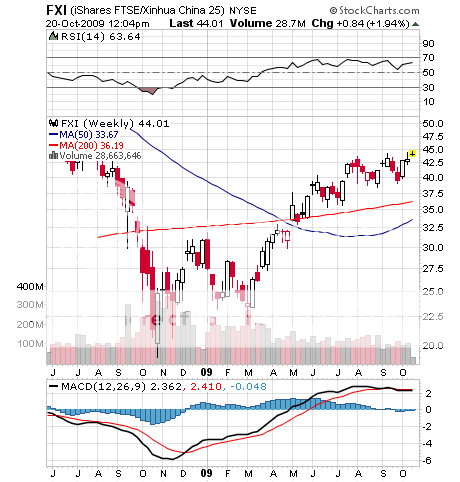

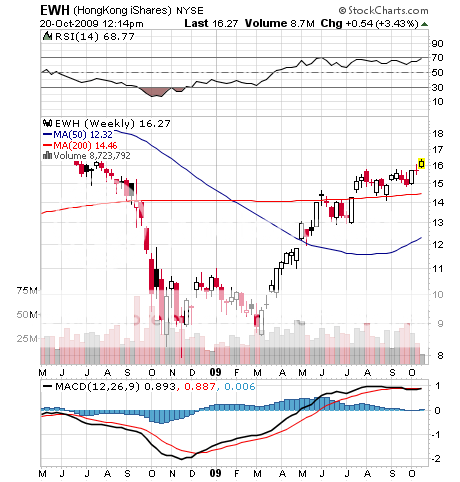

2) Two of my favorite picks for the year blasted through to new highs last night, the Hong Kong ETF (EWH) and the China ETF (FXI). Even Bono is singing about Chinese stocks going up. The FXI is now up a staggering 136% from the March lows, compared to a measly 65% for the S&P 500. Looks like those decades of eating fish heads and rice are finally paying off for me. Have you ever noticed how the quality investments rise much faster than the dodgy ones over time? At least the global wave of liquidity is surging into the good names, not only just the crap, as it is here in the US. Jim Rogers, are you listening yet?

3) Feel like investing in a state sponsor of terrorism? How about a country whose leaders have stolen $400 billion in the last decade and have seen 300 foreign workers kidnapped? Another country lost four wars in the last 40 years. Still interested? How about a country that suffers one of the world's highest AIDs rates, endures regular insurrections where all of the westerners are massacred, and racked up 5 million dead in a continuous civil war? Then Africa is the place for you, the world's largest source of gold, diamonds, chocolate, and cobalt! The countries above are Libya, Nigeria, Egypt, and the Congo. Below the radar of the investment community since the colonial days, the Dark Continent has recently been attracting the attention of large hedge funds and private equity firms. Goldman Sachs has set up Emerging Capital Partners, which has already invested $1.6 billion there. China sees the writing on the wall, and has launched a latter day colonization effort, taking a 20% equity stake in South Africa's Standard Bank, the largest on the continent. In fact, foreign direct investment last year jumped from $53 billion to $61 billion, while cross border M & A leapt from $10.2 billion to $26.3 billion. The angle here is that all of the headlines above are in the price, that price is very low, and the perceived risk is much greater than actual risk. Price earnings multiples are low single digits, cash flows are huge, and returns of capital within two years are not unheard of. The reality is that Africa's 900 million have unlimited demand for almost everything, and there is scant supply, with many firms enjoying local monopolies. The big plays are your classic early emerging market targets, like banking, telecommunications, electric power, and other infrastructure. For example, in the last decade, the number of telephones has soared from 350,000 to 10 million. It reminds me of the early days of investing in China in the seventies, when the adventurous only played when they could double their money in two years, because the risks were so high. This is definitely not for day traders. If you are willing to give up a lot of short term liquidity for a high long term return, then look at the Market Vectors Africa Index ETF (AFK), which has rocketed by 82% from the March lows to the recent highs, and the SPDR S&P Emerging Middle East & Africa ETF (GAF).

'Interest rates are at zero. The Fed has made it very painful not to take risk,' said Ed Yardeni, president of Yardeni Research, a former chief economist at EF Hutton and Federal Reserve Governor.