October 23, 2009

October 23, 2009

(SPECIAL WHEAT ISSUE)

Featured Trades: (AGU), (POT),

(MON), (DBA), (CAT), (JON STEWART)

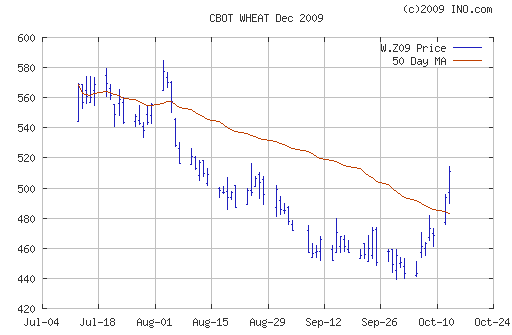

2) I don?t normally rely on National Geographic magazine for investment advice, but in the June issue the screaming long term bull case for the soft commodities is there in all its glory (see their cool website by clicking here). During the sixties, new dwarf varieties, irrigation, fertilizer, and heavy duty pesticides tripled crop yields, unleashing a green revolution. But guess what? The world population has doubled from 3.5 to 7 billion since then, eating up surpluses, and is expected to rise to 9 billion by 2050. Now we are running out of water in key areas like the American West and Northern India, droughts are hitting Africa and China, soil is exhausted, and global warming is shriveling yields.?? Water supplies are so polluted with toxic pesticide residues that rural cancer rates are soaring. Food reserves are now at 20 year lows. Rising emerging market standards of living are consuming more and better food, with Chinese pork production rising 45% from 1993 to 2005. The problem is that meat is an incredibly inefficient calorie transmission mechanism, creating demand for five times more grain than just eating the grain alone. I won?t even mention the strain the politically inspired ethanol and biofuel programs have placed on the food supply. It is possible that genetic engineering, sustainable farming, and smart irrigation could lead to a second green revolution, but the burden is on scientists to deliver. The net net of all of this is that food prices are going up, a lot. Entertain core long positions in corn, wheat, and soybeans on the next dip, as well as the second derivative plays like Agrium (AGU), Potash (POT) and Monsanto (MON). You might also look at the PowerShares Multi Sector Agricultural ETF (DBA). These will all surpass last year?s stratospheric highs at some point.

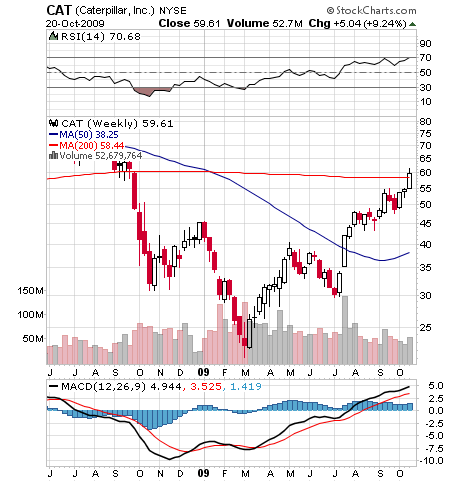

3) Caterpillar (CAT) presents itself as a bib overall, straw hat, work boot wearing, ?aw shucks,? rural Illinois company, much like the open pit miners and roustabouts who use their elephantine products. In reality, CAT is one of the slickest, most sophisticated multinationals selling, 70% of its wares to the harshest, most unforgiving corners of the globe, where sweaty, determined men rip things out of the ground for a living. That is why CAT is one of the few companies that I have followed on a bottom up basis for the last 35 years as a great ?tell? for the future course of all things I hold dear, like gold, silver, copper, iron ore, coal, and agriculture. In announcing his 53% drop in Q3 YOY earnings to $404 million, CEO Jim Owens made crystal clear that he is of the ?V? persuasion. He thinks a horrific -6.1% GDP quarter will be followed by two back to back 3%-4% quarters. Confidence is returning in the crucial growth markets in Asia, and rising commodity prices auger well for the future. Last year?s melt down was so traumatic that the best companies in the world radically cut inventories, which now have to be rebuilt in a hurry. Owens sees starts in housing, another big market for the firm, recovering to the one million level next year because pent up demand is building, and affordability is at a 25 year high. The only doubts stem from the disturbing degree that this spending is accomplished with borrowed money here and around the world. Last February, I told you I would lay down on the nearest railroad tracks and let a train run over me if you didn?t load up on CAT at $25 as a great indirect commodities play (click here ).? The big question now is whether Owens will put his money where his mouth is and hire new workers. Everything Owens says is incredibly bullish for energy and commodities of every flavor.

4) I am frequently asked where I find my best sources of market intelligence. Well here they are: Saturday Night Live, The Colbert Report, The Onion, and The Daily Show With Jon Stewart. How else would I know that Jim Cramer argued vociferously that Bear Stearns wouldn?t go under, a week before it croaked, or that Dora the Explorer had been appointed to the Supreme Court? For a great example of Stewart?s astute analysis, click here for his take on the Goldman Sachs (GS) earnings. I?ve seen my trading performance improve significantly when I keep the Comedy Channel on all day, instead of CNBC, which has degenerated into a wearisome series of softball questions and an endless infomercial for its owner, General Electric (GE). And now I hear it?s for sale. I though the ?cash for clunkers? program had ended. If you can?t have a sense of humor about this business, it?s time to retire.

QUOTE OF THE DAY

?The rate of profit is always highest in the countries that are going fastest to ruin,? said Adam Smith, on the dangers of ?overtrading? in The Wealth of Nations.