October 26, 2009

Global Market Comments

October 26, 2009

Featured Trades: (CANADIAN DOLLAR), (FXC),

(AUSTRALIAN DOLLAR), (FXA), (NEW ZEALND DOLLAR),

(BNZ), (RSX), (OIL), (ZACHARY KARABELL)

1) It?s all about the dollar, which I have despised all year like the red headed stepchild it has become (click here for my initial recommendation). The assured onslaught of federal debt issuance headed our way will be the overriding investment consideration for traders and portfolio managers for the next decade. That will knock the stuffing out of the greenback against every currency except the Zimbabwean dollar, and even that will rally when you get a long overdue regime change. As the new currencies of barrels of crude oil, 100 pound ingots of copper, or rail cars of iron ore won?t fit into your wallets or purses, foreign currencies offer a great dollar alternative. There was once an argument that foreigners piled into these currencies to capture a huge yield pickup, but even that advantage is now gone, with almost everything now yielding nothing. The soggy buck also explains a lot of what is going on in our stock market, with companies earning most of their revenues from increasingly wealthy foreigners, like those in technology, energy, and commodities. As I write this, I am looking at new one year highs for my favorite picks of the former British crown colony currencies of the Canadian dollar (FXC), up 28% YTD, Australian dollars (FXA) up 49% , and New Zealand dollars (BNZ), up 80%? dollars. Their bounteous natural resources, Anglo-Saxon contract law, a semi common language, and vibrant ports make them the safe bet of choice. Sure, they are all overheated and way overdue for a short term pull back. But over the long haul, you can count on the loony to hit parity, to be eagerly followed by the Aussie dollar, and then the kiwi. And once again, I am including a gratuitous photo of my favorite Canadian, Pamela Anderson to pique your interest.

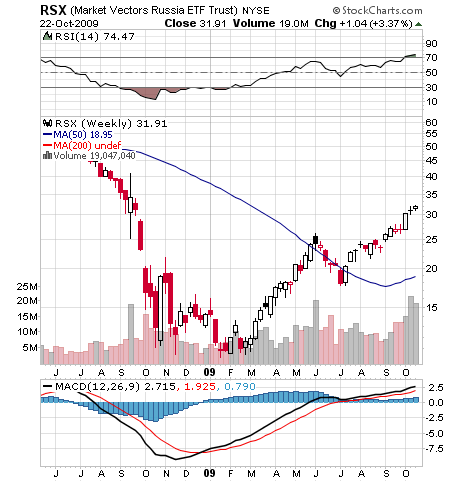

2) Last January I was extremely positive about building long equity exposure in Russia, one of the two BRICKS that is a big energy exporter (click here for the call ). I predicted that the Market Vectors Russia ETF (RSX) would deliver double the upside of the S&P 500 in the imminent bull market. Well I lied. It actually tripled, while the Dow eked out a measly 70%. It even would have worked as a market neutral pairs trade, long Russia, short the US. This was an oil play on steroids, and with crude then trading in the $30s, how hard of a call was that? A recovery in the ruble also gave you a nice hockey stick effect in the dollar traded ETF. The bounce in the Russian currency stopped the country?s reserve outflow dead in its tracks, and enabled the Russian Central Bank to start slashing interest rates from the nosebleed territory of 13%. There is plenty of room for further cuts. But Russia is not out of the woods yet. Some 30% of the $780 billion in corporate debt is due for rollover this year, and the unemployment rate is at 9.5% and climbing. It also doesn?t help that they lock up oligarchs on bogus tax charges, and will expropriate foreign assets at the drop of a hat, as they did from Shell and British Petroleum. But none of my investors told me I could only do business with nice people who gave me a warm and fuzzy feeling. A rising oil price atone for all sins, as any Middle Eastern sheik can attest. You might want to take a shower after you write the trade ticket, buy hey; sometimes you just have to follow the money. Just watch out for the volatility.

3) Zachary Karabell, president of River Twice Research, is one of the few original thinkers out there who also has a sense of humor. So there?s more than one? Zach has brought his considerable talents to bear on the current state of the Chinese-American relationship in a new book, Superfusion: How China and American became One Economy and Why the World?s Prosperity Depends On It.? International trade has fused the two countries into a single economic unit that accounts for a quarter of the world?s population and a third of its GDP, despite wildly different cultures, much like the loose confederation that makes up the European Community. The Middle Kingdom now has reserves of $2.3 trillion, which is overwhelmingly invested in the US. Where else can it go? That enabled them to step up and play an important role in the bail out of the US financial system this year. But it is an imbalanced agglomeration, with Americans over consuming and under saving and the Chinese doing the reverse. This has to stop, lest the symbiotic relationship tears itself apart. The tit for tat, storm in a tea cup, where the US imposed punitive import duties on Chinese tires and the they retaliated with a ban on American chicken feet (yes, they eat them, yuk!), is a recent example. The reality is that old, boring industries that once might have fought tooth and nail for protection are now migrating to China en masse and finding new life. Bet you didn?t know that General Motors sells more cars in China than in the US, some 1.6 million this year? Don?t hold your breath waiting for China to float the Yuan, as it is one of the few tools that give the Mandarins in Beijing direct control of a huge, disparate economy. Chinese military spending is so parsimonious that it won?t remotely comprise a threat to the US. What little they have is directed at potential regional aggressors, like Japan, India, and Russia. The greatest risk to the existing relationship is that Chinese growth continues so rapid, that it pits them against the world in resource bidding wars, which could get ugly. With crude at $82 and copper at $3, has that already started? The book is well worth a read for some excellent ?out of the box? analysis. Does anyone have any good recipes for chicken feet?

QUOTE OF THE DAY

?Looking at dreadful air pollution outside, we see an environmental disaster and the Chinese see progress,? said Zachary Karabell, president of River Twice Research.