October 6, 2010 - The Seductive Allure of Brazilian Bonds

(SPECIAL FIXED INCOME ISSUE)

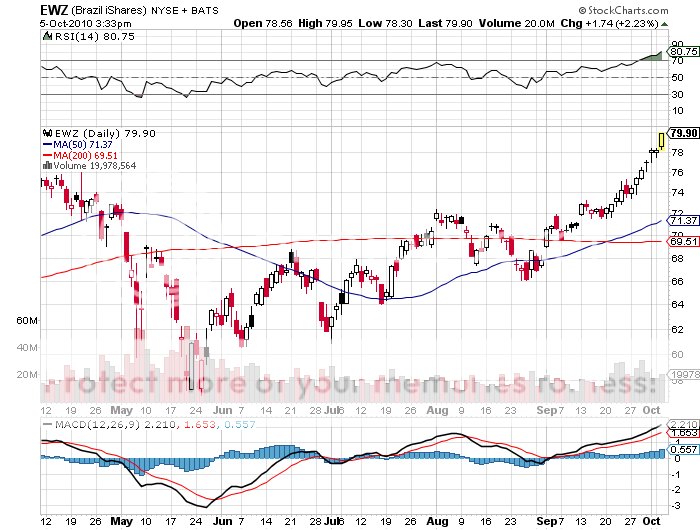

Featured Trades: (BRAZILIAN BONDS), (EWZ)

2) The Seductive Allure of Brazilian Bonds. OK, let's say that if you don't own bonds, but someone is holding a gun to your head, dangling you by your ankles outside a window on a high floor, or threatening to cut you off their Christmas card list, if you don't buy some. Or worse, you offended you boss's wife at the last office party, and as a result have been put in charge of running the firm's bond fund. What do you do?

There is only one place on the planet I would consider owning bonds right now, and that is in Brazil. Local government one year debt, denominated in the Brazilian currency, the real, is yielding 11.3% . The real is appreciating against the dollar, offering investors a double leveraged effect that will deliver returns above and beyond the coupon. The one year maturity eliminates your duration risk. Inflation is under control at 4.7%. With GDP forecast to grow at 7% a year, the country has a long and merry series of credit upgrades to look forward to.

Capital is pouring in to take advantage of these lofty, double digit yields, with foreign investors snapping up over $5 billion of the $900 billion market this year. These bonds have become especially popular with investors in low yield countries, like Japan, where ten year bonds pay a parsimonious 0.90% a year (that's no typo), and increasingly in the US.

Why are yields so high?? Brazil is still laboring under the weight of its own history, when many of these issuing entities defaulted during troubled times in the seventies and eighties. It turns out that Latin American generals aren't very good at running countries or economies. There is also some concern that growth will become so white hot, that the government would be forced to raise rates to cool inflation, burning bond investors.

If you are a major hedge fund with a 24-hour trading desk in Rio de Janeiro, you will have no trouble picking up a position here, if you haven't already done so. If not, you may have a problem finding paper, as these securities are not to be found in your standard online trading account. If anyone knows better, please let me know.

The only easy way in is through an international bond fund, like the (PCY), which I have been recommending for over a year, with stellar results (click here for the call). The problem here is that Brazil never accounts for more than 10% of these funds, and your gains are diluted by other positions you would rather not have, such as in Greece and Portugal. You could also learn the salsa, become fluent in Portuguese, and pick up a Brazilian girlfriend to get access to the local market. That strategy might offer other advantages as well.

Check Out Those Double Digit Yields in Brazil