Oil Isn't What It Used to Be

Virtually every analyst has been puzzled by the endless weakness in oil prices (USO), (DIG), (DUG), which have been in a downward spiral for more than a year. Since Russia first invaded Ukraine, the price of Texas tea has collapsed from $132 to $66 a barrel.

In fact, oil ain’t what it used to be.

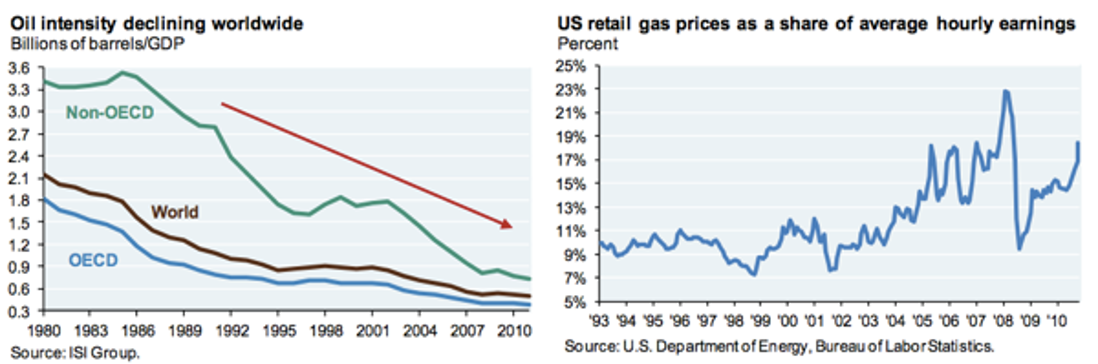

The first chart below shows the number of barrels of oil needed to generate a unit of GDP, which has been steadily declining for 40 years. The second reveals the percentage of hourly earnings required to buy a gallon of gasoline in the US, which has been mostly flat for three decades, although it has recently started to spike upwards.

The bottom line is that conservation, the rollout of more fuel-efficient vehicles and hybrids, and the growth of alternatives, are all having their desired effect. Notice how small all the new cars on the road are these days, many of which get 40 mpg with conventional gasoline engines.

As for my own household, it has gone all electric. Some 15% or all the new cars sold in the US are EVs, which don’t use oil at all, except for a tiny amount of grease on the wheels and suspension

Developed countries are getting six times more GDP growth per unit of oil than in the past, while emerging economies are getting a fourfold improvement.

The world is gradually weaning itself off of the oil economy. But the operative word here is “gradually”, and it will probably take another two decades before we can bid farewell to Texas tea, at least for transportation purposes.

But the Mileage is Great!