Overcoming Uncertainty in 2025

There have been many prognosticators concerned that next year is trouble for tech stocks, but I am here to dispel that notion.

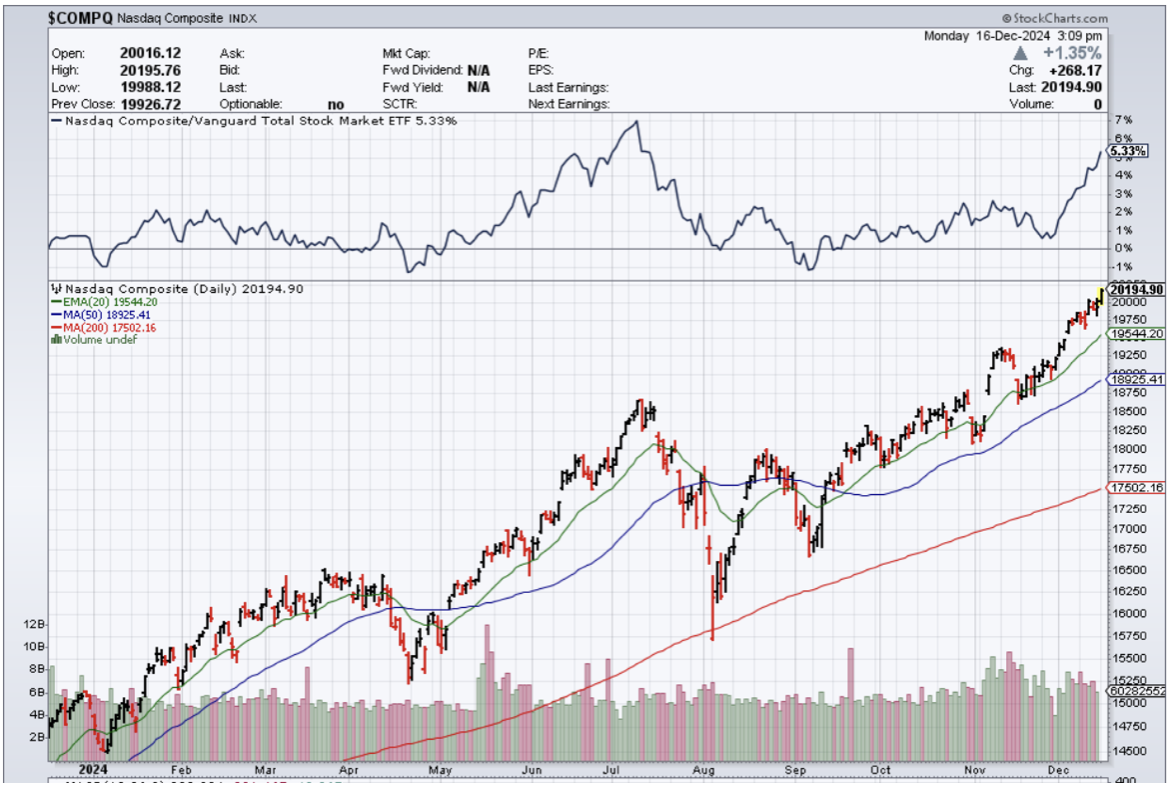

The uncertainty has permeated into global investment fund management with some even calling for a mild pullback in tech valuations ($COMPQ).

Concerns are concerns and that doesn’t mean we will get a wild selloff or a crash.

There are still too many drivers that tech can pull to bail itself out of any hole they or others might dig for them.

I do agree with the notion that the era of super growth for the current tech business model is over and we are really trying hard to eke over the bar every quarter now.

One trend that could go into overdrive next year is the acceleration of AI investment from funds waiting on the sidelines.

I’ve mentioned to people off the record the staggering amount of capital that has poured into the US after the election.

The surprising part of this is that a meaningful amount of these funds are foreign.

Remember that in places like China and Europe, economics are going in the wrong direction and investment funds have nowhere to place their capital.

Europe has overregulated itself to death more interested in protecting the old money and destroying anything closely relating a start-up.

I argue to clients that Europe is the last place on earth I would ever start a tech company.

China has reached the end of its current growth phase and now has a system that won’t change just to protect the incumbents.

Inherently, Chinese tech could turn into the next Japan.

The end results are a terrible foreign tech scene in most places not named the United States.

Japan, for a matter of fact, has produced people like Softbank CEO Masayoshi Son who try to scrape as many billions together to throw into US tech.

Part of the foreign capital I talk about comes from him, but also other massive funds such as Norway’s sovereign fund valued at over $2 trillion now.

More than 40% of that portfolio is in US tech stocks giving them ammunition for an even bigger step up next year.

President-elect Donald Trump, with SoftBank Group CEO Masayoshi Son at his side, announced that SoftBank would invest $100 billion in the U.S. over the next four years in what would be a boost to the U.S. economy.

Trump said in his joint appearance with Son that the investment would create 100,000 jobs focused on artificial intelligence (AI) and related infrastructure, with the money to be deployed before the end of Trump's term.

Son has been a strong proponent of the potential for AI and has been pushing to expand SoftBank's exposure to the sector, taking a stake in OpenAI and acquiring chip startup Graphcore.

The uncertainty is warranted, because we will replace a U.S. administration with a vastly different view of the economy and tech scene.

I do believe we missed a bullet. If Harris won, she would of choked off the vitality of Silicon Valley and placed power and control in the hands of a few.

I say that even though tech stocks performed greatly the past 4 years.

I don’t believe that tech stocks are about to lose steam and the case for the new administration turbo charging the economy is definitely realistic.

Trump wants to cut U.S. corporate tax to 15% and that 6% drop for U.S. tech firm would represent a gargantuan windfall to the bottom line.

If Silicon Valley is the beneficiary pro-corporate legislation, the sky is the limit for tech stocks next year even if they don’t create anything game changing.

Playing with house money is fun and we could be in a situation next year where U.S. tech firms can shoot for the stars.