Playing the Short Side with Vertical Bear Put Debit Spreads

I have a new training video on how to execute a vertical bear put debit spread. You can watch the full 34:17 video by clicking here.

The last one was made seven years ago.

Since then, we have learned a lot from customer questions. The nature of the options markets has also changed. I recommend watching it on full screen so you can read all the numbers on my options trading platform.

I am normally a pretty positive person.

For me, the glass is always half full, not half empty, and it’s always darkest just before dawn. After all, over the past 100 years, markets rise 80% of the time, and that includes the Great Depression.

However, every now and then, conditions arise where it is prudent to sell short or make a bet that a certain security will fall in price.

This could happen for myriad reasons. The economy could be slowing down. Companies might disappoint in earnings. “Sell in May and go away?" It works….sometimes. Oh, and new pandemic variants can strike at any time.

Other securities have long-term structural challenges, like the US Treasury bond market (TLT). Exploding deficits, as far as the eye can see, assure that government debt of every kind will be a perennial short for years to come.

Once you identify a short candidate, you can be an idiot and just buy put options on the security involved. Chances are that you will overpay and that, accelerated time decay will eat up all your profits even if you are right, and the security in question falls. All you are doing is making some options traders rich at your expense.

For outright put options to work, your stock has to fall IMMEDIATELY, like in a couple of days. If it doesn’t, then the sands of time run against you very quickly. Something like 80% of all options issued expires unexercised.

And then there’s the right way to play the short side, i.e., MY way. You go out and buy a deep-in-the-money vertical bear put debit spread.

This is a matched pair of positions in the options market that will be profitable when the underlying security goes down, sideways, or up small in price over a defined limited period of time. It is called a “debit spread” because you have to pay money to buy the position instead of receiving a cash credit.

It is the perfect position to have on board during bear markets, which we will almost certainly see by late 2019 or 2020. As my friend Louis Pasteur used to say, “Chance favors the prepared.”

I’ll provide an example of how this works with the United States Treasury Bond Fund (TLT), which we have been selling short nearly twice a month since the bond market peaked in July 2016.

On October 23, 2018, I sent out a Trade Alert that read like this:

Trade Alert - (TLT) - BUY

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) November 2018 $117-$120 in-the-money vertical BEAR PUT spread at $2.60 or best.

At the time, the (TLT) was trading at $114.64. To add the position, you had to execute the following positions:

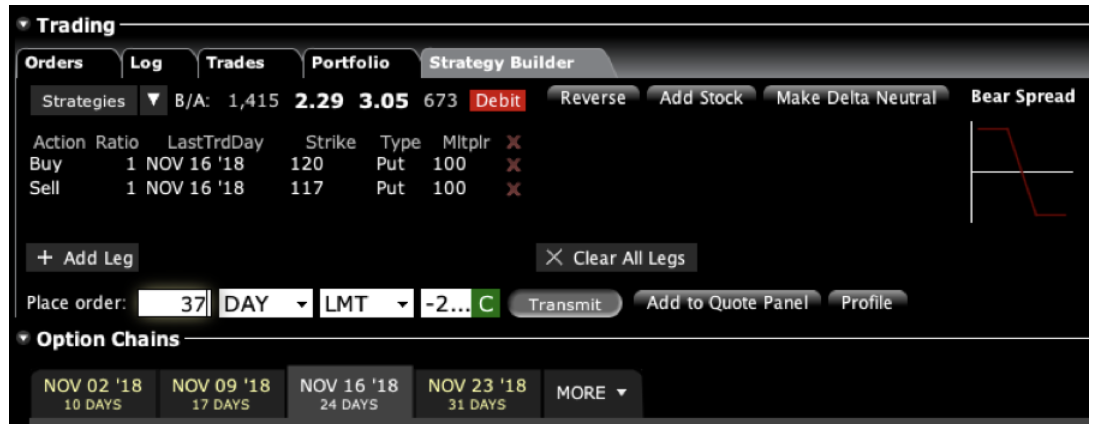

Buy 37 November 2018 (TLT) $120 puts at…….………$5.70

Sell short 37 November 2018 (TLT) $117 puts at…….$3.10

Net Cost:………………………….………..…………......….....$2.60

Potential Profit: $3.00 - $2.30 = $0.40

(37 X 100 X $0.40) = $1,480 or 15.38% in 18 trading days.

Here’s the screenshot from my personal trading account:

This was a bet that the (TLT) would close at or below $117 by the November 16 options expiration day.

The maximum potential value of this position at expiration can be calculated as follows:

+$120 puts

- $117 puts

+$3.00 profit

This means that if the (TLT) stays below $117 the position you bought for $2.60 will become worth $3.00 by November 16.

As it turned out, that was a prescient call. By November 2, or only eight trading days later, the (TLT) had plunged to $112.28. The value of the iShares Barclays 20+ Year Treasury Bond Fund (TLT) November 2018 $117-$120 in-the-money vertical BEAR PUT spread had risen from $2.60 to $2.97.

With 92.5% of the maximum potential profit in hand (37 cents divided by 40 cents), the risk/reward was no longer favorable to carry the position for the remaining ten trading days just to make the last three cents.

I, therefore, sent out another Trade Alert that said the following:

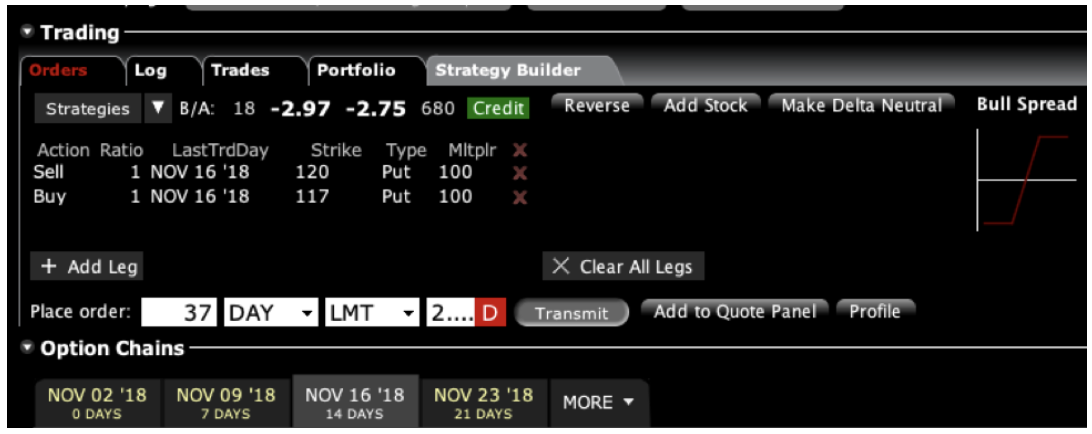

Trade Alert - (TLT) – TAKE PROFITS

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT)November 2018 $117-$120 in-the-money vertical BEAR PUT spread at $2.97 or best

In order to get out of this position, you had to execute the following trades:

Sell 37 November 2018 (TLT) $120 puts at……………........…$7.80

Buy to cover short 37 November 2018 (TLT) $117 puts at….$4.83

Net Proceeds:………………………….………..………….…..............$2.97

Profit: $2.97 - $2.60 = $0.37

(37 X 100 X $0.37) = $1,369 or 14.23% in 8 trading days.

Of course, the key to making money in vertical bear put spreads is market timing. To get the best and most rapid results, you need to buy these at market tops.

If you’re useless at identifying market tops, don’t worry. That’s my job. I’m right about 90% of the time and I send out a STOP LOSS Trade Alert very quickly when I’m wrong.

With a recession and bear market just ahead of us, understanding the utility of the vertical bear put debit spread is essential. You’ll be the only guy making money in a falling market. The downside is that your friends will expect you to pick up every dinner check.

But only if they know.

Understanding Bear Put Spreads is Crucial in Falling Markets