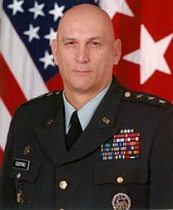

?The strength of the Army must be credible enough to keep the knuckleheads abroad from miscalculating and instigating conflicts which they can?t win,? said Army Chief of Staff, General Ray Odierno.

?There?s been a lot of lost face in asset allocation over the past five years. Who would have thought that government bond yields could have gone so low?? said Michael Turner, a strategist at Aberdeen Asset Management.

?Right now, our politics are holding us back. It?s like being the children of permanently divorcing parents. The political environment is a real downer for a lot of people, and their holding back,? said New York Times columnist, Tom Friedman, author of the book, That Used To Be US.

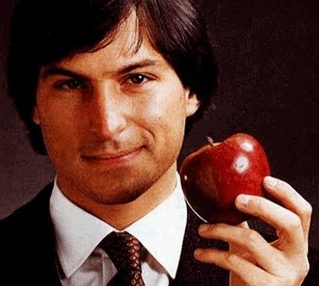

?Today, 20% of enterprises are using Apple computers on their desktop. For the first time in 30 years, for developers, it is Apple first, not Apple second. This fundamentally changes our investment thesis,? said Ann Winblad of Winblad Hummer Venture Partners.

?Rock stars get room keys. I get business cards,? said New York Times columnist, Tom Friedman, and author of the book, That Used To Be US.

I?ve said it many times. Energy?s share of GDP at 17% is a wall. When we get to 17%, we almost always have a recession. And by the way, we are at 15% now,? said Joe Petrowski, CEO of the Cumberland Gulf Group, a petroleum marketer.

?We can?t even have a decent conversation about tax reform because there is so much mythology out there,? said former Treasury Secretary, Paul O?Neill.

?Liquidity is not a financial term, it is a psychological term,? said former Federal Reserve governor Alan Greenspan.

?There will be much more printing of money because central bankers are willing to do that. This does solve problems, it postpones them so they can become larger,? said Mark Faber, publisher of the Gloom, Boom, and Doom Report.

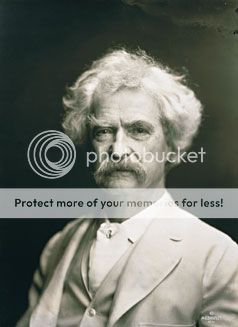

?I used to tell lies. But I?ve given it up, because the field has become overrun with amateurs,? said the great American 19th century humorist, Mark Twain.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.