?People that have complete disdain for government intervention in the economy and markets of the West have complete faith in nine guys in a room being able to figure out the very complex and rapidly growing Chinese economy,? said hedge fund manager Jim Chanos of Kynikos Associates, about foreign investors? unlimited faith in the Middle Kingdom?s politburo

My problem with the stock market is that I fail to see who the incremental buyer will be to take the S&P 500 to 1,500. It?s not going to be the retail investor who has been hit with a 34% drop in home prices, two market crashes in the last decade, and a flash crash while their incomes are not keeping up with inflation. The last thing on their minds right now is to buy stocks,? said Doug Kass of hedge fund Seabreeze Partners.

?The Bernanke put is still there, but it is far more out of the money that it was a few days ago,? said Doug Kass of hedge fund Seabreeze Partners.

?A statistical model built around a normal distribution when applied to markets can be a very dangerous thing,? said David Kelly of JP Morgan.

?Equities lead the risk appetite on the way up, and they will lead on the way down,? said Lincoln Ellis of the Linn Group

?It's very difficult to navigate a business through a paradigm shift. You must hard wire your system to second guess all the time, questioning what is next, and then what is next. You've got to retain optionality for both investment portfolios and the business your run to navigate this well,? said Mohamed El-Erian, co-chairman of the bond house PIMCO.

?The luckiest person in the world today is the baby being born in the United States. The outlook for this country is fantastic,? said Warren Buffet.

?Bankers will get away with whatever they can get away with. Our banking system is socially useless,? said an oversight body in the United Kingdom.

?When it?s raining gold, reach for a bucket, not a thimble,? said Oracle of Omaha Warren Buffet.

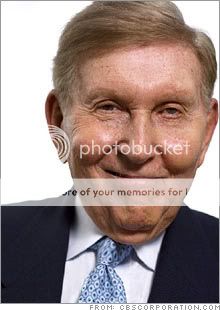

?Rupert Murdoch is very smart and is a great leader, but he?s made a mistake. He?s buried in ink, and in my view, there won?t be any newspaper business ten years from now. Fortunately, we?re buried in television and movies, and they?ll be here forever,? said Sumner Redstone, chairman of Viacom and CBS.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.