"We've seen the S&P 500 drop 50% twice in the last two decades. That is the new normal," said Richard Kang of Emerging Global Advisors.

"We've seen the S&P 500 drop 50% twice in the last two decades. That is the new normal," said Richard Kang of Emerging Global Advisors.

"Though the preachers of pessimism prattle endlessly about America's problems, I've never seen one who wishes to emigrate (though I can think of a few for whom I would happily buy a one-way ticket)," said Oracle of Omaha Warren Buffett.

"Traders are very good at looking at the second hand on the clock, but not so good with the hour hand," said Gene Munster of venture capital firm Loup Ventures.

"Every smart guy is tempted by leverage, and some are broken by it," said Oracle of Omaha Warren Buffett.

"Technology is going to be stealing market capitalization from other industries for the next ten years," said Gene Munster of Silicon Valley venture capital firm Loup Ventures.

Quote of the Day

"A lasting relationship with a woman is only possible if you are a business failure," said John Paul Getty, a Morgan Stanley billionaire client who was married five times.

"Success is the ability to go from one failure to another with no loss in enthusiasm," said the wartime British Prime Minister, Winston Churchill.

"If a cluttered desk is a sign of a cluttered mind, what is an empty desk a sign of?" asked Albert Einstein.

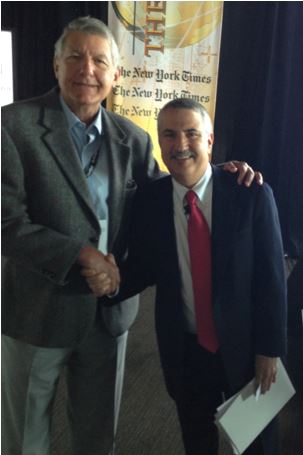

"If horses could have voted, there never would have been cars," said my friend, Tom Friedman, a columnist at the New York Times.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.