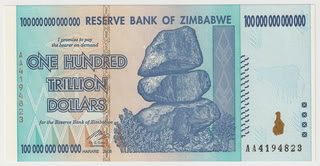

?Over the long term, all of the fiat currencies of the world are involved in a competitive devaluation. The structural stresses in most of the western economies are such that centrals banks will attempt to continue to substitute liquidity for solvency.? said Rick Rule, chairman of Sprott US Holdings, a precious metals specialist.

?People are investing with a rear view mirror. Last year, you had people legitimately scared out of the market. Unfortunately, you are losing a generation of investors at a time when they ought to be thinking about buying high quality stocks.? said Hersh Cohen of Clearbridge Advisors.

?Treat everyone you meet with professionalism and respect, but also have a plan to kill them.? said my friend, former Marine Corps General James ?Mad Dog? Mattis, the newly appointed Defense Secretary.

?Liquidity is a coward. It?s never around when you need it.? said market commentator, Jeff Saut.

?You want to rotate your money into the sectors where Donald Trump?s policies are potentially going to work: those are financials, health care, and industrials?. said Erin Browne, head of macro investing at UBS O?Connor.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.