?I must study politics and war that my sons may have liberty to study mathematics and philosophy. My sons ought to study mathematics and philosophy, geography, natural history, naval architecture, navigation, commerce, and agriculture, in order to give their children a right to study painting, poetry, music, architecture, statuary, tapestry, and porcelain,? said John Adams, the second US president.

?The Fed cannot permanently raise stock prices,? said James Bullard, president of the Federal Bank of St. Louis.

?It?s not overly frightening to have the Fed move away from massive accommodation. I think the market may struggle, but it is not a death blow,?

said James Paulson, chief investment strategist at Wells Fargo Asset Management.

?The lack of complacency is at odds with the view that the market has peaked?peaks are turned in when every last bear has thrown in the towel, and the bulls are screaming to buy from the roof tops,? said David A. Rosenberg, of research boutique Gluskin Sheff.

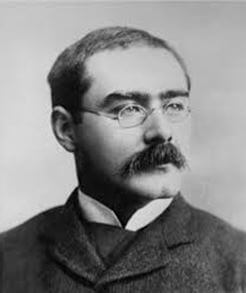

?I keep six honest serving men. (They taught me all I knew); Their names are What and Why and When and How and Where and Who.? said the writer, Rudyard Kipling.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.