Rally Caps On

The biotech sector just flipped its rally cap inside out. After a brutal losing streak, it's clawing its way back. The SPDR S&P Biotech (XBI) exchange-traded fund, a barometer for the sector, started to show signs of life when it soared by 5.7% last month, cresting over $100 a share for the first time in two whole years.

While champagne might be premature, this comeback is heating up, and whispers of a full-fledged rally are echoing through Wall Street.

After a rough patch that kicked off in early 2021, seeing the fund take a nosedive of over 60% by late October 2023, the tide began to turn last fall. Initially, whispers of lower interest rates in 2024 sparked interest across small-cap indexes, including our biotech heroes.

Yet, lately, the buzz is all about biotech's own merits — think breakthrough medical trials and the juicy prospect of big pharma playing Pac-Man with smaller but promising biotech firms to beef up their drug pipelines.

And let me tell you, if the current rally's got legs, we might just be witnessing the most thrilling biotech comeback in over half a decade. Especially if the merger and acquisition scene stays hot, we could see biotech stocks climbing even higher.

Take everything that happened in the sector in February as an example. Viking Therapeutics (VKTX) threw down the gauntlet with promising data on its weight loss drug, VK2735, making investors sit up and take notice.

Actually, this candidate is shaping up to be a formidable rival to obesity treatments from Eli Lilly (LLY) and Novo Nordisk (NVO), sending Viking's shares skyward by a jaw-dropping 121% in a single day.

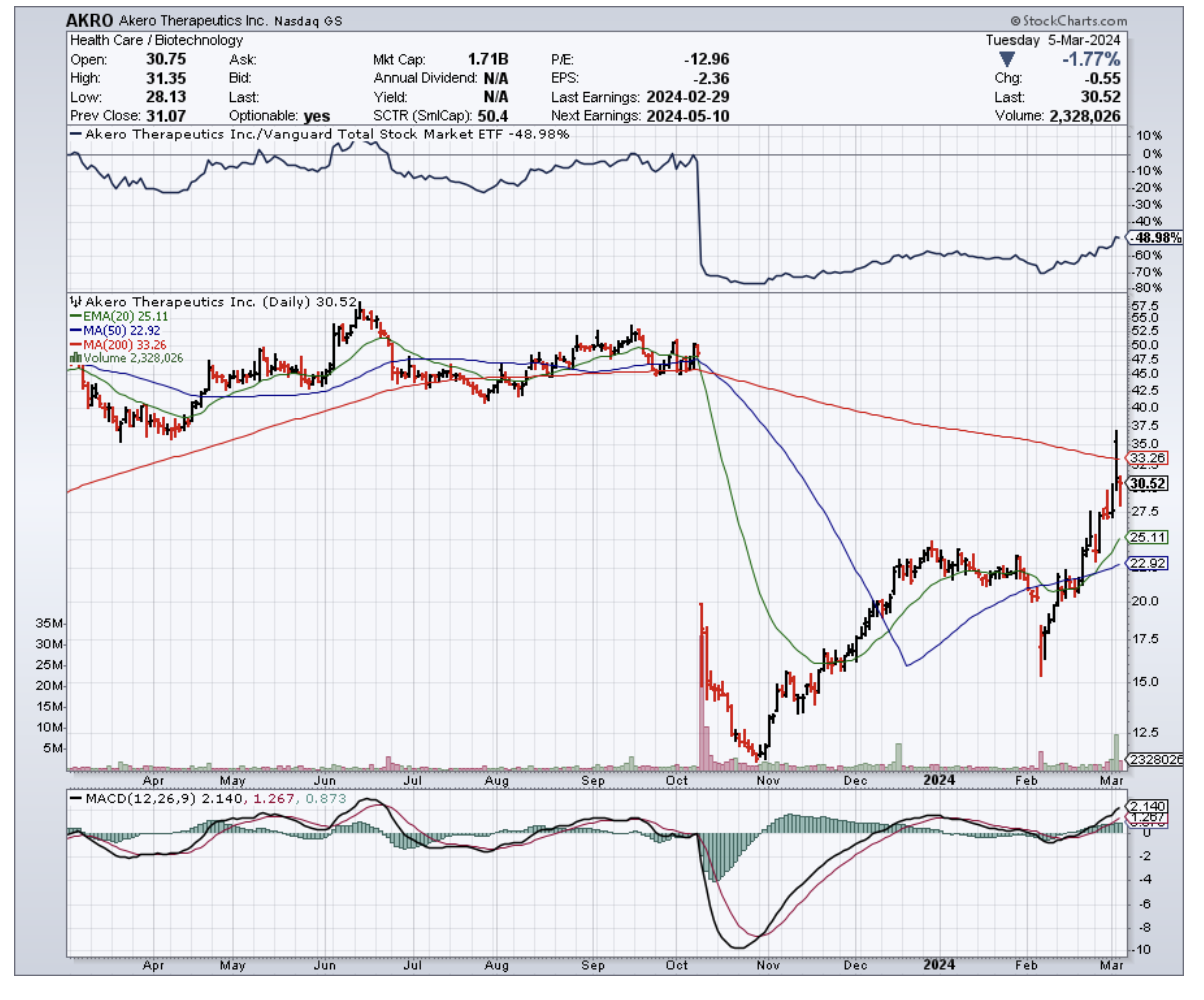

And it's not just Viking stealing the spotlight. Another biotech named Akero Therapeutics (AKRO) also bounced back with some impressive data of its own, challenging the doom and gloom that settled over biotech firms following Eli Lilly's bombshell MASH trial results.

Akero's mid-stage study showed that their drug, efruxifermin, could significantly roll back liver fibrosis in MASH patients — putting a whopping 75% of high-dose recipients on the mend, a stark contrast to the 24% placebo group.

This revelation was a game-changer, especially after Lilly's tirzepatide threw the sector for a loop, hinting at a potential endgame for MASH-specific treatments. But while Lilly's announcement left many details to the imagination, Akero's clear-cut results have reignited excitement over what might be the best MASH treatment yet seen.

As expected, in the midst of this resurgence, the likes of Viking and Akero are catching eyes not just for their groundbreaking treatments but also as tantalizing acquisition targets. Heavyweights like Gilead Sciences (GILD), Bristol Myers Squibb (BMY), Amgen (AMGN), and Pfizer (PFE) are said to be circling, each eyeing a slice of the biotech pie.

As for the biotech investment landscape in general, it's buzzing with renewed vigor. The early months of 2024 have welcomed a smattering of biotech IPOs, a refreshing change after a long drought. CG Oncology's late January debut practically set the market ablaze, doubling in value on its first trading day.

Moreover, public biotechs have found a lifeline in PIPE deals, sidestepping the regulatory hoops of secondary offerings. For instance, Denali Therapeutics' (DNLI) recent PIPE deal, expected to rake in $500 million, is proof of the sector's warming investment climate.

So, dust off those rally caps because the biotech sector isn't just back in the game – it's swinging for the fences.

Breakthrough treatments, a sizzling M&A market, and investors throwing their support behind innovation — this rally has all the ingredients to paint a bright future for the industry. While there will be bumps along the road, one thing's for sure: the biotech sector is poised for a season no one wants to miss.