Reach for Yield With Master Limited Partnerships

The dramatic collapse in the price of oil is creating a rare opportunity to get into some of the highest yielding paper in the financial markets, master limited partnerships (MLP)?s. These are LP?s that are publicly traded on a securities exchanges. These unique and versatile instruments combine the tax benefits of a limited partnership with the liquidity of publicly traded securities.

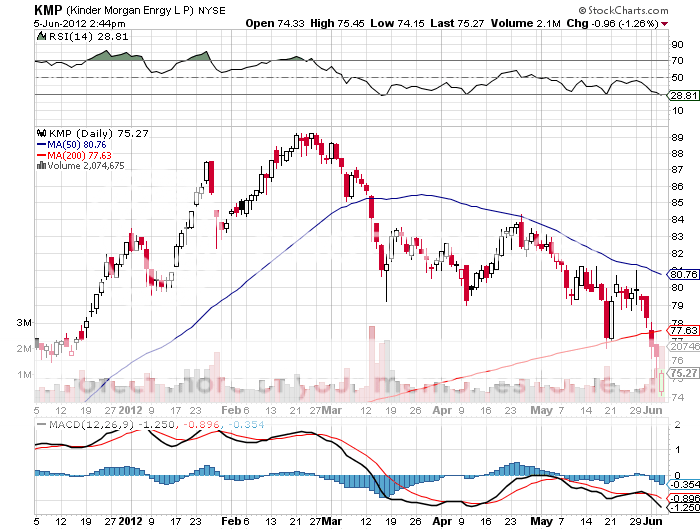

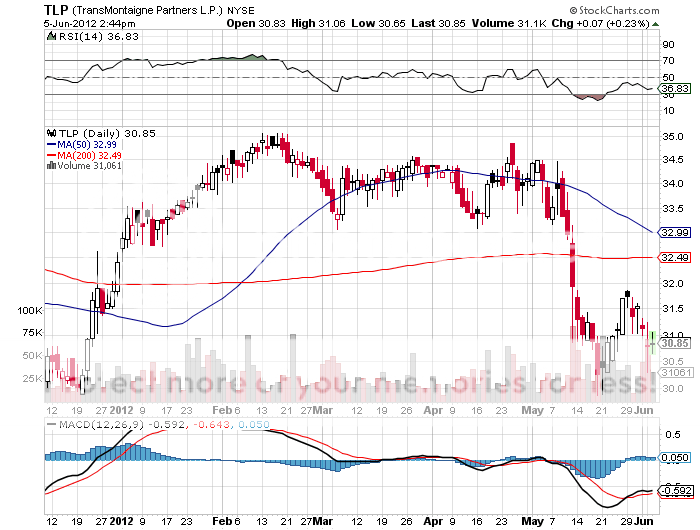

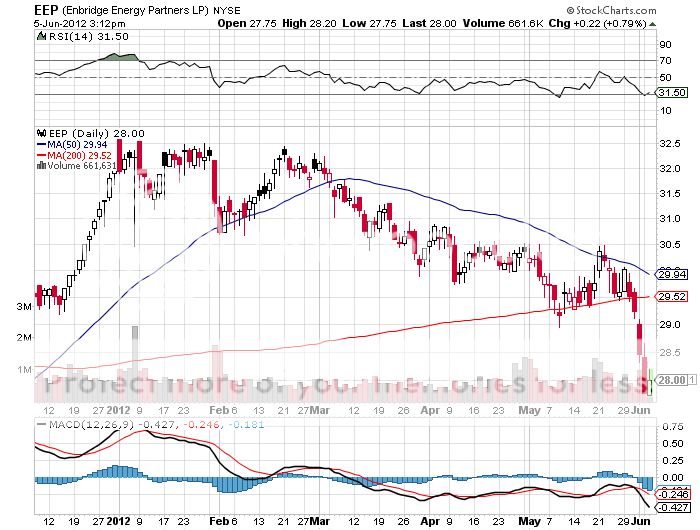

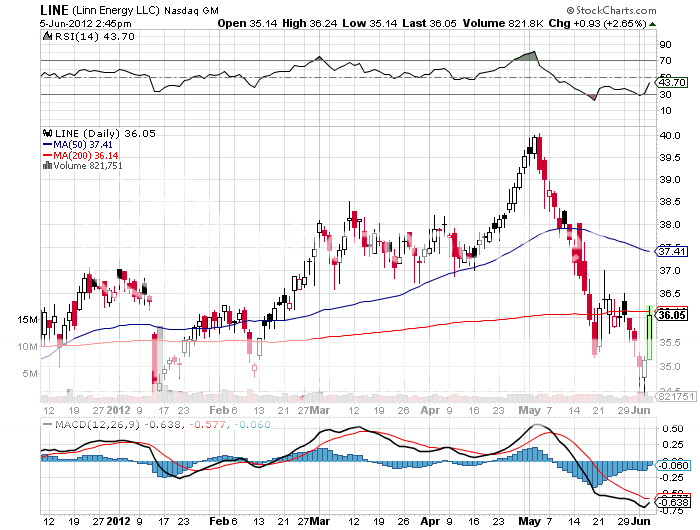

Enbridge Energy Partners (EEP) is run by some of my former colleagues at Morgan Stanley and offers a 7.5% yield. Kinder Morgan Energy (KMP) posts a healthy 5% yield, while Trans Mountain (TLP) ups the ante with an 8% return. Linn Energy goes all the way up to an eye popping 8.5% yield.

Why the enticing cash flow? The problem is that these partnerships suffer from their guilt by association with Texas Tea, which has plummeted by nearly 30% since March 1. Although they have no direct exposure to the price of oil, investors tend to incorrectly classify them as energy stocks and dump them whenever oil falls. The great thing about these high yields is that you get paid to wait until crude makes a comeback, which it always does. Not a bad game to play in a zero return world.

To qualify for MLP status, a partnership must generate at least 90 percent of its income from what the Internal Revenue Service deems "qualifying" sources. For many MLPs, these include all manner of activities related to the production, processing or transportation of oil, natural gas and coal. Energy MLPs are defined as owning energy infrastructure in the U.S., including pipelines, natural gas, gasoline, oil, storage, terminals, and processing plants. These are all special tax subsidies put into place when oil companies suffered from extremely low oil prices. Once on the books, they lived on forever.

In practice, MLPs pay their investors through quarterly distributions. Typically, the higher the quarterly distributions paid to LP unit holders, the higher the management fee paid to the general partner. The idea is that the GP has an incentive to try to boost distributions through pursuing income-accretive acquisitions and organic growth projects.

Because MLPs are partnerships, they avoid the corporate income tax, on both a state and federal basis. Instead of getting a form 1099-DIV and the end of the year, you receive a form K-1, which your accountant should know how to handle. Additionally, the limited partner (investor) may also record a pro-rated share of the MLP's depreciation on his or her own tax forms to reduce liability. This is the primary benefit of MLPs and gives MLPs relatively cheap funding costs.

The tax implications of MLPs for individual investors are complex. The distributions are taxed at the marginal rate of the partner, unlike dividends from qualified stock corporations. On the other hand, there is no advantage to claiming the pro-rated share of the MLP's depreciation (see above) when held in a tax deferred account, like a IRA or 401k. To encourage tax-deferred investors, many MLP?s set up corporation holding companies of LP claims which can issue common equity.

Since 2003, MLPs as an asset class have grown astronomically, from $30 billion to $250 billion , and have also been the best performing asset class in the world over the last 10, 5, and 3 year periods. The recent discovery of new, massive gas and oil fields in the US and the rapid expansion of shale fracking should auger well for the rising popularity of this instrument.

Nope, Don?t See Any Yield Yet