Report from the August 4 Tesla Shareholders Meeting

I have to admit, listening in on the August 4 Tesla (TSLA) shareholder’s meeting was something like going to a rock concert.

There was plenty of loud music, shouting fans, flashing lights, and cool videos, and it definitely had its own rock star dancing on the stage in a black suit.

Yet, there was something different too.

Virtually everyone in the room had placed their entire life savings in the company’s stock, thus immeasurably changing their lives for the better. That includes many who bought in during the early days and faced down several bankruptcy scares and short selling attacks along the way, including me (post-split cost basis is now $2.35).

That kind of math gave the room an undeniable electric atmosphere and elevated Musk to God-like status.

After the somewhat dry recitation of the standard numbers, Elon took questions from an adoring audience. His answers were nothing less than amazing. I list the highlights below.

Tesla will soon become the largest company in the world, exceeding Apple’s current $2.6 trillion value. Tesla currently only has a market capitalization of $295 billion.

That means Tesla has to rise by 8.8 times from the current price, or to $2,512 a share just to top Apple in size. That will be the next number traders will gun for.

The company will be at a 2 million units a year run rate by yearend.

Total production has gone from 3,000 cars a year to 3 million in ten years. Cleanest form of exponential growth Musk has ever seen.

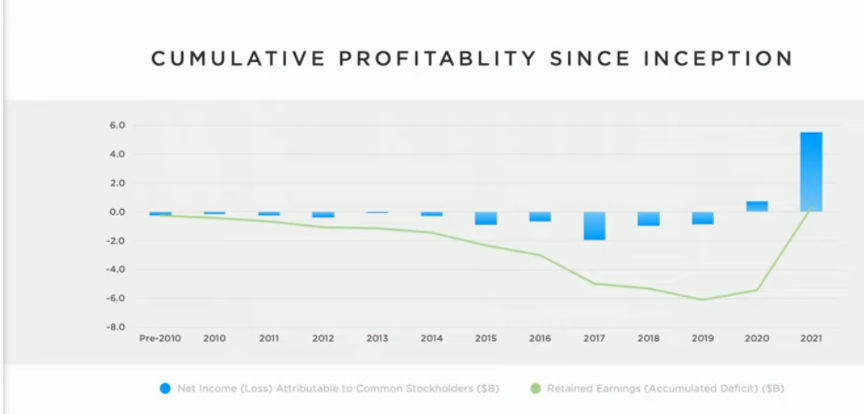

Tesla now has a positive cash flow and retained earnings.

Autonomous driving has 90% success rate with left turns. Whether this was a political reference is anyone’s guess. With Musk, you never know.

Roads are designed for biologicals and eyes, not robots. When the full self-driving autopilot is rolled, out it will solve an important AI challenge. Tesla has just raised the price of its autonomous software from $12,000 to $15,000. Multiply that by $3 million and you get the impact on net earnings. It's all profit.

Elevators went from requiring a human operator in the 1920s to pushbuttons by the 1960s. It will be the same with autonomous cars.

Tesla now has the highest operating margin in the global car industry.

Every time competitors like Ford (F) and General Motors (GM) advertise EVs, Tesla sales go up. Tesla may announce a new North American factory location before the end of 2022. The Tesla Fremont factory, which I have toured more than a dozen times, is the most productive car factory in North America by a huge margin.

If you total all electricity produced by Tesla solar panels in the last ten years, it exceeds all electricity needed to make and drive Tesla cars for those ten years. That makes Tesla a giant power net zero.

Future airbags will anticipate crashes in advance instead of waiting for them to happen, making them much more effective.

Total Tesla miles driven is 40 million up until now and will reach 100 million by yearend.

The Tesla AI software will soon be more valuable than the car, with car costs plummeting.

Tesla will need a dozen factories to produce 20 million cars a year, and they already have four. That suggests massive equity fund raises in the future at $10 billion each.

The Fremont, CA factory (the old GM Geo factory which Tesla got for free) is maxed out and can’t be expanded any further. Tesla is aiming for volume production of its new Cybertruck by mid-2023.

The Supercharging network doubles every year and that growth rate will continue.

Prices for more than half of Tesla commodity inputs are trending down, inflation is falling, pointing to a mild recession at worst. We won’t have a big recession because there isn’t fundamental misallocation of capital as was the case in 2007-2008, such as the overbuilding of new homes and excessive leverage in the stock market.

I just thought you’d like to know.