All good things must come to an end, and that includes bull markets in stocks.

But this one is not over yet. If my calculations are correct, the current correction should end right around here over the next week or two. Like the famed Monte Python parrot, the bull market is not dead, it is only resting.

My logic is very simple. In February, the Dow Average suffered a 3,300 point downdraft. However, at least 1,000 points of this was due to the overnight implosion of the $7 billion short volatility industry that spiked the (VIX) up to $50.

That trade no longer exists, at least to the extent that it did in January. There is no Velocity Shares Daily Inverse VIX Short Term ETN (XIV) blow up in the cards at tomorrow morning’s opening.

With the Dow Average down 2,200 points, or 8.14%, from its September high, the major indexes ought to bottom out right around here. I also expect the Volatility Index to peak here at $30.

Incredible as it may seem, the Dow Average has given up almost all of its 2018 gains. Unchanged on the seems to be a point that the market wants to gravitate to, and then sharply bounce off of.

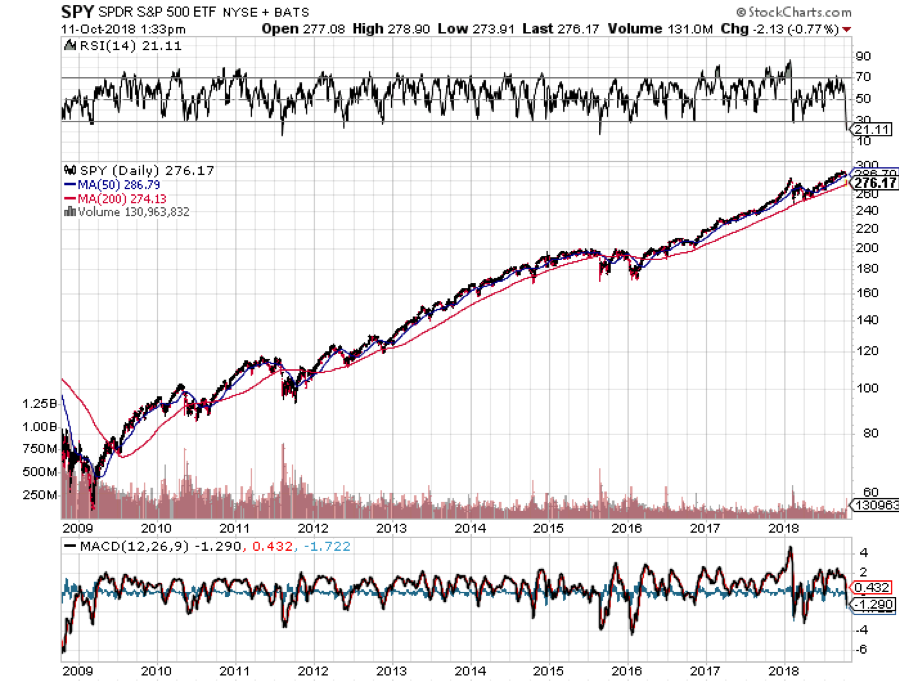

That means the 200-day moving average for the S&P 500 should hold as well near $274, down 6.4% from all-time highs made only last week. That has provided rock-solid support for the index since the bull market began in 2009, except for brief hickeys in 2011 and 2015.

At these prices the PE multiple for the S&P 500 has plunged back down to only 16 times, providing substantial valuation support that has held for years. The economy is still growing at a 4% clip and I expect that to continue through the end of 2018.

The hissy fit between the White House and the Federal Reserve was the principal cause for the Wednesday 831-point selloff. There is a reason why the president has never been allowed to control interest rates in the United States. Telling the citizenry that the “Fed is loco” does not inspire confidence among stock buyers.

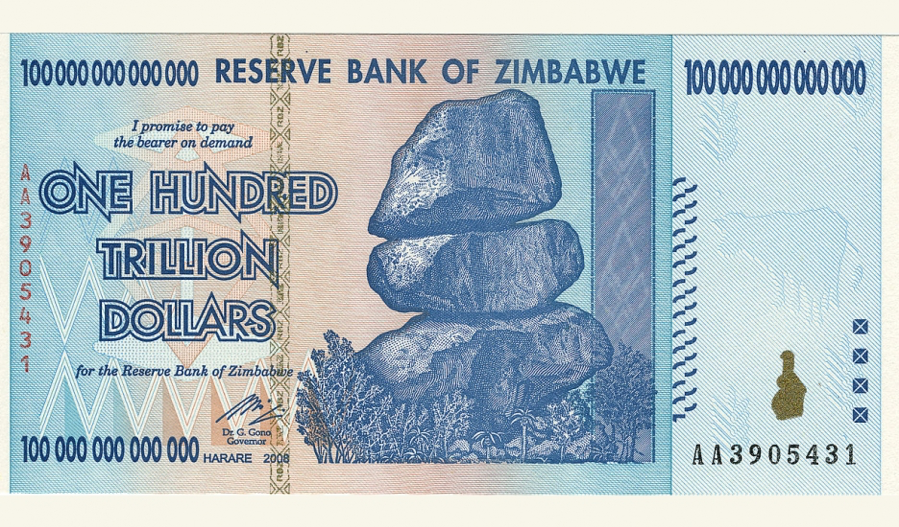

If he could, they would be zero, all the time, forever, and the US dollar would have the same purchasing power as the Zimbabwe one or Weimar German Deutsche Mark.

Another crucial factor that investors are missing is that we are now in the blackout period for Q3 earnings when companies are not allowed to buy their own stocks. Companies have almost become the sole buyers of equities in 2018 and are expected to reach a record high of $1 trillion in purchases this year.

A blackout means that the nice guy who has been buying all those drinks has suddenly become stuck in the bathroom for an extended period of time.

That makes the biggest buyers of their own stock like Apple (AAPL), Cisco Systems (CSCO), Amazon (AMZN), and Amgen (AMGN) particularly interesting.

The shackles come off Apple’s buybacks when the Q3 earnings are announced after the close on November 1, a mere 14 trading days away. Apple CEO Tim Cook has committed to buying $100 billion worth of Apple shares.

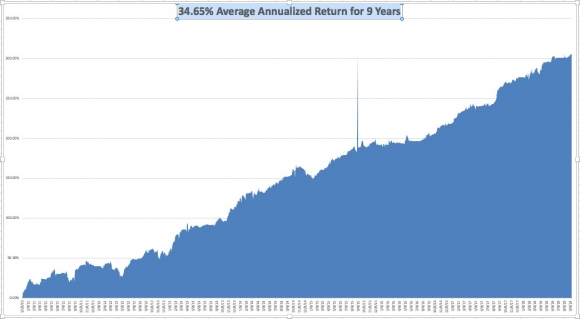

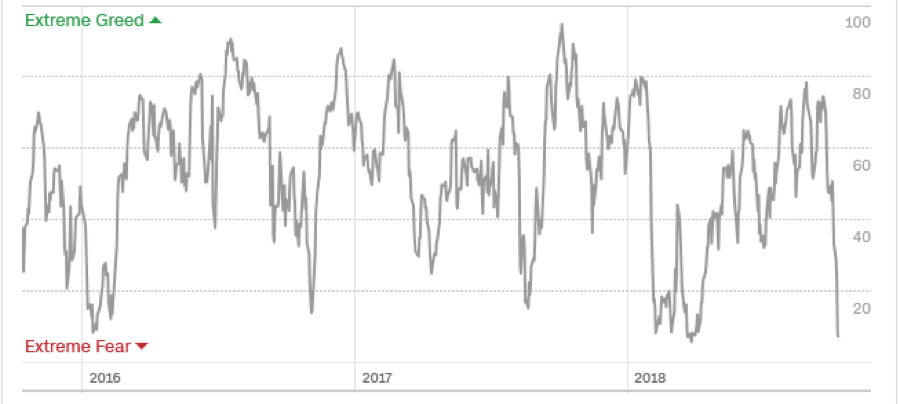

Finally, my Mad Hedge Market Timing Index, which has been worth its weight in gold, just hit its all-time low at 4 and is flashing an extreme “BUY”. The last time this happened was at the February 8 capitulation low.

Of course, we will probably still see some heart-stopping volatility in the run up to the election. But after that, I still expect a burst to new all-time highs. If my 3,000 S&P 500 target is hit, that means there is a potential 9.5% gain from today’s low.

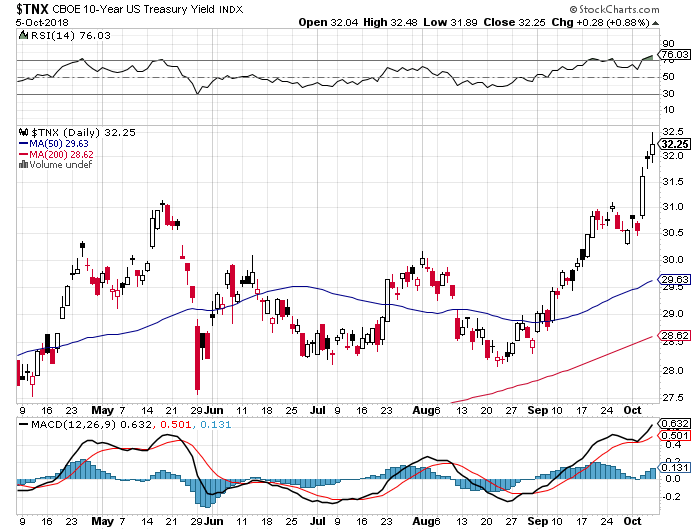

Investors raced to unload winners in the run up to yearend. Now that many of those winners have become losers, the selling should abate. Oh, and that bond collapse? Bonds have actually gone up since the big stock selling started two days ago, taking yields down from 3.25% to 3.13%. At some point, someone will notice.

Unfortunately, making money in the market is no longer the cakewalk that it used to be. There’s no more loading the boat, and then going on a long cruise. From now on, we are going to have to work for our money.

We may see a bottom this morning when banks announce their Q3 earnings. JP Morgan’s Jamie Diamond starts his conference call at 8:30 AM EST and the entire investment industry will be listening with baited breath.

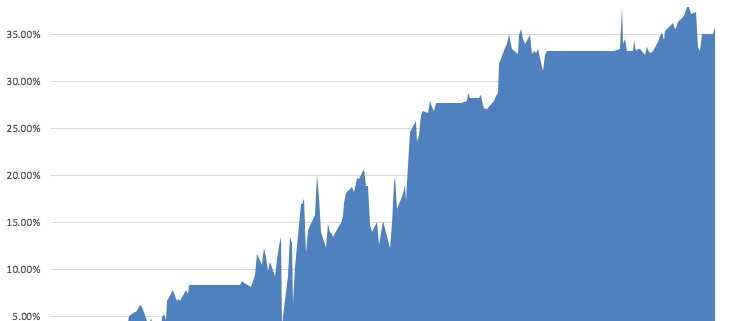

Mad Hedge Market Timing Index

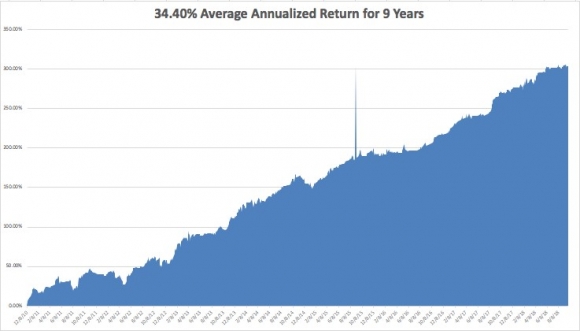

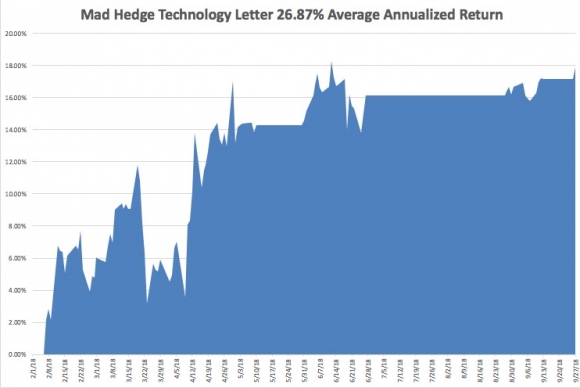

Correction? What Correction?