Retail Therapy, Meet Retail RX

In my years of covering the markets, from the trading floors of Tokyo to the halls of power in Washington, I've seen my fair share of unexpected partnerships.

But the recent tie-up between Walmart (WMT) and Humana (HUM) has me sitting up and paying attention.

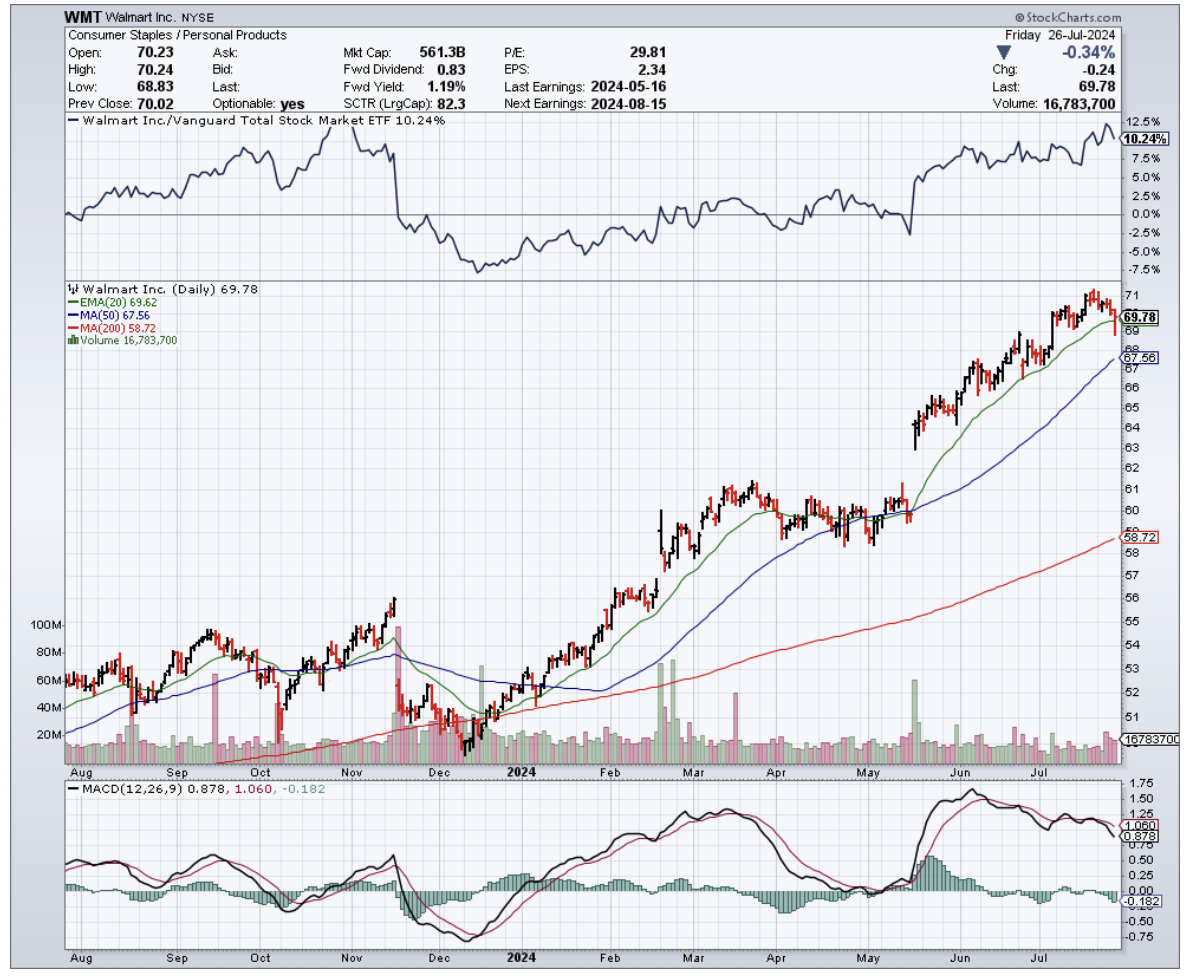

That’s right. Walmart, the king of rollbacks and home of the $1 hot dog, has found a new tenant for the vacant spaces that used to house its healthcare business: Humana's CenterWell health clinics.

Humana, as you know, is one of the biggest players in the Medicare Advantage game, and is setting up shop in 23 Walmart Supercenters across Florida, Georgia, Missouri, and Texas.

And they're not just dipping their toes in the water – they're diving in headfirst, with plans to have these clinics up and running by the first half of 2025.

Now, I know what you're thinking. "John, why should I care about some dusty old retail giant like Walmart getting into bed with a health insurance company?"

Let me tell you why.

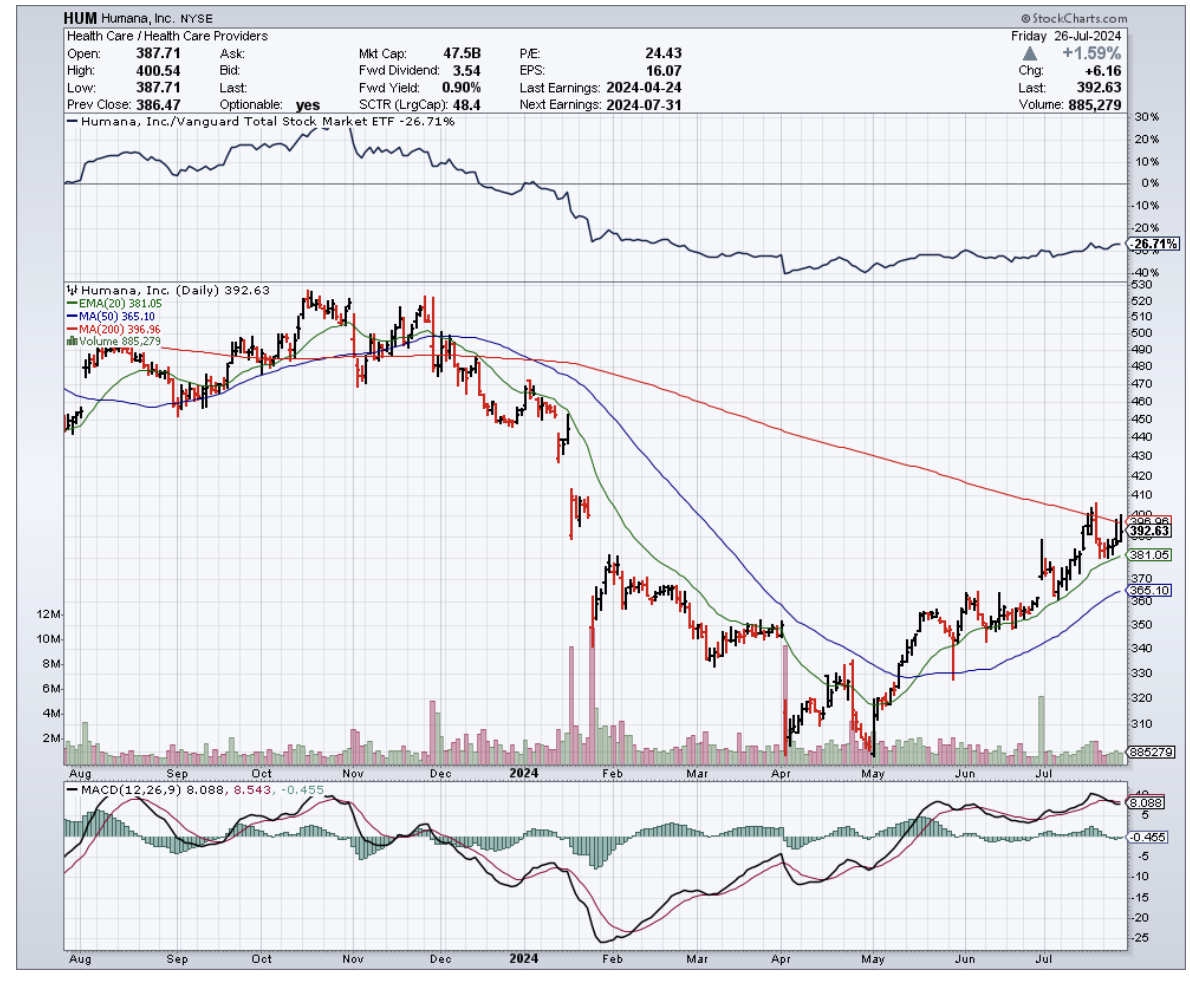

Humana's Q1 2024 earnings were nothing to sneeze at, with revenues growing 11% year-over-year to a whopping $29.6 billion.

And while the company did revise its full-year EPS guidance downward, it maintained its outlook for adjusted EPS and even revised its membership growth in MA plans upward.

This is a big deal, folks. Medicare Advantage plans have been the bread and butter of Humana's business model, underpinning the company's phenomenal share price gains from $25 per share in 2010 to over $550 in late 2022.

With the population aging faster than fine wine, the demand for senior-focused healthcare services will only grow.

But Humana isn't the only one benefiting from this partnership.

For Walmart, renting out these spaces to CenterWell allows them to recoup some of the infrastructure investments they made in building out their 51 Walmart Health clinics, which they recently shut down due to profitability challenges.

It's like finding a roommate to help pay the rent after your startup goes belly up.

But the healthcare industry is like a giant game of Jenga, with players constantly pulling out blocks and hoping the whole thing doesn't come crashing down.

Just look at Walgreens Boots Alliance (WBA), another retail giant that recently announced the closure of 150 of its in-store clinics due to profitability challenges. It's a stark reminder of how difficult it can be to make a buck in this business.

That's why Walmart's pivot to a partnership model with Humana is so intriguing.

By leasing out pre-equipped facilities to CenterWell, Walmart is essentially letting Humana handle the nitty-gritty of patient care while still maintaining a presence in the rapidly growing primary care industry.

It's like having your cake and eating it too, without having to worry about the pesky details of actually baking the cake.

As expected, Walmart and Humana aren't the only ones making moves in the healthcare space.

CVS Health (CVS) and UnitedHealth Group (UNH) are also betting big on primary care, with CVS acquiring Oak Street Health for $10.6 billion and UnitedHealth's Optum division going on an acquisition spree to expand its network of physicians and healthcare providers.

Then, there’s the meteoric rise of telehealth during the pandemic. Companies like Teladoc Health (TDOC) saw their revenues skyrocket as patients turned to virtual care in droves.

While growth has slowed down since the height of the pandemic, telehealth is still a force to be reckoned with and could potentially disrupt traditional brick-and-mortar clinics.

So, what does all this mean for us?

Well, if you're an investor looking to get in on the action, you've got plenty of options. From established players like Humana and UnitedHealth to up-and-comers like Oak Street Health and Teladoc, there's no shortage of companies vying for a piece of the healthcare pie.

With an aging population, rising healthcare costs, and a growing focus on preventative care and chronic disease management, the demand for innovative healthcare solutions is only going to increase in the coming years.

And who knows, maybe one day we'll all be getting our annual check-ups at the local Walmart, with a side of low-priced toilet paper and a jumbo bag of Cheetos.

Stranger things have happened in the wild world of healthcare.