Riding the eBay Boom

Investors following the eBay (EBAY) saga should be cheering from the sidelines as the master plan from Elliot Management and Starboard are pressuring eBay’s management into the radical changes the investors initially called out for.

Rewarding the vulture funds with two board seats along with spearheading a comprehensive review of the business model appears more probable than not.

The forced changes have imminent repercussions to the stock price as the breaking up of the company into individual pieces is seen as coaxing out more embedded value while separating out the main e-commerce platform for a long-awaited fix.

These are two highly bullish signals.

Elliot’s reasons for altering eBay’s business model were essentially blamed on two issues - shoddy management and the commingling of growth assets with its inferior e-commerce platform within the eBay umbrella hindering value appreciation.

Even though prospects look bright on this fix, Elliot doesn’t always get its way.

Four years ago, Elliot was the primary investor in Samsung's construction division and rebuffed efforts from Jay Y. Lee, the South Korean business elite and the vice chairman of Samsung Group serving as de facto head, to have another division of Samsung purchase the construction arm for $8 billion.

In 2017, Lee was convicted of bribery and imprisoned and sentenced to three years, Elliot sold their Samsung construction shares after the tide went against them and could not prevent the eventual purchase.

Lee was later set free in 2018 demonstrating the unfettered power of the ruling Korean families and Elliot was up against it in someone else’s backyard.

Even with that setback, Elliot has been ultra-successful abroad, examples are plentiful such as in May 2018, Elliott Management seized control of Telecom Italia controlling two-thirds of Telecom Italia's board seats.

This vulture fund has been specialists at pinpointing ill-ran operations and squeezing the fat off the edges to later sell off assets for a profit.

These tactics have usually centered around cost-cutting, financial engineering, or draining the upper management swamp if need be.

Personally, eBay has the foundations to be competitive with the top e-commerce companies and they need an activist investor to turn this ship around.

In this way, the turnaround will occur much quicker than an organic method because Elliot will apply pressure on all the cancerous parts of the model and stamp them out as fast as possible.

Elliot now has a golden path to two board seats and spinning off StubHub, its uber-growth online events tickets selling platform, will guarantee Elliot and Starboard walk away from this transaction with a heavy profit.

StubHub was bought on the cheap in 2007 when online assets were trading cheaply for $310 million.

The firm contributes 11% to eBay’s top line.

The classified ads business is the other part of the high-growth online portfolio that could be sold for a profit. They operate mainly in Germany and the United Kingdom and comprise almost 10% of sales.

The plan after these premium assets are sold is to focus on mending its wounded e-commerce business.

The core business would need a flushing out of current management.

Bringing in some established hands to reroute the company’s course will boost the shares another 25%.

The phrase “more efficient use of resources” or a similar version of this meaning was used six times in Elliot Management’s letter to eBay Shareholders.

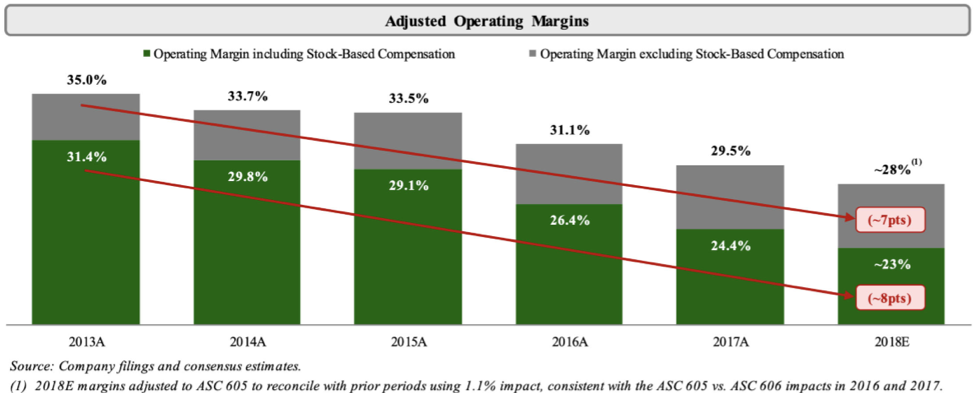

They cited in the letter that EBITDA margins have declined YOY for 12 straight quarters proving that revenue-boosting initiatives have failed spectacularly.

Elliot hopes a better run company will constitute in higher operating margins to the tune of “32% in 2021.”

In the next 3 years, Elliot wants to raise operating expenses by $250 million but reduce “wasteful spend” which they outlined as one of the main reasons hamstringing the company.

Missed opportunities is another major opportunity cost contributing to the underperformance of eBay.

eBay has been left out of the niche e-commerce areas where former eBay employees exploited this untapped source of growth.

The success of Wayfair (W), the furniture e-commerce platform, and Etsy (ETSY), the personalized crafts e-commerce platform, are two glaring examples of sales that should have been registered by eBay but gobbled up by two minnows.

In short, Elliot’s flawless execution and aggressive plan are ideally playing itself out how they wrote it up from the beginning.

It’s hard not to see eBay’s stock higher a year from now as long as Elliot and Starboard get their way.

The brilliant part of this whole turnaround is that eBay doesn’t have to become Amazon to reap share appreciation, they merely need to be not as bad as they were which at the first stage of rebooting the business is the lowest hanging fruit out there.

Once the company becomes mature and more successful, growth and beating relative expectations are harder to achieve.

I am bullish eBay - buy on the next pullback.