Rumblings in Tokyo

I spent ten years of my life tramping in and out of Japan?s Ministry of Finance headquarters in Tokyo?s Kasumigaseki district. It was a dreadful reinforced steel and concrete affair with a dull grey tile siding that was so solidly built that it was one of the few structures in the city to survive WWII. But the building offered spacious prewar dimensions, and I never tired of walking its worn hardwood floors. I was there so often that some government officials thought I worked there, and they did eventually give me an office, the first ever granted to a foreign correspondent.

So to get an update on the Land of the Rising Sun, I called a senior official whose father I knew well as a Deputy Minister of Finance for International Affairs during the 1970?s. I was a regular at his apartment in Shinjuku on Saturday nights, where we spent endless hours alternately playing chess and Scrabble over a bottle of Johnny Walker Red and smoking Mild Sevens. We did everything we could to expand each other?s? Japanese and English vocabularies with the words not found in dictionaries. When the bottle was almost finished and his face was beet red, the Elvis impersonations would start.

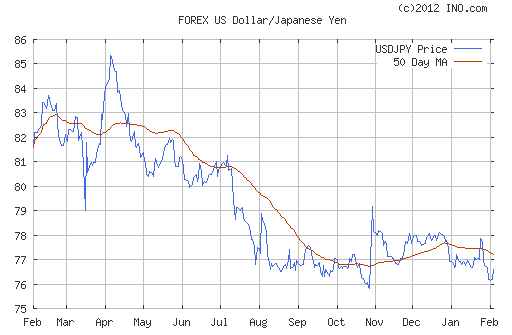

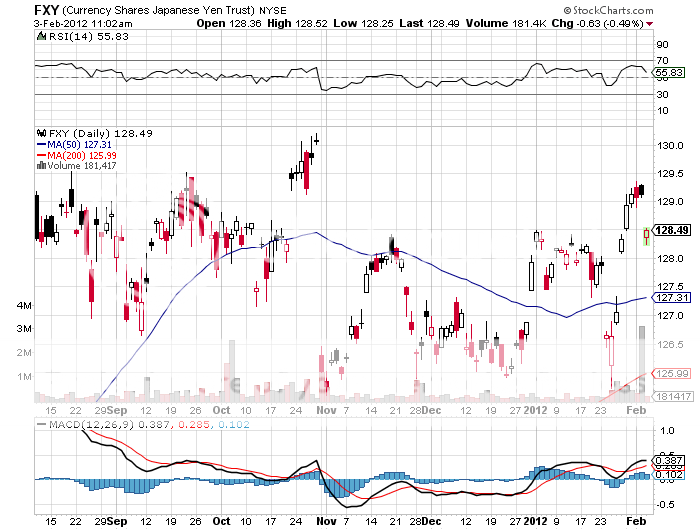

My friend told me that the ongoing strength of the yen is rapidly becoming a major political issue in Japan. The spot market is now threatening an all-time high, and on a trade weighted basis it was already at a new peak. Exporters were getting destroyed by the strong yen, which was making their goods increasingly expensive in a cost cutting competitive world.

This was forcing them to accelerate a 20 year effort by corporations to offshore production to China, which was ?hollowing out? Japan and causing economic growth to bleed away, and unemployment to rocket. The situation was getting so bad that American companies that offshored jobs to Japan years ago, like Caterpillar (CAT), were taking them back home because labor costs are so high. He expected Japan?s GDP to shrink at a 1.4% annualized rate during Q4, compared to a healthy 2.9% rate in the US.

His boss, Japanese finance minister, Juri Azumi, made comments in the Diet this week about his concern over yen strength. More specifically, he is seeking approval for a much more aggressive stance to pursue Bernanke style quantitative easing to knock the stuffing out of the yen and stimulate the economy.

The last time he did this, on October 31 last year, the Bank of Japan followed up with a massive $120 billion intervention in the foreign exchange market a few weeks later. One of the largest such interventions in history, it instantly knocked the yen down from ?75.90 to ?79.20. We may be about to see a replay. In fact, if they can just break resistance at ?80, then they might be able to knock it down to the 2011 low of ?85.30.

This time, Azumi has much more ammunition to work with. Japan reported its first trade deficit in 30 years just a few weeks ago. This may not be an anomaly. In response to the tsunami induced melt down at the Fukushima plant, Japan is permanently shutting down a large part of its nuclear power generating capacity. At its peak, nuclear accounted for 25% of the country?s electric power supply. That is forcing a huge surge in oil imports from the Middle East that has greatly tipped Japan?s balance of trade against it. Crude?s surge from $75/barrel to as high as $103 has only made matters worse.

He then told me that he too was now learning to play Scrabble and asked me for my list of words where the letter ?Q? is not followed by a ?U?. I said that I was not inclined to disclose America?s most valuable trade secrets to a foreign competitor. However, in deference to his late father, he couldn?t go wrong starting with ?Qi?, ?Qabala?, ?Qadi?, ?Qaid?, ?Qat? and ?Qanat?. I hung up the phone and immediately sold more yen against the dollar.