San Francisco?s Suffering Renters Take Another Hit

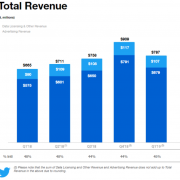

The San Francisco Bay area?s beleaguered renting class moaned again when the social media giant, Twitter (TWTR) finally went public a couple of years ago.

The deal immediately placed $1.82 billion into the pockets of early shareholders, almost all of whom live near the company?s San Francisco headquarters.

This is adding insult to injury to those in the region who are desperately seeking a home. San Francisco already has the most expensive rentals in the country.

The median rent for a modest two-bedroom apartment in a marginal neighborhood with poor access to public transit and no view is $4,500 a month.

Forget about it if you smoke, have a pet, or suffer from a poor credit rating. That compares to $3,150 a month in New York City, $2,300 in Boston, and $2,250 in Los Angeles.

This is just the latest tsunami of cash to hit the city?s torrid real estate market. Since 1998, Apple (AAPL) has created $700 billion in equity for shareholders, while Google (GOOG) has manufactured a further $450 billion.

In 2012 Facebook (FB) joined their ranks with a $100 billion IPO that quickly went sour. What is hoody wearing Mark Zukerberg?s creation worth today? A stunning $339 billion.

The first thing these newly enriched entrepreneurs do is buy a nice big house. This is not just limited to founding technology nerds and geeks wearing hoodies.

During the early start up days of these cash starved companies, shares are handed out to employees in lieu of better pay, all the way down to the secretary level. When they go public, thousands of millionaires are created and not a few billionaires.

Presto! A housing bubble!

Renters are getting creative in dealing with the high prices. Some are doubling up the use of bedrooms. Others rent out their beds during the day to programmers who often prefer working all night, much like hot sheet hotels of old.

Many have moved into the garage and sleep with the business they are trying to develop. Some homeowners with yards are leasing out spaces to pitch tents, while others are taking advantage of new services on the internet that allow them to rent spare rooms by the night.

There is no way of telling how far this will go. The last technology bubble popped when price earnings multiples hit 100. Most established tech firms are now trading in the 11-18 range, so the day of reckoning could be quite a ways off. Rentals could reach the astronomical levels now seen in London and Hong Kong.

In the meantime, I?m thinking of renting out my tool shed in the garden. My agent says that I could get at least $1,000 a month. The alternative is for home seekers to move to Las Vegas, where they can get a larger two bedroom without the need for heating for only $900 a month.

Do you think it is worth the commute?