September 10, 2009

September 10, 2009 Featured Trades: (GOLD), (ABX), (GLD), (MCO)

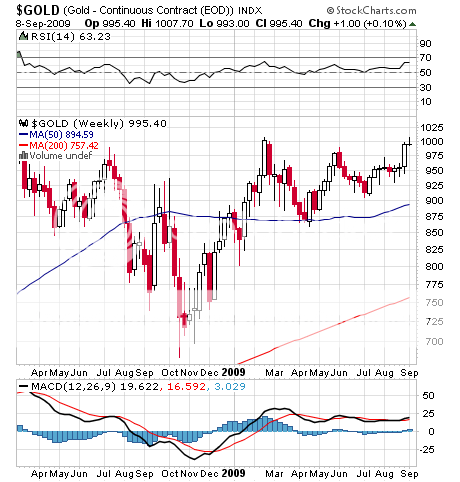

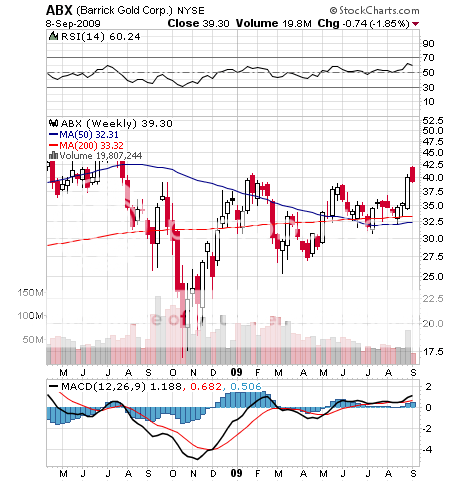

1) The precious metals markets were stunned with Barrick Gold?s (ABX) announcement that it will float a $3 billion public offering to retire its gold hedges in the futures markets. This means that the world?s largest producer is cashing in its downside protection and gearing itself for a ballistic move up in the price of the barbaric relic. The timing of the announcement, the day that the yellow metal broke $1,000 for the first time since February, couldn?t have been more auspicious. I have been a huge fan of Peter Munk?s ABX all year, cajoling readers into the stock at $27 in January before its 56% run (click here for report ) . South Africa?s largest gold miner, AngloGold Ashanti?s CEO Mark Cutifani says his company put its money where its mouth is, taking off its hedges some time ago. ?People are doing what they have been doing for 5,000 years, and that is buying gold as the only hard currency,? opines Cutifani. In the meantime, the Street Tracks gold ETF (GLD) announced that it has $34 billion of gold holdings, making it the largest ETF of all, and the fifth largest owner of gold in the world after four central banks. If you want to buy gold bullion or coins for the tightest spread over spot, check out http://www.millenniummetals.net.

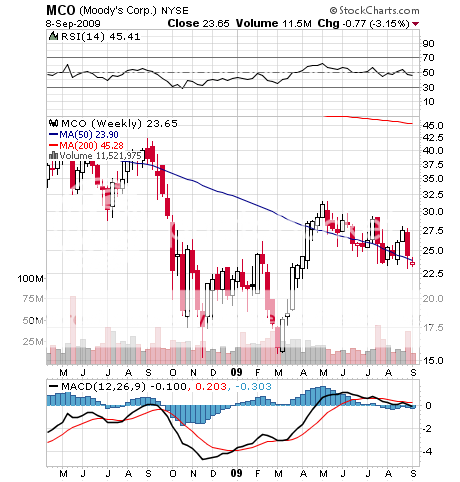

2) The case against the Big Three rating agencies took another step forward when a New York judge threw out the freedom of speech defense for one of the complaints. Terry McGraw, CEO of McGraw Hill, and owner of defendant Standard & Poor?s, says that at the peak in 2006, the industry was prepared for a worst case scenario of a 15% draw down in real estate prices over 18 months on the local level. Instead, it got a 50% national plunge that is now two years old and aging. It didn?t help that a Moody?s analyst wrote an e-mail saying he would rate paper issues by ?cows.? In the race for market share, Moody?s, S & P, and Fitches? competitively devalued the meaning of ?AAA? so that even the most toxic subprime sludge came out highly rated. With their seals of approvals, the agencies became the facilitators-in-chief of the over lending and over borrowing that made the crash a mathematical certainty. The hedge funds that made billions wisely ran their own in-house ratings departments which thought otherwise. They fell down on their knees, thanking God that inflated ?independent? ratings led to wild over valuation of debt securities and set up some of the greatest shorts of the century. There is no Hell hot enough to make ratings agencies adequately pay for their deliberate misdirection of trusting investors. As for the hedge funds, their new short play is the one rating agency that is still publicly traded, Moody?s (MCO).

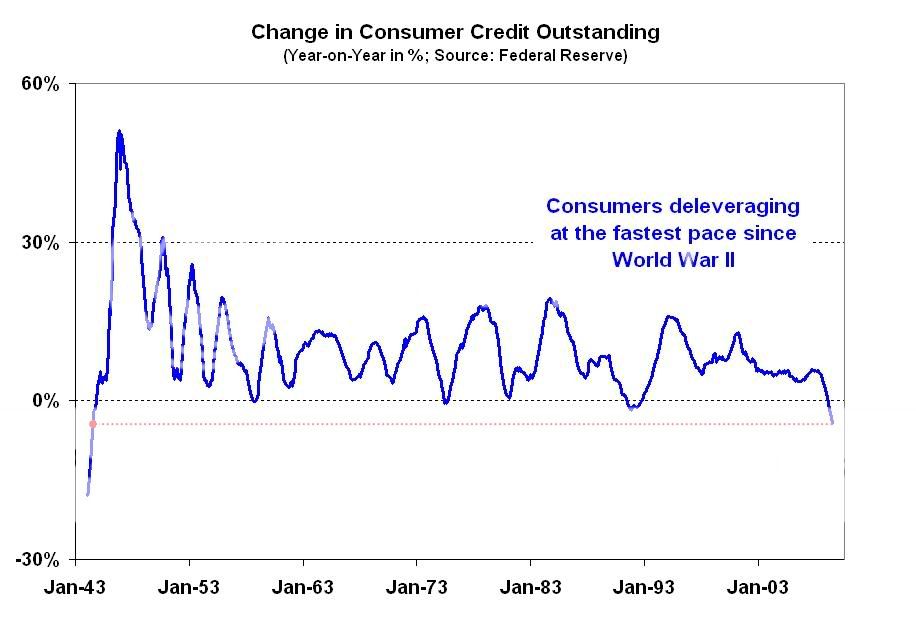

3) Consumer credit plunged by $21 billion in July, taking it down to the lowest level since WWII. The last time it was this low wartime rationing was in effect and a lot of individual purchases ended up in a booming black market. Instead of buying that new Cadillac Escalade with the chrome wheels, they are paring down debt. Gun shy credit card companies are happy to take the money, and American express has been cutting back limits in zip codes with the weakest housing like California and Florida, even for current accounts. Banks have gone back to lending only to people who don?t need the money. The savings rate has gone from zero to 7%, on its way to 10%,?? not exactly a great springboard for an economic boom. The catatonic consumer is the main reason why I have not played equities from the long side since May, preferring instead to dabble in commodities. With 70% of GDP in shrink mode, any move up in the indexes is just fluff. For more reasons on why you should break into an ugly rash before buying stocks at these levels, look at Martin Hutchinson?s piece by clicking here

QUOTE OF THE DAY

?Beware of Wall Street geeks bearing formulas,? said Vince Farrell, CIO of Soliel Securities.