September 10, 2010 - The Fat Lady is Also Singing in Japanese

Featured Trades: (JGB), (YCS)

2) The Fat Lady is Also Singing in Japanese. A political slugfest in Japan could also be signaling the end of the great bull market in the JGB market, which I have been pissing on from the greatest possible height (click here for 'Why the JGB Market May be Ready to Collapse').

Political kingpin, Ichiro Ozawa, is challenging prime minister Naoko Kan a scant three months after he landed the top job with promises of increases stimulus spending to revive an economy that has been comatose for two decades. If Ozawa wins, he could push Japan's debt/GDP ratio above 200%, a level that would prompt the IMF to warn the country that it is over its debt limit. That in turn would lead to downgrades of Japanese paper by the ratings agencies.

You could easily see the entire house of cards falling apart after that. Since I posted my last piece on the topic, the yield on the ten year JGB has leapt from 0.89% to 1.19%, while 30 year paper has rocketed to 1.97%. I always thought that a selloff in the Japanese bond market would happen along with the collapse in the yen. But with the Japanese currency still flirting with 15 year highs at ??83.7, it looks like the country's bond vigilantes are unwilling to wait.

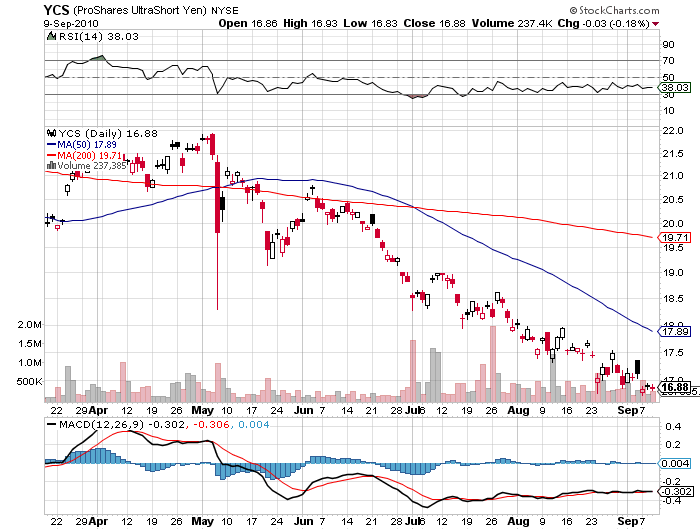

No, there is no readily available short JGB ETF which you can use to cash in on this move, as there is for the yen (YCS) but you can bet that one will magically appear when the trend gets going. There is a JGB contract listed on the CME, but the real volume and tight spreads are to be found in futures markets in Osaka and Singapore.