September 11, 2009

September 11, 2009

Featured Trades: (EUROYEN), (HEDGE FUNDS), (CANADIAN DOLLAR)

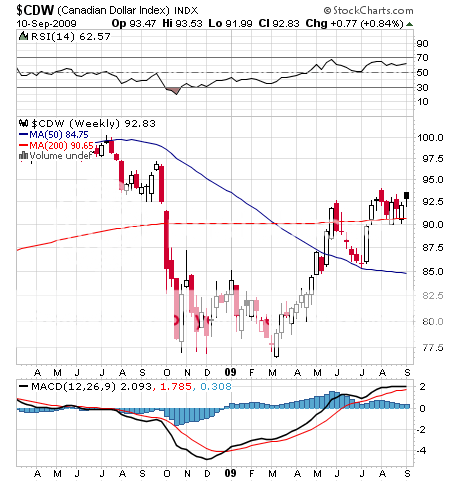

1) Hedge fund longs have been bunching up in the Canadian dollar for the past two months. Canada makes what everyone wants and doesn?t have enough people to consume it, making them a major exporter of everything hot. I bet you didn?t know that the frozen wasteland to the North is our largest foreign oil supplier. Most people guess Saudi Arabia. The Canadian supply is slated to double over the next 20 years, thanks to the environmental atrocity of oil sands. The land of Mike Myers, Jim Carey, and Pamela Anderson (note gratuitous photo below) is also a big supplier of gold, silver, lead, grain, uranium, wood, and other hard things. As for mosquitoes, they?ve got a lock on the market. Use dip to accumulate the loony. If you catch me singing ?O Canada? in the shower, you?ll understand why.

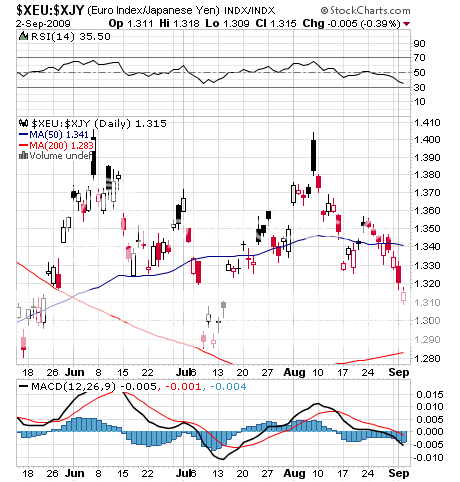

2) The euroyen cross has served as my faithful lapdog for 20 years, accurately forecasting the global risk appetite, rising when hedge funds were eager to roll the dice, and retreating when they went into hiding (see my earlier work by clicking here ). But lately this pet has forgotten its house training, much to the delight of my dry cleaner, delivering an unpleasant stream of false signals. When Japanese overnight rates were at zero, and the rest of the world was at 5%, it was easy to let Japan be your piggy bank and finance everything for free by denominating your debt in yen. This carry trade of choice became a strategy on its own. Leverage it ten to one and you earned a handy 50% annual return, and more, if the yen then depreciated. The problem is that the rest of the world has become Japan, with overnight rates everywhere at, or converging on zero, sending the predictive value of euroyen down the toilet. Thus, it joins the dustbin of history with other indicators that drew our collective gazes, like the money supply, the trade deficit, and rail car loadings. If I find a new one, I?ll let you know. Does anyone out there have any suggestions?

3) There is no doubt that hedge funds have been the chief whipping boy for the financial crisis. Fear of rumor mongers and unnamed conspiracies abounded, leading to measures like short selling restrictions, stock lending bans, and punitive new taxes that only caused more damage. The industry even suffered a close call by almost being villainized in Oliver Stone?s upcoming sequel to his landmark film Wall Street. Industry veteran Jim Chanos talked him out of it. The industry is now at last organizing, creating its own Washington lobby group, the Coalition of Private Investment Companies (CPIC), with Chanos as the chairman. They have put up a polished website that provides some basic stats about the business, and seeks to shoot down some of the more egregious urban legends. To access their site at http://www.hedgefundfacts.org.

QUOTE OF THE DAY

?A statistical model build around a normal distribution when applied to markets can be a very dangerous thing,? said David Kelly of JP Morgan.