September 11 Biweekly Strategy Webinar Q&A

Below please find subscribers’ Q&A for the September 11 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe Nevada.

Q: Will the Fed cut by 50 basis points at their next meeting?

A: The probability of that happening actually dropped by about half with the warm CPI report this morning with core CPI at 0.3%. That may have pushed the Fed from a 50% basis point rate cut back down to only 25%. I think if we only get 25%, the market will sell off. So that’s Wednesday next week. Mark that on your calendars—the market may well be on hold until then.

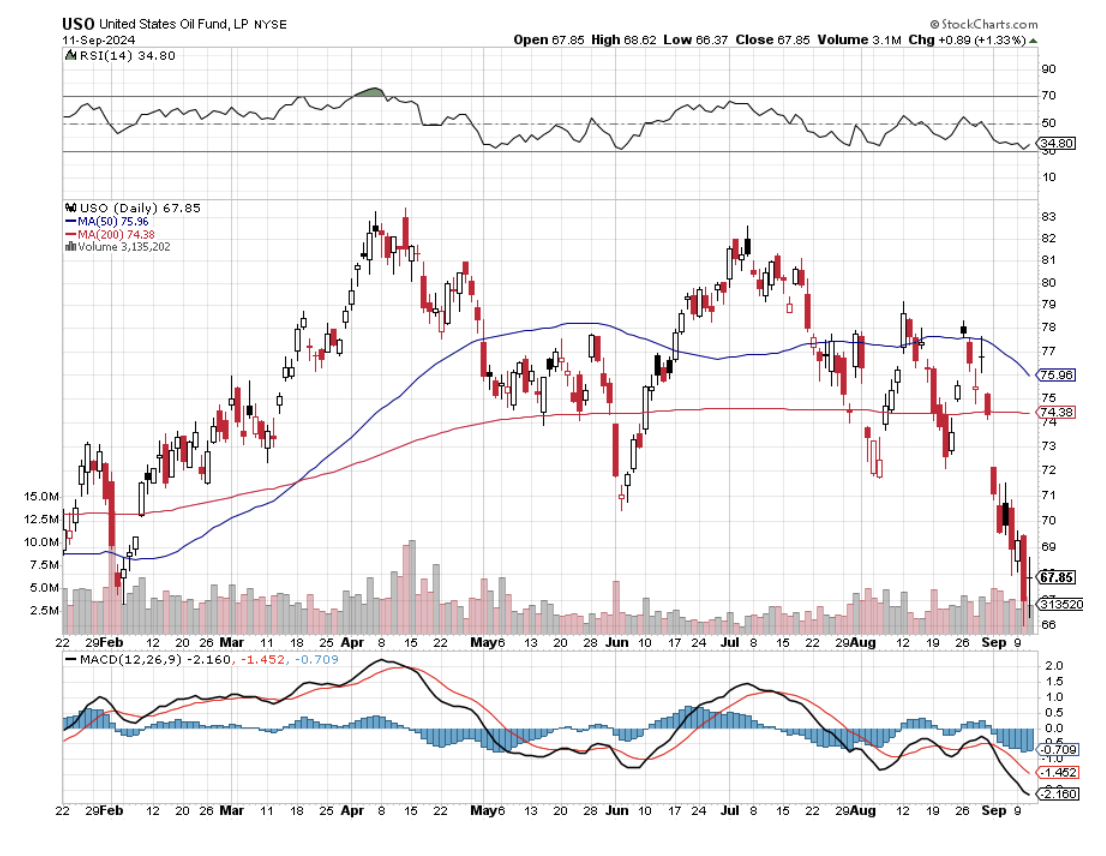

Q: Is $50/barrel oil (USO) coming by the end of this year?

A: No, but I think $60 is in the works. And that may be the bottom of this cycle because after that we expect an economic recovery, greater demand for oil, and rising prices in 2025. Until then, overproduction both in the US and in the Middle East is knocking prices down.

Q: Will the US dollar (UUP) continue its terrible performance through the end of the year?

A: Yes, and in fact, it may be for the next 10 years that the US dollar is weak—certainly 5—so any rally or dips you get in the currencies (FXA), (FXE), (FXC), and (FXB) I’d be buying with both hands.

Q: Where are you hiding at the moment?

A: 90-day T-bills, which are yielding 4.97%. You can buy and sell them any time you want, and the interest is only payable when you sell them.

Q: Is September 18th the selloff?

A: It depends on how much we do before then. Obviously, we’re making good progress today with the Dow ($INDU) down 700 points, so we shall see. However, the market is flip-flopping every other day, making it untradable—you can’t get any position and hold on to it long enough to make money, so it’s better just to stay out. There’s no law that says you have to be in the market every day of the year, and this is a day not to be in the market for sure.

Q: How will the presidential debate reaction affect the market?

A: There’s only one stock you have to follow for that and that’s the (DJT) SPAC, and that’s Trump’s own personal ETF, and it is down 13% today to a new all-time low. I believe that’s well below its IPO price, so anyone who’s touched that stock is losing money unless they got out at the top. That is a good signal.

Q: JP Morgan (JPM) stock had a steep pullback to $200/share—is it a buy here?

A: No, but we’re getting close. If we can get (JPM) close to its 200-day moving average at $188 on high volatility, that would be a fantastic buy, because (JPM) will benefit enormously from falling interest rates, and it is the world's quality banking play.

Q: Is it too soon on Berkshire Hathaway (BRK) and Tesla (TSLA)?

A: Yes on both. It’s too soon for anything right now. I wouldn’t touch anything before the interest rate cut unless you have a really special situation, and there are some out there.

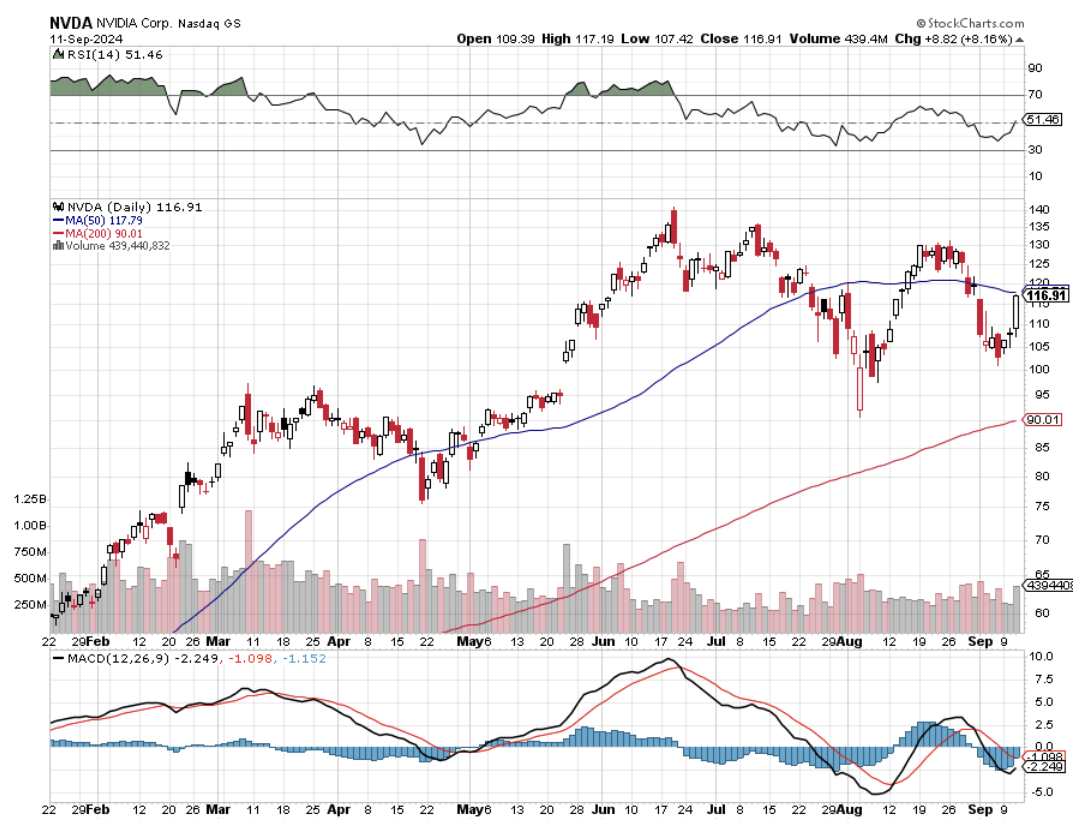

Q: Do you think Nvidia (NVDA) could test $90 again?

A: It could very easily; it got within $10 of that last week. So, it just depends on how bad the news is and how scared people get in September.

Q: Is the end of carry trade affecting the market?

A: No, we had a big deleveraging there. Although people are going back in again now, it’s not enough to hurt the market.

Q: I heard Putin is threatening over raw materials. What do we get from Russia, and what stocks or ETFs would be impacted?

A: We get nothing from Russia anymore. We used to get a lot of commodities and oil from them, and that has ceased. Russia has essentially exited the global economy because of the sanctions and the war in Ukraine, so they can’t really hurt anyone at this point.

Q: What about Russia doing an end-run around with direct trade? BRICS block is going to make the dollar even more worthless in the future.

A: I don’t buy that at all. I’ve been covering sanctions for 50 years; they always work, but they always take a long time. You could always do black market trade through the back door, but the volumes are way down, and the profits are much less because people only buy sanctioned goods at big discounts. The oil that China is buying from Russia is something like a 30% discount to the market. They execute a high cost of doing business, and nobody wants to be in sanctions if they can possibly do avoid. That said, when the war ends, the sanctions may end. That could be some time next year when Russia completely runs out of tanks and airplanes.

Q: Should I buy Nvidia (NVDA) call options now?

A: It's not just a matter of Nvidia. It's what the general market is doing, and tech is doing. And tech is not doing that well—even on the up days. So I would hold off a bit on Nvidia.

Q: Why is Warren Buffet (BRK/B) unloading so much of his equity portfolio?

A: He thinks the market is expensive, and he has thought it has been expensive for years and he's been unloading stocks for years. He has something like $250 billion in cash now so he can buy whole companies in the next recession. Whether he'll live long enough to see that recession is another question, but his replacement staff is already at work and running the fund, so Berkshire will continue running on autopilot even after he’s gone.

Q: Is IBM an AI play?

A: (IBM) wants to think that it’s an AI play. They haven’t disclosed enough to the public to make the stock a real AI investment, so I would say it probably is, but we don’t know enough at this point, and there are probably too many other candidates to buy in the meantime.

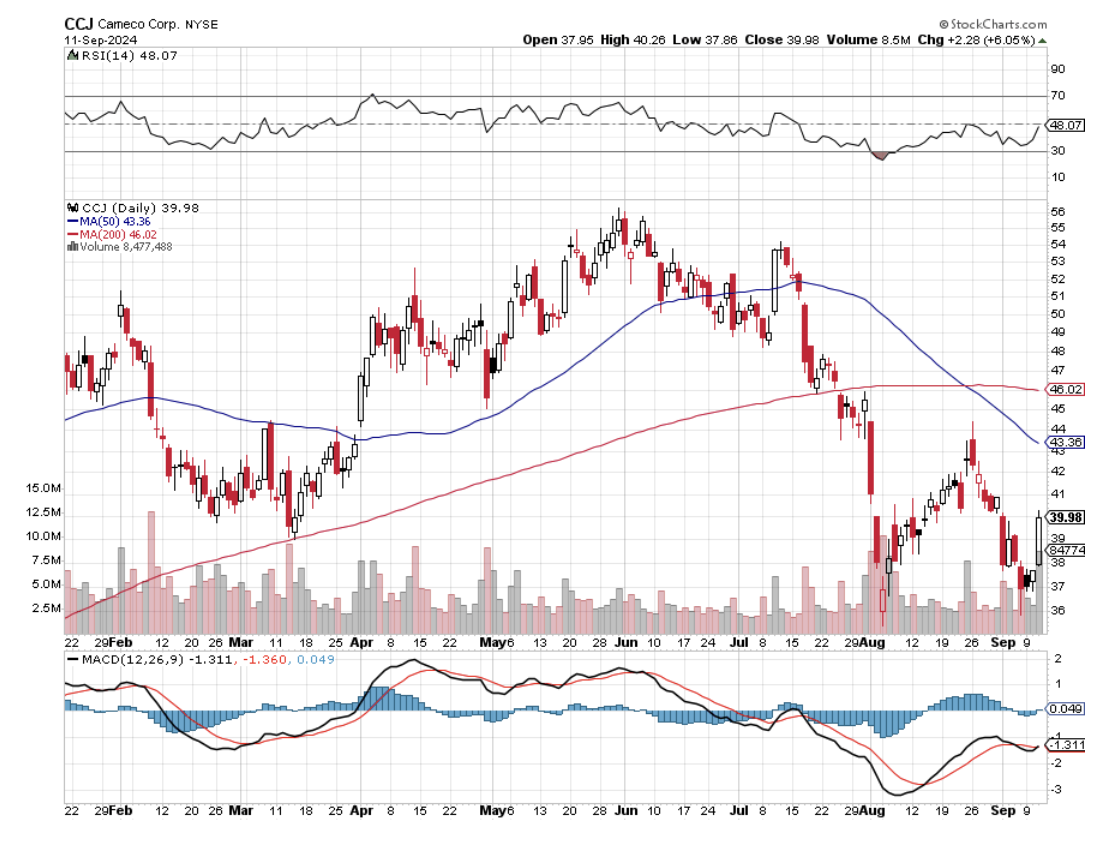

Q: How do I invest in green energy stocks, and do you have any names for me?

A: Well here’s one right here and that’s the Canadian uranium producer Cameco (CCJ). There is a nuclear renaissance going on. China just announced an increase in their plants under construction from 100 to 115. You have the new modular technology ready to take off in the US, and it uses uranium alloys, or uranium aggregates, so it’s impossible for a plant to go supercritical. You also have other countries reactivating nuclear plants that have been closed, and California even delayed its Diablo Canyon shutdown by 5 years. So Nuclear is back in play, and we have an absolute bottom in the stock here and it just dropped 37%, in case you needed any more temptation. So this would be a very attractive alternative energy play for the long term right here.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

1942 Grumman Wildcat on Guadalcanal