September 14, 2009

September 14, 2009 Special Silver Issue

Featured Trades: (SILVER), (CDE), (SLW), |

(HL), (UNG), (NATURAL GAS), (MS)

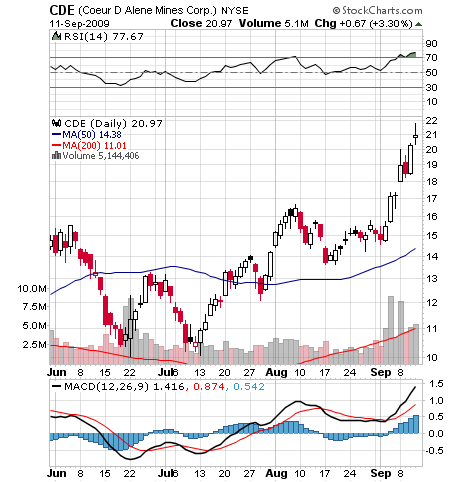

1) Those transfixed by gold blasting through the $1,000 level have been missing the real action in silver. The white metal has soared 57% to $17 since the beginning of the year, compared to only a 22% move for the barbaric relic, an outperformance of almost three to one. I have been a raging bull on silver all year, and on May 7, grabbed you by the lapels and shook you senseless if you didn?t buy at $12.70 (click here for earlier report ). It is nothing less than owning gold with a turbocharger. Silver gives you a nice double play. Its qualities as a precious metal are giving it a major boost from the flight from the dollar, one of this year?s certainties.?? It is also an industrial commodity, which unlike gold, is consumed, and therefore gives you a call on the recovering economy. If you don?t think this move is real, check out the shares of the silver producers. Coeur D Alene Mines (CDE) has rocketed by 57% this month and is up 144% YTD, while Silver Wheaton (SLW), and Hecla Mining (HL) have also done well.?? If you want to get set up on buying silver futures, e-mail me at madhedgefundtrader@yahoo.com and I?ll tell you how to do it. To accumulate .999 fine silver dollars for only a buck over spot, or bullion at the lowest spreads in the market, visit www.mileniummetals.net by clicking here. How long will it take to get to the old high of $50? The Hunt brothers must be grinding their teeth.

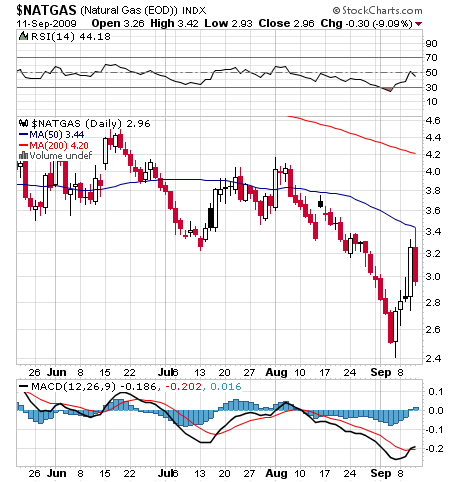

2) Since I have had such a hot hand in natural gas (see my call to sell at $4.30 in June by clicking here ), many have asked me to comment on yesterday?s surprise announcement that the ETF, UNG, finally got permission to issue new shares. The easy answer here is that UNG will crater. There is no reason for the fund to trade at a premium, whatsoever, which at one point traded as high as 20%, an overvaluation you normally only see in closed end funds at bear market bottoms. These ETF?s are simply pass through vehicles which make it easier for investors to own NG in stock form when they are legally unable, or too lazy to open a futures trading account. They should never trade more than 1% out of line with the underlying to account for the admin and execution costs of running such an instrument. The people who made the killing? here were the handful of hedge funds that were able to borrow UNG shares, sell them short, and go long the futures, locking in a guaranteed 20% spread. They will cash in their profit next week. Something similar is still going on where smart industry players have locked up salt caverns to store gas, buy it cheaply on the spot market, and sell it forward. This is possible because yesterday you could buy October at $3.25/MCF and sell it for April delivery at $5.32, giving you an annualized return of 127%. Leverage that, and you are talking about some serious money. If you were wondering where the money was coming from to buy those G5?s, this is it. The fundamentals for the industry are still terrible, and there is a risk that the market could completely grind to a halt when the country runs out of storage, so the volatility will remain huge. This week?s explosive 44% move from $2.40 to $3.44 was nothing more than pure short covering. I expect a quick double in NG once the storage issue is resolved, and the cheapest, cleanest, and most liquid way to participate is through the futures. If you need help in how to do this, e-mail me at madhedgefundtrader@yahoo.com.

3) The retirement of John Mack as the CEO at Morgan Stanley truly marks the end of an era at the venerable, once white shoed investment bank. I knew John 30 years ago when he ran fixed income sales, and every bond salesman lived in terror of his very shadow. Don?t let his relaxed, easy going demeanor on TV fool you. He was truly aggression distilled, the head piranha in a river full of piranhas, and is the main reason I became an equity guy. The former Duke football player once had counters installed on his department?s phones to tally outgoing calls, and fired the least loquacious producers, earning the sobriquet ?Mack the Knife.??? Another time, when the firm was trying to muscle its way into a corner of the bond business, he spent months recruiting a top trader from another leading house, only to fire him on the first day. To a class of young incoming MBA?s he showed a slide of a heavily hirsute laughing man walking out of a shower, wearing only soap suds in the key areas, and told them ?This is how we like to leave our clients, plucked clean and happy.? Jaws dropped when we realized it was a picture of him in his frat days. He surfed a massive wave of government and corporate debt issuance to the top of MS. When a prestigious golf club turned him down for membership, no doubt because of his Lebanese heritage, he set up his own. I shall leave the darker urban legends confined to the dustbin of history. Waleed Chama will take over as president of Morgan Stanley International, a more sober banker there never was. We traipsed around the Persian Gulf sheikdoms together in the old days, when the long range artillery from the Iran-Iraq war kept us awake at night at the Kuwait Hilton, and shark eaten bodies of soldiers would wash up on the beach every morning. John will hang on as chairman, which means playing golf full time with the firm?s largest clients. As for the stock, you can expect another double after its near death experience at $6, once the economy gets back to normal.

QUOTE OF THE DAY

?When the music is playing, you have to dance,? said John Mac, retiring CEO of Morgan Stanley, explaining why he ramped the firm?s leverage ratio up to 32 times going into the financial crisis.