September 14, 2010 - The Big Win in Emerging Markets

Featured Trades: (EMERGING MARKETS), (ECH), (IDX), (TF), (EZW), (GXG), (EIRL)

iShares MSCI Chile Index Fund ETF

Market Vectors Indonesia Index ETF

Thai Capital Fund Inc.

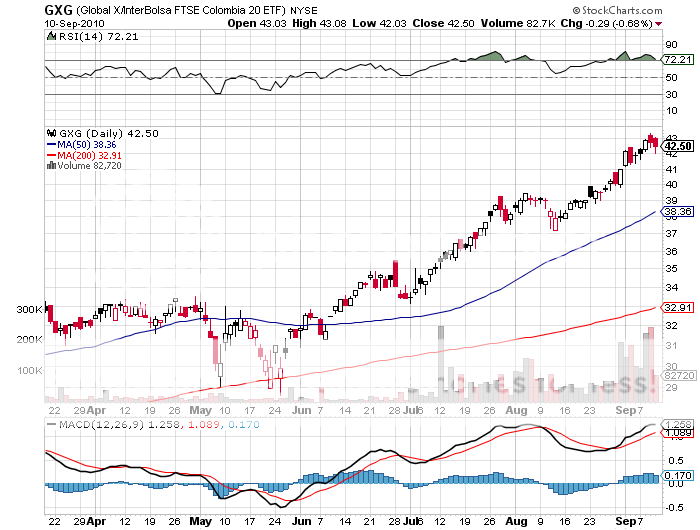

Global X/Interbolsa FTSE Columbia 20 ETF

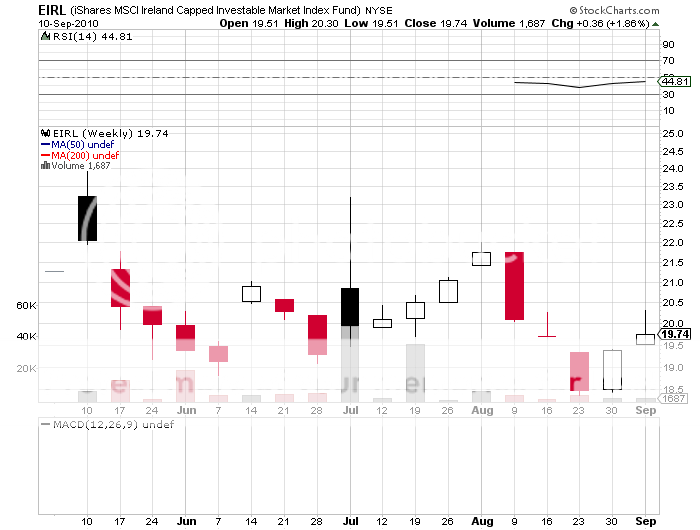

iShares MSCI Ireland Capped Investable Market Index ETF

PowerShares Water Resources Portfolio ETF

1) The Big Win in Emerging Markets. Take a look at the three year ranking of world stock markets below, and the themes that I have been pounding on the table about in this letter for the past 18 months will practically jump off the page at you.

Emerging markets shout out loud and clear, with the US down in the dumps at an 8.96% loss, and the lower echelons are populated with the widely despised PIIGS showing double digit losses. In fact, emerging markets occupy 18 of the top 20 spots.

Two of my picks, Indonesia (IDX) (click here for the call) and Chile (ECH) (click here for 'Chile is Looking Hot' ) grabbed the number two and three positions.? Thailand (TF) comes in at number seven (click here for that piece), while South Africa (EZW) (click here for 'On Safari for Trades in South Africa'), ranked ninth.

I missed the number one performer, Colombia (GXG), which brought in an annual 25.14% return for the last three years. But who new Juan Valdez was going to dump his job as a coffee grower and head up the Latin American desk at a major macro hedge fund (click here for 'Hedge Funds Head for the Frontier') ?

I have no doubt that emerging markets will maintain growth rates a multiple of ours for at least another decade. The $64,000 question is that a decade into the move, how much of this is already in the price? Buy on dips.

| Country | 3 Yr | ev/Emerging |

| COLOMBIA | 25.14% | E |

| INDONESIA | 13.56% | E |

| CHILE | 12.40% | E |

| PERU | 8.44% | E |

| MALAYSIA | 6.86% | E |

| BRAZIL | 6.27% | E |

| THAILAND | 6.13% | E |

| ISRAEL | 2.41% | D |

| SOUTH AFRICA | 1.40% | E |

| PHILIPPINES | 1.26% | E |

| INDIA | 1.12% | E |

| TURKEY | -0.07% | E |

| SINGAPORE | -1.16% | D |

| SINGAPORE FREE | -1.16% | D |

| HONG KONG | -2.70% | D |

| CANADA | -3.20% | D |

| EGYPT | -4.83% | E |

| SWITZERLAND | -5.04% | D |

| MOROCCO | -5.47% | E |

| CHINA | -5.55% | E |

| MEXICO | -5.56% | E |

| DENMARK | -6.05% | D |

| TAIWAN | -6.19% | E |

| AUSTRALIA | -6.31% | D |

| SWEDEN | -7.66% | D |

| KOREA | -7.73% | E |

| CZECH REPUBLIC | -8.60% | E |

| USA | -8.96% | D |

| SPAIN | -11.42% | D |

| JAPAN | -11.60% | D |

| NETHERLANDS | -13.00% | D |

| UNITED KINGDOM | -13.35% | D |

| GERMANY | -13.48% | D |

| RUSSIA | -13.51% | E |

| NORWAY | -13.93% | D |

| FRANCE | -13.96% | D |

| POLAND | -14.51% | E |

| NEW ZEALAND | -15.27% | D |

| HUNGARY | -15.82% | E |

| PORTUGAL | -19.52% | D |

| ITALY | -21.18% | D |

| FINLAND | -22.61% | D |

| BELGIUM | -23.12% | D |

| AUSTRIA | -27.53% | D |

| GREECE | -32.75% | D |

| IRELAND | -42.10% | D |

From Coffee Growing to Hedge Fund Trading?