September 14, 2010 - My Sugar Buy Explodes to the Upside

Featured Trades: (SUGAR), (SGG), (PHO)

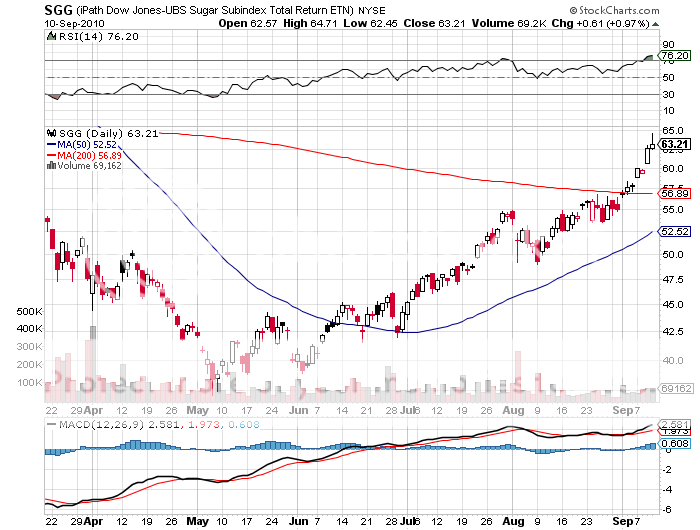

iPath Dow Jones-UBS Sugar Subindex Total Return ETN

3) My Sugar Buy Explodes to the Upside. I just got a bill from my dentist, accrued since the sudden onset of my sweet tooth on August 2, and it was an absolute whopper! The good news is that the 31% move in the price of sugar since then, and 68% since most ags caught on fire in May, means that I can afford it.

My ETN pick in the sector (SGG) is up a stunning 32% in little more than a month (click here for 'I'll Take Two Lumps, Please'). And you wonder why people bother to trade stocks?

You all know that I have been a huge bull on food related stocks all summer (click here for 'Going Back Into the Ags' ). The arguments in favor of sugar specifically are growing more persuasive by the day. China's middle class is expected to rise by 300 million over the next five years, which is equal to the entire population of the US. The link between sugar consumption and standards of living is one of the most unassailable correlations out there in the commodities world. Ethiopians eat a meager 6.6 pounds of the sweet stuff a year, while chocolate loving Belgians consume a mind blowing 77 pounds.

There is another play here. I am also a bull on water (PHO) (click here for 'Why Water Will Soon Be More Valuable Than Oil'). Anyone who has spent extensive time in the cane fields of Hawaii and the Philippines can tell you that sugar cane is one of the most water intensive crops out there. A rising global shortage of fresh water will hit sugar before other crops.

Then there is the ethanol problem. Brazil, the world's large producer, is already diverting 50% of its sugar production towards its flex fuel program, thereby taking those calories off of the world market.

Of course, I am still a firm believer in the long term case for food. It is simply the old Malthusian dilemma that the world is making people faster than new food supplies, and conditions will get a lot worse before they get better.

After the recent parabolic returns we have seen, you might want to snug up your risk control. When I see such blistering returns as these while everyone else mired in other asset classes is doing so miserably, the inner trader in me wants to pause and take stock.

Tighten up your stops on futures and ETF's and roll up your strikes on the options. The hard truth in the ag space is that you are always one rain storm away from a limit down move. I know because such unpredictable weather occurrences have cost me big time in the past.

Party away, but with your Blackberry in hand, and always stay close to the exit in case the flash fire hits. And if you want to sleep at night, you might want to consider taking some profits here. A 32% gain in a month in a zero return world is a lot. I also know from hard earned experience that mean reversions can be a real bitch.

A Belgian Dentist?