September 16, 2010 - Make or Break Time for Silver

SPECIAL GOLD ALL TIME HIGH ISSUE

Featured Trades:? (SILVER), (SLV), (GLD)

iShares Silver Trust ETF

SPDR Gold Shares Trust ETF

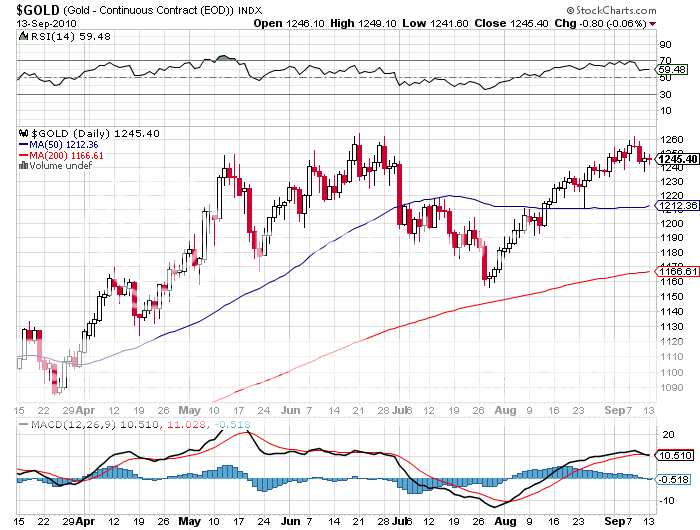

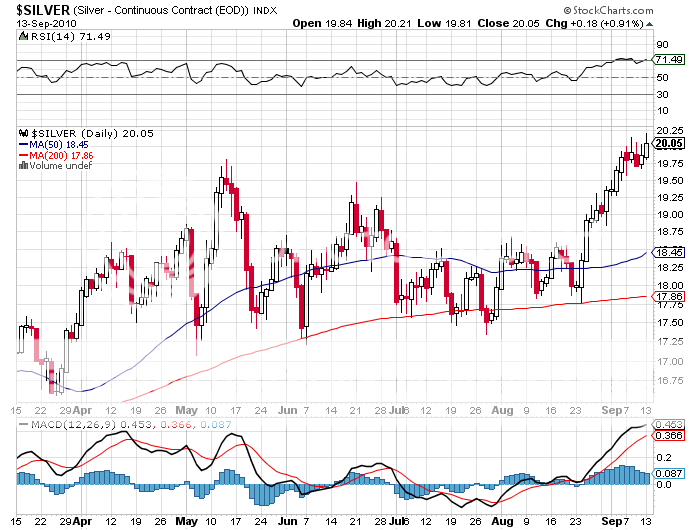

2) Make or Break Time for Silver.? Those who took my advice to load up on silver a month ago (click here for 'Why the Really Big Play is in Silver'), are laughing all the way to the bank. The white metal outperformed gold better than 1.6:1 ratio that I predicted. Silver is now trading at a two year high, is overbought, and bumping up against key technical resistance.

Unsurprisingly, I have been flooded by emails from readers asking what to do now. Short term traders, those in the futures markets, and anyone using a degree of leverage should take the money and run. As I have pointed out with my hugely successful agricultural trades this summer (corn, wheat, sugar), we now live in a zero return world, and the 13% gain silver has posted since August 23 puts you way ahead of the pack. Mean reversion can be such a bitch that it makes your ex wives appear like a convent full of nuns.

For those who hold physical bars and coins, it is a different story. Just keep it locked up and throw away the key. My multiyear target for silver is the old 1979 high of $50. Some hyper bulls, like Europacific's Peter Schiff, thinks it may go to $100 (click here for my interview with Peter ).

In any case, the round trip dealing costs for physical bars and coins are too high, sometimes reaching 20%. There are also the tax implications, for those who bother with such things. Remember, coin dealers are now required to file 1099's with the IRS on all precious metals sales by individuals. And if things don't work out with this financial markets thing, and we enter the Armageddon daily predicted on the Internet, you can always use your silver to bribe the border guards.

If you want to pick up more silver coins for the long term, please click here.

Better to Bribe the Border Guards