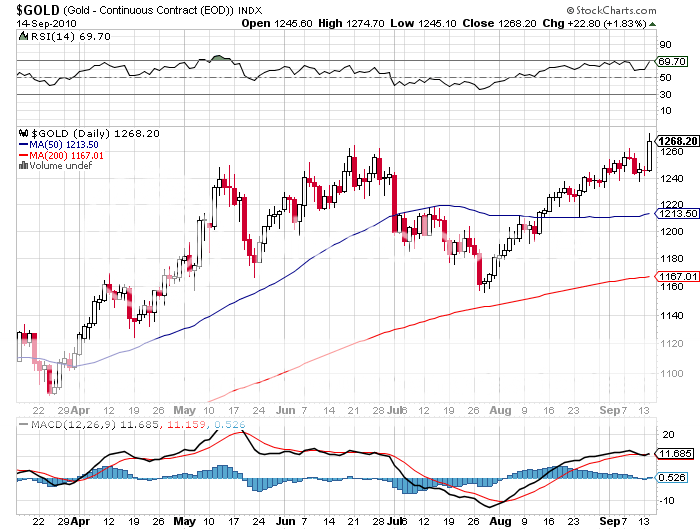

September 17, 2010 - More Reasons to Buy Gold

Featured Trades: (GOLD), (ABX), (AU), (GLD)

SPDR Gold Trust Shares ETF

2) More Reasons to Buy Gold. As a four decade observer of the global financial markets, I often see a situation where the higher a price goes, the more reasons for it to rise come out of the woodwork. That is happening with gold now.

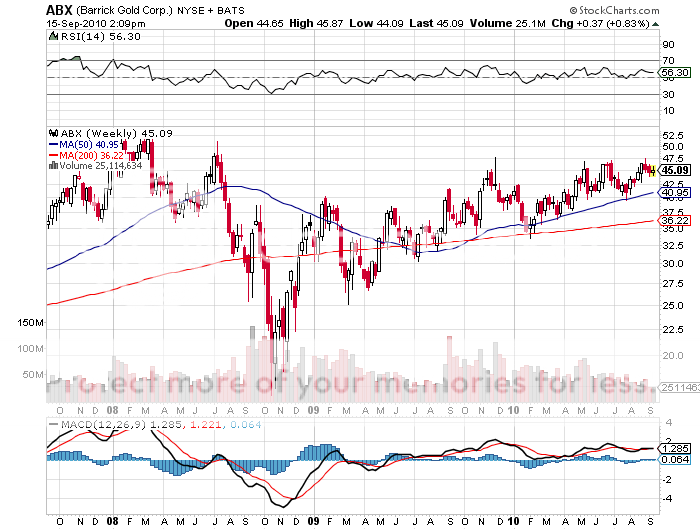

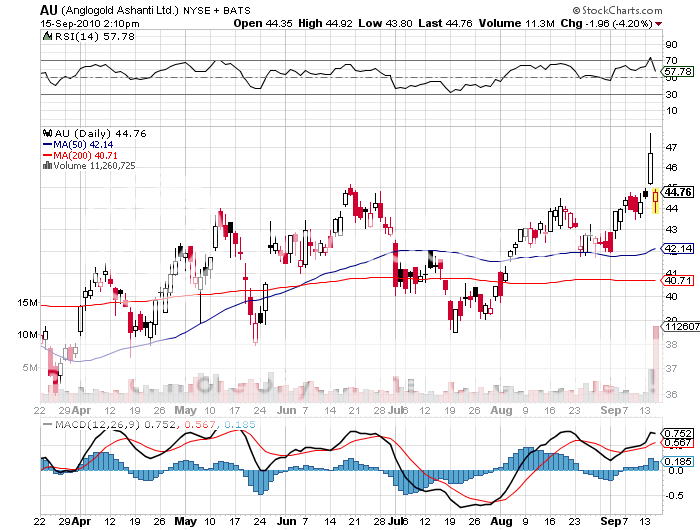

Yesterday, I learned that Anglo Gold Ashanti is spending $1.375 billion to take its gold hedges off. The obvious implication here is that they have studied the long term supply and demand for the lustrous product, and believe that the downside risk no longer exists. When an organization with far more massive resources than I reaches such a conclusion, should I follow suit? Barrack Gold (ABX) did the same a year ago, and the move was one of the sparks that ignited the jump in the yellow metal from $950 to $1,200.

And then I read in the Financial Times today that central banks are planning to buy 15 tonnes of the barbarous relic in 2010, flipping them from net sellers to net buyers for the first time in 20 years (click here for my piece predicting this seven months ago). For the past decade, central banks averaged 442 tonnes/year in sales. Gone are the perpetual rumors of the elusive 400 tonne IMF sale that overhung the market. It seems the list of emerging market central banks loading up on gold is growing by the day. I think the outlook for the value of my gold teeth is looking pretty good these days.