September 2, 2009

September 2, 2009

Featured Trades: (MONGOLIA), (SPX), (IVN), (RTP),

(FSLR),(STP) (YGE), (LEN), (DHI), (TOL)

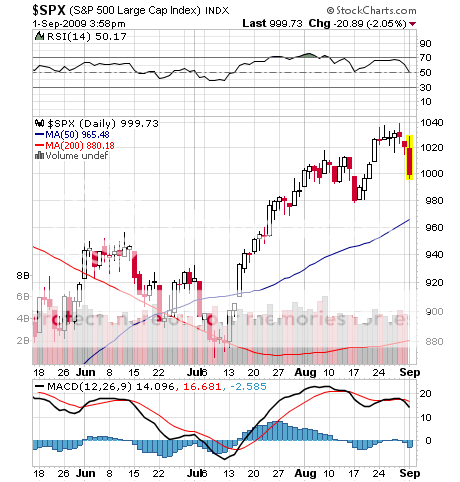

1) US stocks are now the most expensive they have been in seven years, and never really got cheap during the March low, just fairly valued. At least I have some good company in my views, which are also shared by David Rosenberg of Gluskin Sheff, the former economist at the late Merrill Lynch. The 'faith based' rally is now discounting a GDP growth rate of 4.0%, which has a snowball's chance in Hell of actually occurring. This is up dramatically from the 2.5% growth rate the S&P 500 was discounting when the index was at 667. The best stock market rally since 1933 added an unprecedented eight PE multiple points to stocks, and there is now more risk in the market than the 2007 peak. Underweight portfolio managers and momentum driven day traders are to blame. It's what happened after the 1933 rally that scares me. Needless to say, stocks offer no value here. You can sign up for David's well thought out research for free by going to his website at http://www.gluskinsheff.com/.

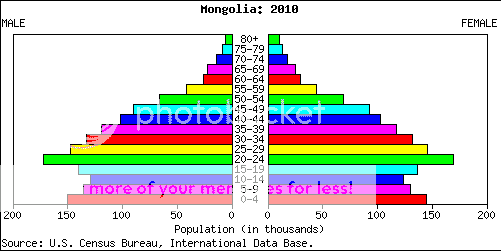

2) There's nowhere I won't go to make a buck, so I had to sit up and pay attention when friends in Tokyo told me that the next big Asian equity play will be in Mongolia. Genghis Khan's ancestral land has enormous mineral resources which make it a natural commodity play (did he know?), and it has one of the world's most GDP friendly population pyramids. But incompetent government administrators with antiquated Soviet era sentiments managed to kill every nascent development opportunity in the crib with onerous windfall taxes and harsh joint venture restrictions. The resources stayed in the ground. National elections finally turned over the regressive administration in 2008, and the anti growth tax regime was dumped last week. Mongolia is now close to inking a deal with Ivanhoe Mines (IVN) and Rio Tinto (RTP) to develop the massive Oyu Tolgoi gold and copper mine, which could lead to a doubling of the GDP in five years. We're talking a gigantic 450,000 tons of copper and 330,000 ounces of gold a year. Also on tap is the development of huge coking coal and uranium deposits. The spillover benefits for the rest of the economy would be substantial.?? Mongolia's Lilliputian stock market offers few opportunities for foreign investors. So unless you want to get a job there or invest directly in a local company, you'll have to wait for the ETF to come out, and then the dip to get in. This is exactly what unfolded in Vietnam. Now that visas are no longer impossible to get, as they were in my day, my Japanese and Chinese speaking son tells me that Ulan Bator has become the trendy place for American college grads fleeing unemployment at home. Who knows? Give me a low enough PE multiple and I might even develop a taste for sheep brains and fermented mare's milk.

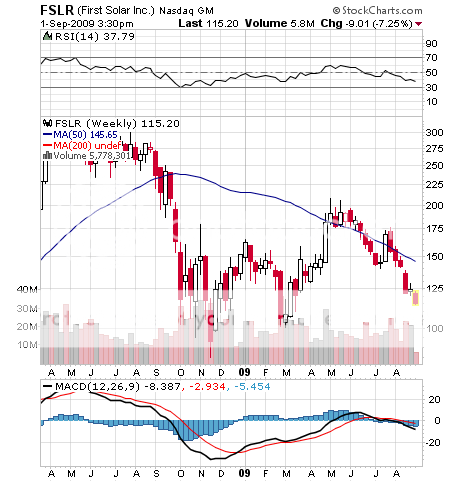

3) The solar industry is suffering some 19th century Darwinian style competition, with Chinese manufacturers Suntech (STP) and Yingli Green Energy Holding (YGE) clearly dumping panels below cost to gain market share. You may laugh, but I watched the Japanese pursue the same strategy in the seventies and eighties to devastating success. They now control half the US automobile market, and the most profitable half at that. As a solar consumer I shouldn't care, as the 50% price drop has, with Obama's generous tax subsidies, made new installations cheaper than obtaining electricity from my local power company (PGE) at 12 cents a kilowatt. It's just a matter of booking the profit in China instead of Phoenix. But the predatory pricing has also kicked my beloved First Solar (FSLR) in the shins, which has dropped from 44% from $205 to $115 since May. Use the move to pick up FSLR on the cheap. The company is using advanced cadmium telluride based thin film semiconductor technology, which has enabled it to match the Chinese price cuts dollar for dollar, and the engineering will allow them to continue to do so. The Chinese, wedded to an older polysilicon product, can't keep playing this game, unless they want to hemorrhage cash, or face US anti-dumping enforcement. To see more on the current fundamentals of solar, please click here.

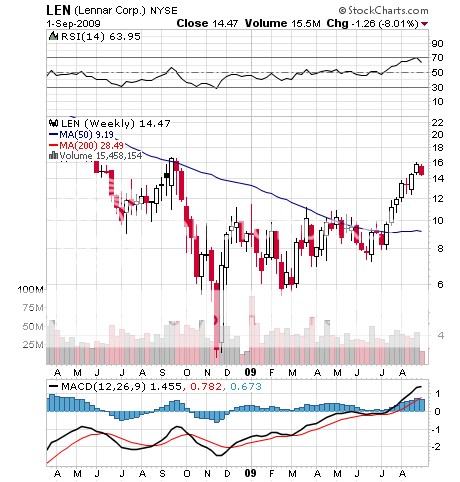

4) Don't kid yourself into thinking that the real estate collapse is over. Yes, you can be forgiven for thinking so with July new home sales up 10%, the Case-Shiller home price index up two consecutive months, and homebuilder stocks like Toll Brothers (TOL),?? D.R. Horton (DHI), and Lennar (LEN) through the roof. Nationally, home prices have fallen back to their historic average of 3.2 times earnings. The problem with all of this is that crashes don't end at the averages, they overshoot. Some cities like Los Angeles, New York, and Washington DC are still historically expensive. Take away the life support of ultra low interest rates, the $8,000 first time buyer tax credit, the $6,000 California tax credit, $1 trillion in Fed purchases of securitized debt, and toss in another five million expected new foreclosures, and that might give you your final bottom. But that isn't happening this year. Rent, don't buy. For more on this, look at Martin Hutchinson's excellent work by clicking here

QUOTE OF THE DAY

'The total breakdown of the system is ahead of us. It may come in four, five, or ten years, and it will devastate the world economy. By bailing out the issuers of derivatives, the Fed actions have only postponed the day of reckoning,' said Marc Faber, publisher of the Gloom, Doom & Boom Report.