Featured Trades: (APPLE'S NEXT STOP:$1,000), (AAPL)

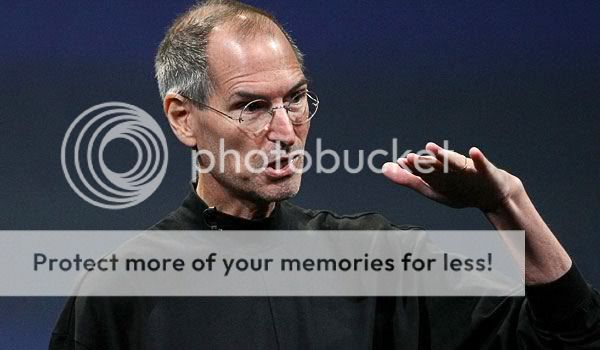

4) Apple's Next Stop: $1,000. Watching Apple (AAPL) post a new all-time high today, I was struck by a wave of nostalgia. When I took a young, cocky, long haired, Levis wearing Steve Jobs around to meet Morgan Stanley's institutional investors to pitch an Apple secondary share offering 28 years ago, I vowed never to buy anything from the man. He was such a great salesman, and possessed such a messianic devotion to his product, the risk of getting legged over had to be great.

This proved a good strategy for the next 18 years, when the company nearly went under three times, and the stock repeatedly plunged from its initial listing price of $22 down to $4. Disastrous products like the Apple Newton came and went, and then poor Steve got fired. Ouch!

Living in the San Francisco Bay Area, I was also creeped out by the fanatical cult following that Steve enjoys. Criticize an Apple product here, and you risk getting attacked, ostracized, deleted from address books, chopped off Christmas card lists, banned from Facebook pages, and ejected from Twitter accounts. There was also no end of abuse from my IPod, Imac, and Tablet addicted kids who accused me of being a dinosaur sticking with my Windows based PC and Blackberry.

I have to confess now that my prior prejudices lead me to miss the boat on Apple for the last decade, when the stock soared from $4 to $420, eventually topping Exxon (XOM) with a gargantuan $390 billion market plus capitalization. To see the company bring out a ground breaking, high end $499-$829 product like the IPad and sell 2 million units in a short two months during unstable economic conditions is nothing less than amazing.

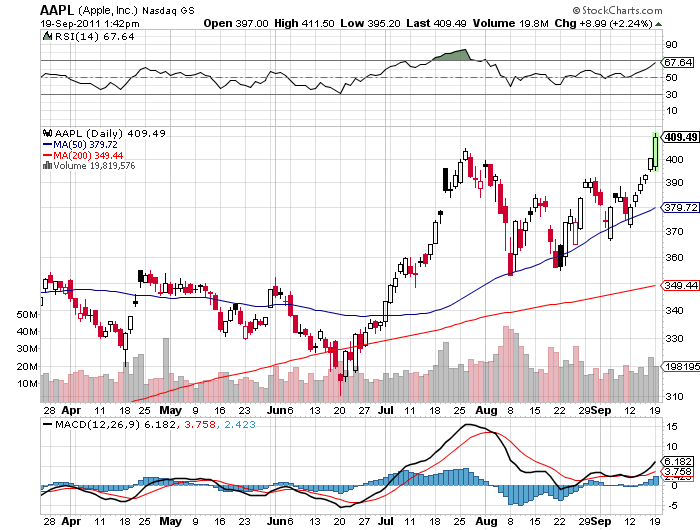

The recent stock performance has also been miraculous, bouncing back from a flash crash low of $195 to challenge its old high in a matter of weeks, while the rest of techland lay in ruins. Forecasts for the global smart phone market are ratcheting up by the day on the back of surging demand from emerging markets. Sales could reach 250 million units annually by 2012, of which 17% currently is sold by Apple.

The company has become a monster cash flow generator, spewing out $12 billion over the last 12 months. It sits on a cash mountain of $66 billion. Apple now has the envious problem in that sales of several of its products are going hyperbolic at the same time. Some analysts have Apple's earnings skyrocketing from the current $25/share to $30 over by next year, which at the current 16 multiple would take the share price up to $480.

If the company's multiple expands to its pre-crash average of 35 X, that would take the stock to a positively nose bleeding $1,050, giving it a 250% return over the next two years. Call me crazy, but if corporate American finally starts supporting Apple products in their own business applications, which I hear is in the works at several Fortune 100 firms, that forecast could be low.

I'm not saying that you should rush out and load up on stock today. But it might be worth taking a stake on the next wave of fear that strikes the market. For momentum players, buy yesterday!

-

-

What a Long and Winding Road It's Been