September 23, 2009

September 23, 2009 Featured Trades: (COAL), (CCS), (BTU), (SINA), (BIDU), (SOHU, (NTES)

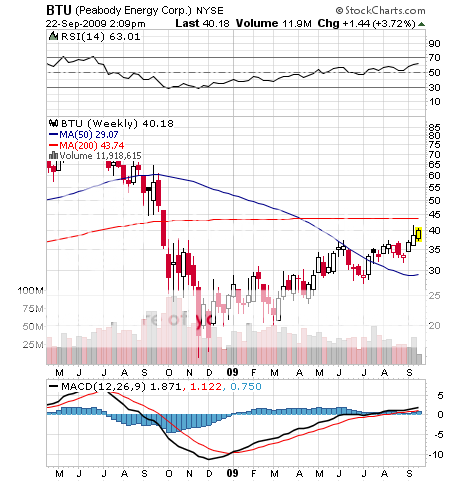

1) Peabody Energy?s (BTU) CEO, Gregory Boyce, says that the Chinese buying of coal is real, not stockpiling, and expects to see a 7.5% annual growth in sales for the next five years (click here for their website ).?? The big demand is for metallurgical coal used to make steel, which the Middle Kingdom is importing at a record rate. Investors have already figured this out, taking the company?s stock up 400% in a year. Coal has been the fastest growing energy source in the US for the last six years, and now accounts for 50% of our electricity supply and 85% of energy generation. The problem is that the industry is target numero uno with the environmental movement, which now holds significant sway in Washington. Thanks to a 150 year lobbying effort, the coal industry has already carved out preferential treatment in the upcoming cap & trade wars at the expense of other fossil fuels.?? They are also pushing hard for carbon capture & sequestration (CCS), which strips the CO2 out of emissions and pumps it down to 8,200 feet underground. All eyes are now on the first such plant to come online this week in New Haven, West Virginia (click here for link to the full New York Times story ). Industry analysts say it will cost $1 trillion to convert the country?s 400 plants to generate power 30% more expensive than we are currently paying.?? You might also get polluted ground water and earthquakes as part of the deal. Sounds like a high price to pay to save a few union mining jobs. I vote for a natural gas based solution, which is currently coming out of our ears.

2) I met with my next Congressman, John Garamendi, who will be replacing Ellen Tauscher, after Hillary bumped her up to an Asst. Secretary of State job. John comes to the seat via UC Berkeley, the Harvard Business School, a Peace Corps stint in Ethiopia, the California State Assembly and Senate, Deputy Secretary of the Interior under Clinton, and state Lieutenant Governor. While the general election is not until November, his win is assured by the 18% lead the Dems have over the Republicans in California?s 10th Congressional district. The timing for Garamendi is unfortunate, as his 15 years as the Golden State?s first elected insurance commissioner would come in handy in the health care debate, which will be decided by then. One of the most gerrymandered districts in the country, on the map it looks like either a butterfly flipped over on its side, or a giant Rorschach test. This is not an easy area to represent. It includes big helpings of liberal San Francisco suburbanites balanced with conservative Central Valley farmers, and includes the worst Berkeley radicals, sizeable minority groups, cattle ranchers, and foaming at the mouth fruit farmers. Garamendi has taken the traditional liberal tack, supporting public single payer health care, the environment, education, jobs programs, infrastructure spending, and a pro-Israel foreign policy.?? The insight he gave me is that Obama is assuming he will have control of both houses of Congress for only four years, so it will be pedal to the metal to get his reforms programs through quickly. Every session on the Hill will be extended to the max, and there will be no rest for the wicked. If you think this year?s donnybrook over health care was tough, wait until you see the battles over tax reform, cap & trade, and financial regulatory reform in 2010. In my world this means that politics will become a much larger factor in the markets than it ever has in the past. Better go short more dollars.

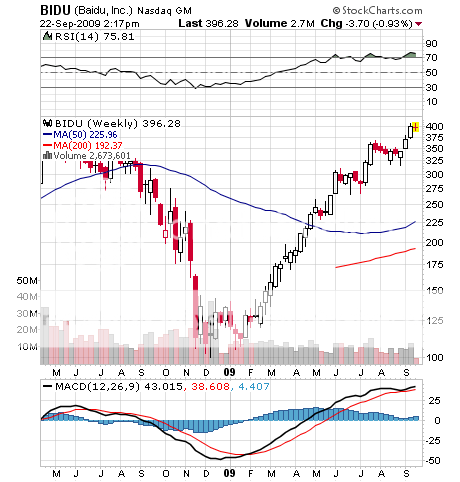

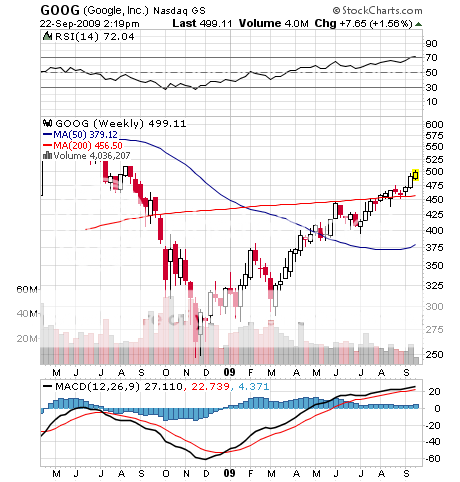

3) After nearly four decades in the industry, I can tell you that stocks can be snarly, bad tempered beasts that would as soon as bite you as give you rabies. So it is a rare pleasure when I get to trade securities like the Chinese Internet companies, which have been purring away like domesticated kittens. If you need further proof of where the future growth in the global economy is coming from, take a look at Baidu (BIDU), the Google of China, which I strongly recommended on March 6. It has quadrupled from the lows to $400, and has been one of the best calls of my career. Look at the chart below, which is probably the most bullish one you will ever see.?? In the meantime, our Google (GOOG) only doubled. These hedge fund darlings are best of breed companies, but the Chinese one outperformed the American counterpart by a factor of 2:1. This is the consequence of the US economy making a permanent shift from a 5% growth rate to 1.5%-2%, and is a pattern you can expect to see repeated around the world for the next decade. The cruel truth here is that American companies, with the twin drags of a mature economy and staggering debt, will never command the same multiples of Chinese ones. When looking for long equity exposure, always look for Chinese ones first. Expect huge growth of the four horsemen of the Chinese Internet sector-Netease (NTES), Sina (SINA), and Sohu (SOHU), and of course, BIDU- who are going to eat our lunch.

QUOTE OF THE DAY

?Coal is the drug of choice of a major industry with a lot of political power,? said David H. Holtz, head of Progress Michigan, and environmental group.