September 23, 2010 - The Markets Develop a Caffeine Habit

Featured Trades: (COFFEE), (JO), (COCOA), (SBUX)

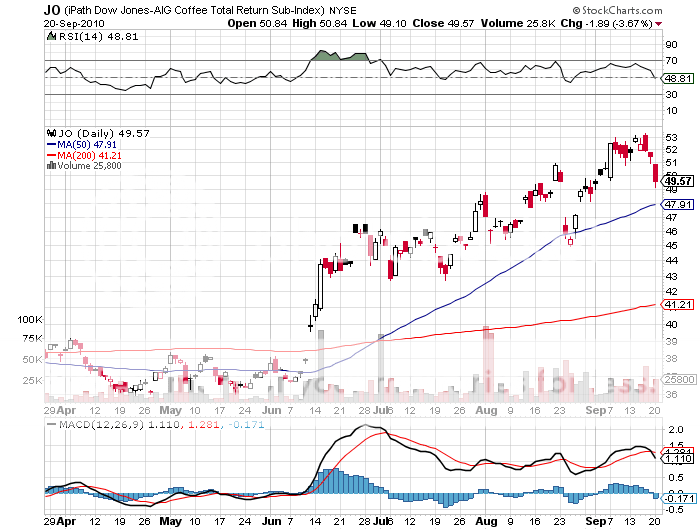

2) The Markets Develop a Caffeine Habit. Since my last piece on coffee two months ago (click here), the ETF for aromatic commodity (JO) has tacked on 23%, and 42% since I put out my watershed call (click here for 'Going Back Into the Ags').

But this may just be the down payment. Weather in primary producer, Latin America, has been poor. US coffee stockpiles are now at 10 year lows. Major producer Vietnam is threatening to cease exports and start hoarding, as Russia has already done with wheat. Although prices are now at 13 year highs, we may get even more of a jolt out of this trade.

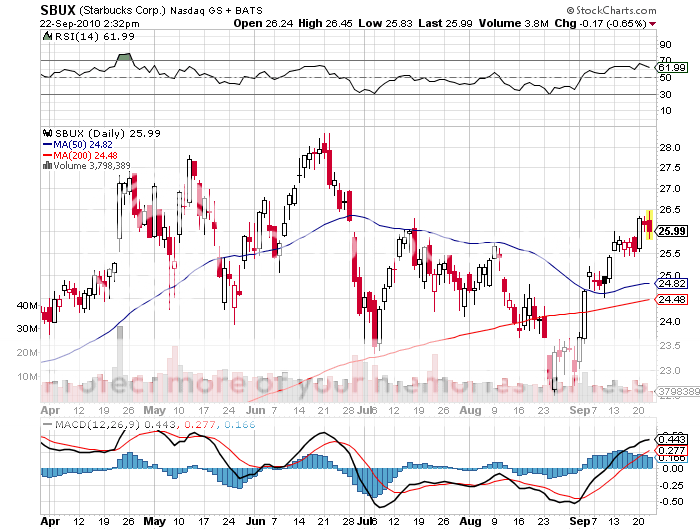

Has anyone thought about shorting Starbucks (SBUX) on this news? They can't keep passing prices on to consumers forever in this deflationary world.? What is the one agricultural commodity that has gone down this summer? Ironically, it is cocoa, where a single hedge fund attempted to corner and create a short squeeze, unsuccessfully, it would appear (click here for 'Hedge Fund Corners the Cocoa Market' ).? Better start stocking up on those 50 pound bags of coffee beans at Costco.

Stockpiling for That Caffeine Habit