September 23, 2010 - Upgrading Copper

Featured Trades: (COPPER), (FCX), (GLD), (KOL), (BHP), (ECH)

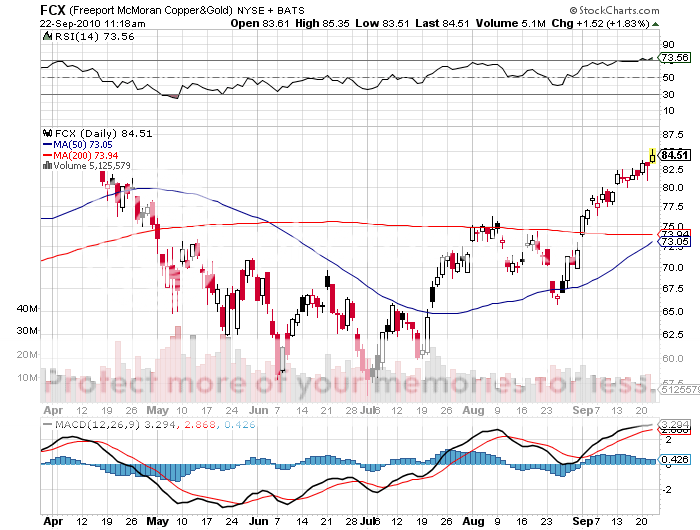

3) Upgrading Copper. They say that imitation is the sincerest form of flattery, so I felt like puffing out my chest yesterday when Goldman Sachs (GS) announced an upgrade of Freeport McMoran (FCX), posting a six month target of $96/share. (FCX) is one of the world's largest copper producers, and has a nice little gold business on the side, as the two are often found together. The Vampire Squid said that demand from China was unrelenting, would continue into the foreseeable future, and that it was not all about stockpiling.

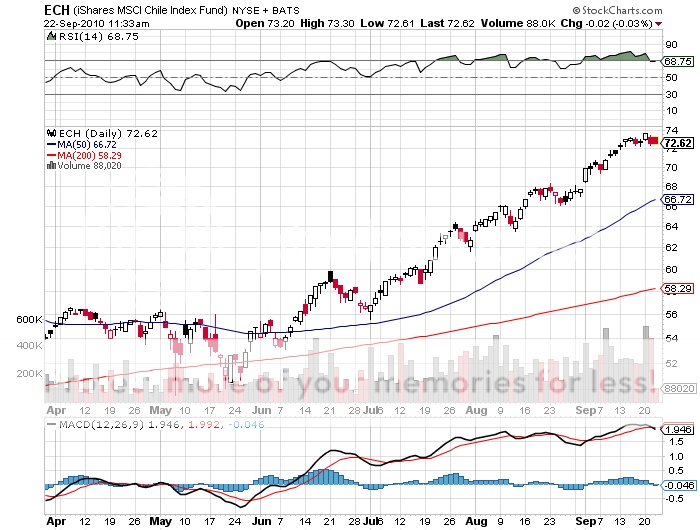

I always welcome more investors joining the bandwagon after I have established a position much lower down. Their report adds confirmation to my recent piece on the red metal (click here for 'Is Copper the New Red Gold'). It also bodes well for my call on Chile (ECH) (click here for 'Chile is Looking Hot'). Long time readers know that I have been bullish on copper all year, listing it in my 2010 Annual Asset Review as one of the commodities that will outperform for the next decade (click here for that report).

Like all other hard assets, copper is a direct beneficiary of the QE II rumors now sweeping the financial markets (see above). In the old days, such a move by the Fed ritually delivered strong bond prices and a weak dollar. In the 'new normal' it also triggers a tidal wave of buying things that hurt if you drop them on your foot, like precious metals (GLD), (SLV) industrial metals, coal (KOL), and iron ore (BHP).

These are the 'new dollars' with the unique attributes that they can't be made with a printing press, aren't being made anymore, and the number of potential consumers is growing by 175,000 a day. If you don't believe me, then check out the World Population Clock by clicking here.

Gotta Love Those Hard Assets