September 24, 2010 - My Big Miss in Cotton

Featured Trades: (COTTON), (BAL)

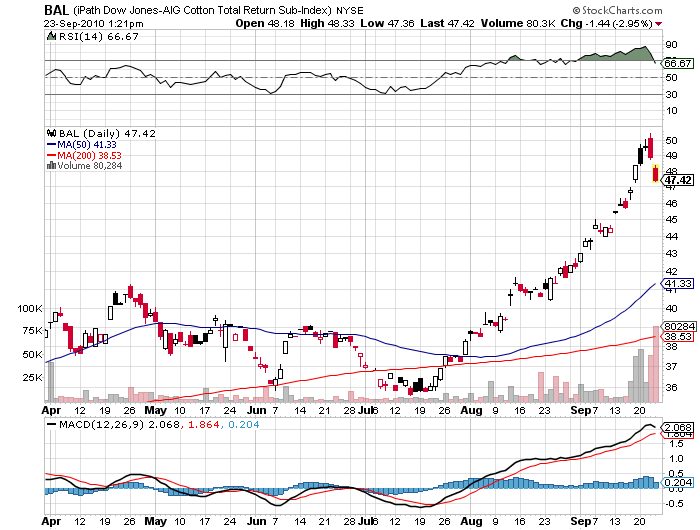

iPath Dow Jones-AIG Cotton Total Return Subindex ETN

3) My Big Miss in Cotton. Those lowriders you have been buying your girlfriend every Christmas are about to get a lot more expensive.? Since the Great Ag Boom of 2010 started in May, the white staple has rocketed 38% to over $1/pound, a 15 year high, and only the second time since the Civil War that it has broken the buck. The cotton ETN (BAL), is up an eye popping 60%.

Rapidly rising standards of living have encouraged demand for cotton to explode in China and India. Heavy rains in China, the world's largest producer, have caused much of this year's crop to rot, and local traders have been paying as much as $1.45/pound. Imports of cotton into the Middle Kingdom have doubled this year.

Much of the crop in Pakistan was destroyed by their recent floods, and India has imposed an export ban. Mills in the US and Europe are now hoarding bales to head off further shortages and price increases. In recent months, the futures exchanges have increased margin requirements to keep hedge funds at bay, which are believed to have doubled long positions in recent months. This has put the squeeze on producers and middlemen alike.

As much as I try, I can't catch each move in every commodity in the world all the time. Instead, I'll take the lessons home that the world economy may be stronger than we realize, and that long predicted inflation is approaching, just not from the direction that we expect.