September 25, 2009

September 25, 2009 Featured Trades: (SPX), (FCX), (FXI), (BYDFF), (BIDU), (X), (JNK), (HYG), (EEM), (EWY), (TBT), (UDN), (ULE), (VIX)

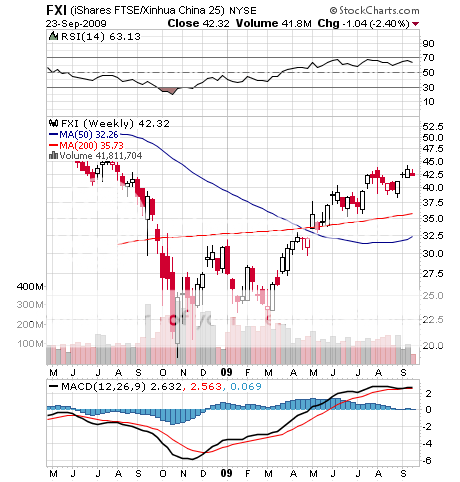

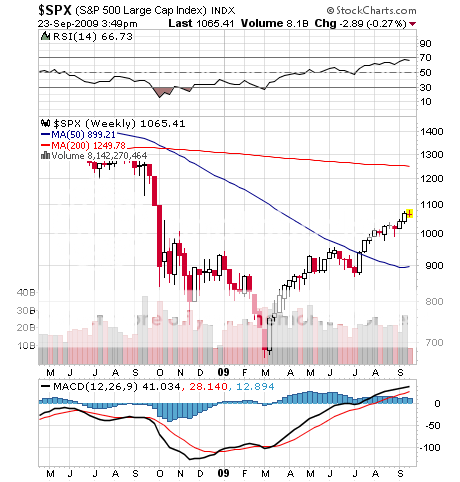

1) The one absolute, take it to the bank, bet the ranch fact you can count on right now is that there is no value in the stock market. We are at a lofty 20 X earnings, and historically, when the market sported such a rich valuation, a 7% drop ensued in the following year. But what is history, but the ravings of an angry, frustrated old trader? Maybe having seen the best bargains in a century only six months ago, I?m spoiled. I have always been a tightwad. I must be the only guy around who flies his own private plane to garage sales for the sheer love of the deal (where else can one find Dean Martin records in decent playable condition for 25 cents each?). I just reviewed all of the stocks and sectors I liked at the beginning of the year, and a more picked over field you never saw. (Click here for my New Year list ) The list of big winners is long: FCX, FXI, BYDFF, BIDU, X, gold, silver, copper, crude, oil services, junk bonds (JNK), (HYG), emerging markets (EEM), BRIC?s, Korea (EWY), with shorts in long dated Treasuries (TBT), volatility (VIX),?? and the dollar (UDN), (ULE). Even tax exempt munis have been on a tear. Many of my core positions are up over 400%. When everything in your portfolio has done so well, it?s time to go hide. The problem is that my more loyal, even fanatical followers have taken out paid subscriptions for up to two years, so I must keep dancing. Hence, the recent increase in book reviews, political pieces, or just outright frivolous stories. What you do here is deep research and list building, so when the window opens you can jump through with both feet, and without any reservations. I hate being out of the market. But I hate losing money even more.

2)For an iconoclastic, myth shattering, eye opening view of the true competitive threat posed by Asia, read the piece in the August issue of Foreign Policy magazine by Minxin Pei, a scholar at the Carnegie Endowment for International Peace. Power is not shifting from West to East; Asia is just lifting itself off the mat, with per capita GDP only at $5,800, compared to $48,000 in the US. We are simply moving from a unipolar to a multipolar world. China is not going to dominate the world, or even Asia, where there is a long history of regional rivalries and wars. China can?t even control China, where recessions lead to revolutions, and 30% of the country, Tibet and the Uighurs, want to secede. All of Asia?s progress to date has been built on selling to the US market. Take us out, and they?re nowhere. With enormous resource, environmental, and demographic challenges constraining growth, Asia is not replacing the US anytime soon. There is no miracle form of Asian capitalism; impoverished, younger populations are simply forced to save more because there is no social safety net. Ever heard of a Chinese unemployment office? Nor are benevolent dictatorships the answer, with the despots in Burma, Cambodia, North Korea, and Laos thoroughly trashing their countries. The press often touts the 600,000 engineers that China graduates, joined by 350,000 in India. In fact, 90% of these are only educated to a trade school standard. Asia only has one world class school, the University of Tokyo. As much as we despise ourselves and wallow in our failures, Asians see us as a bright, shining example for the world. After all, it was our open trade policies and innovation that lifted them out of poverty and destitution. Walk the streets of China, as I have done for nearly four decades, and you feel this. To read the story in its entirety, click here . I think I?ll reread it next time I think about doubling up my FXI and EEM positions.

3) America?s economy was powered by personal computers in the eighties, the Internet in the nineties, and credit cards and subprime loans in this decade. So what is America?s next gig? I think conversion of the global energy grid to alternative sources is the best candidate. If you took this out of the realm of geeky engineering graduate students and high school science projects and made this a national priority and a defense issue, it could become a major GDP driver for decades. Using the broadest possible definitions, the number of green jobs could grow from one million today to 37 million in 20 years, or 17% of the total work force. Since many of these jobs are in local construction and installation they can?t be exported. Last year, 8,000 megawatts of wind power was built, the equivalent of seven large coal fired plants, accounting for 42% of all new power generation. If the US develops cost competitive clean energy while China is still stuck using the expensive dirty stuff, it will have a competitive advantage that could reverse the terms of trade with the Middle Kingdom. The US would also have superior technology that it could sell to the rest of the world. I can tell you that green energy is one of the few themes that gets a hearing with venture capitalists these days, and this will be a major stock market driver down the road. I know this is all long term stuff, but remember buying Apple (AAPL) at $4 in the early eighties?

?In a social democracy with a fiat currency, all roads lead to inflation,? said legendary hedge fund manager Bill Fleckenstein.