September 26, 2011 - Market Carnage Revisited

Featured Trades: (SPY), (IWM), (RSX), (EEM), (CU), (GLD), (JNK), (TBT), (TLT), (GLD), (USO), (FXA), (FXE), (UUP), (VIX)

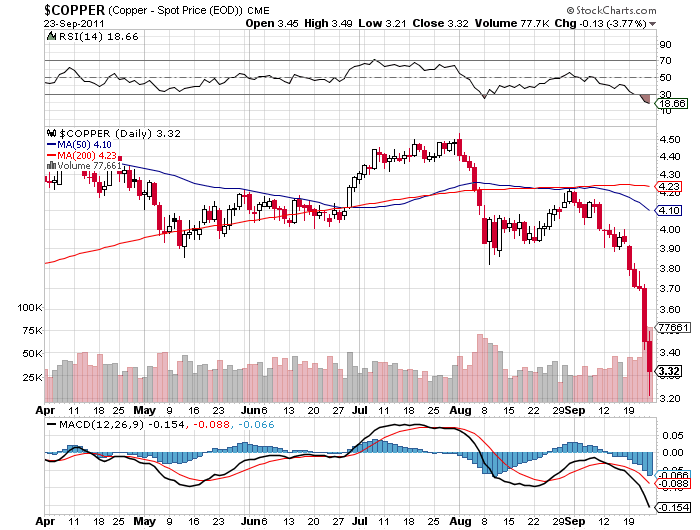

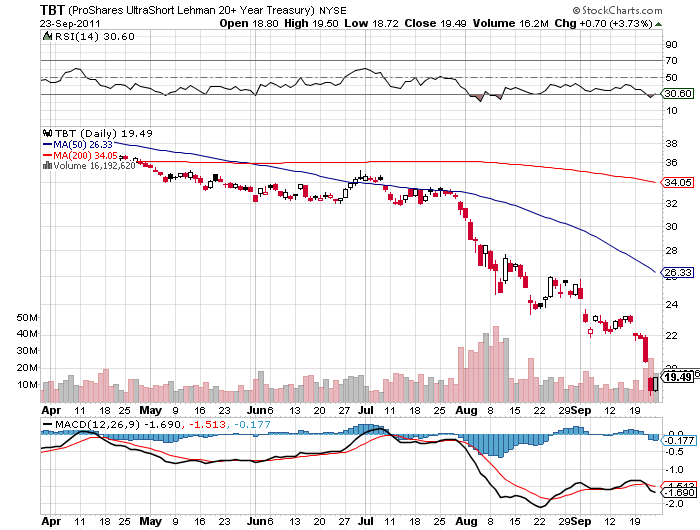

1) Market Carnage Revisited. I have never seen a single word cost me so much money. That word would be 'significant', the word that the Federal Reserve added to the language in its recent release about the current risks to the economy. To the market, this translates into down 1,000 points on the Dow. For copper it means shedding 50 cents per pound. And for the (TBT) it converts into down five points. Ouch, and double ouch!!

-

The newsletter business is a great one to be in, except when it isn't. My workload is so staggering that when the slightest thing goes wrong, it all falls apart like a house of cards. Right when the Dow had plunged 500 points and NASDAQ was bleeding 100 points, the price action melted my computer. I quickly batted out a backup letter for Friday, which is why I was talking about the wonderful world of ETF's when we were facing Armageddon. I then spent the rest of the afternoon using my best Hindi trying to get Dell to fix my machines from Bangalore.

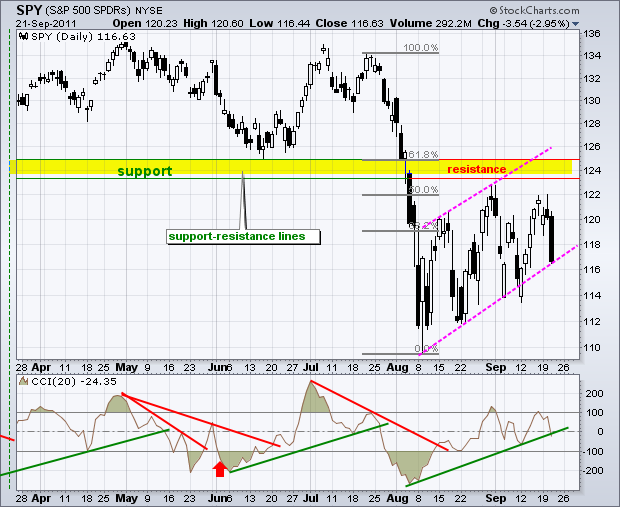

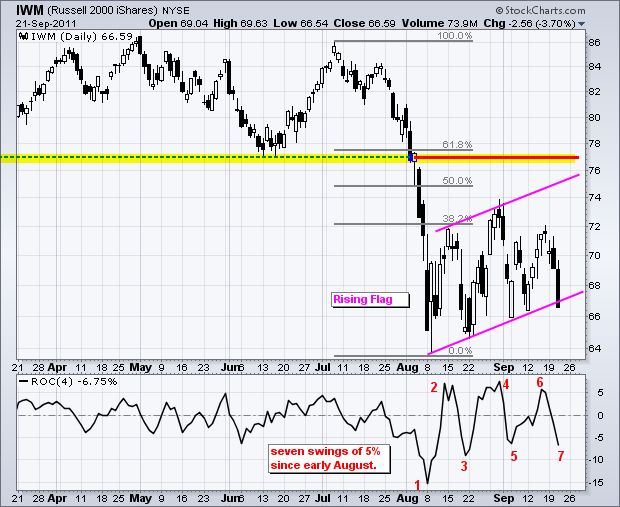

I called the market action going into the Fed release dead on, the S&P rallying all the way up to a healthy 1,220. Over the past six weeks, the 1200 handle has been as rare as a sighting of a blue footed boobie in the middle of the Sahara Desert. I was also accurate in forecasting a post statement rally. Only my timing was off. Instead of giving me a whole day with which I could pound all asset classes at the upper end of their recent rallies, especially stocks, oil, and the euro, the spurt lasted all of 27 seconds. That is how long it took the big hedge funds to mobilize billions of dollars with which to decimate the indexes.

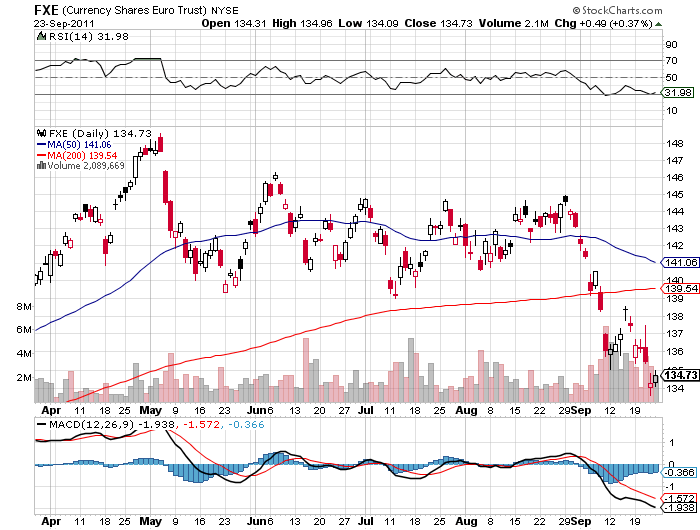

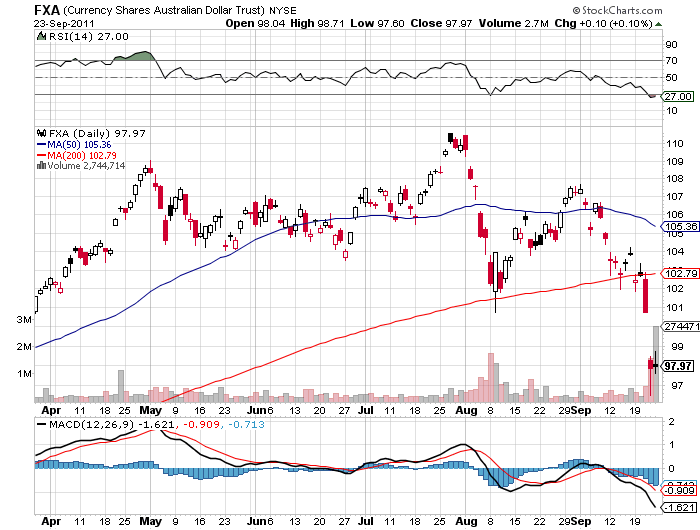

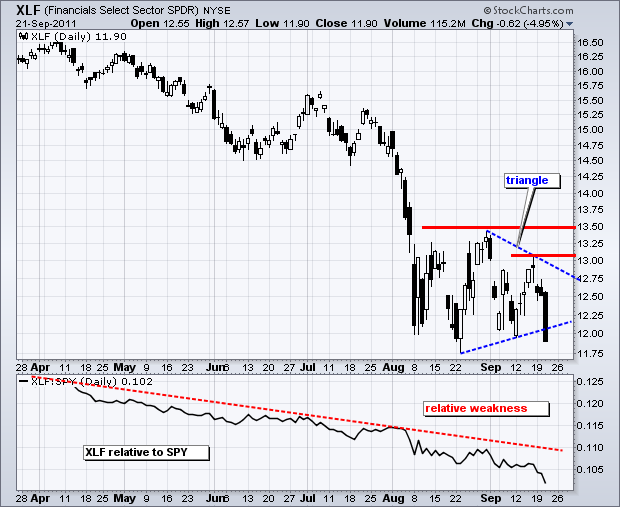

It was a perfect 'RISK OFF' day. Shares suffered their worst week in three years. Crude splashed $9. The industrial metals were shoveled under the carpet. Junk went back to the dump. The Euro was slashed four cents; the Ausie dollar touched 96 cents, down a whopping 15 cents since July. All of a sudden Uncle Buck was everybody's favorite relative. Even Apple was down $20. My goodness!

-

-

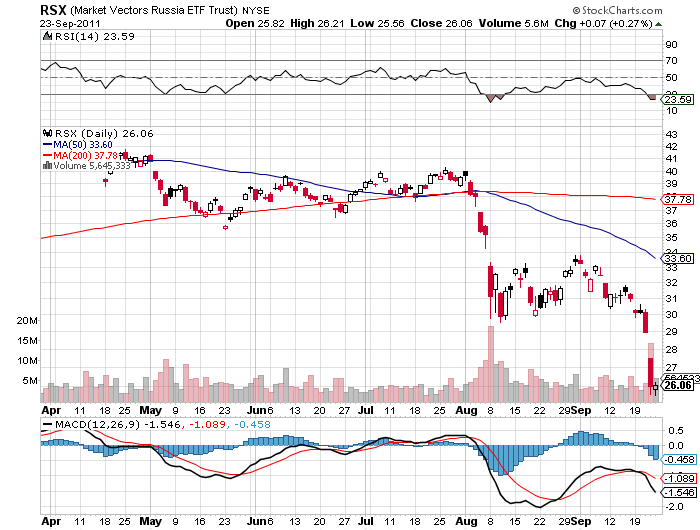

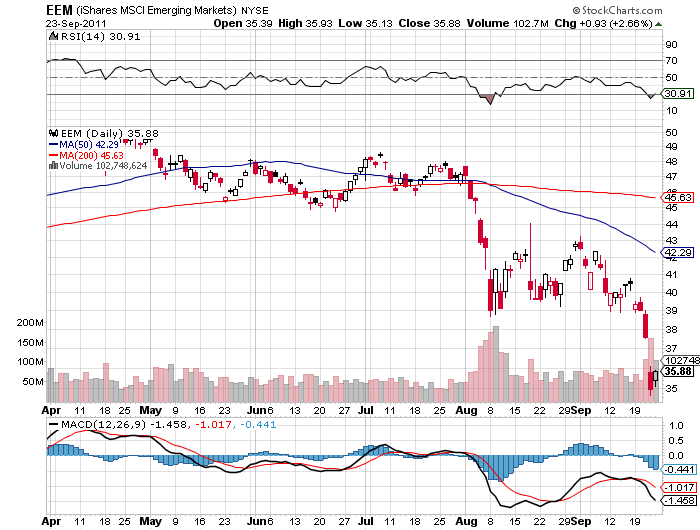

The carnage was global in nature. Commodity based countries and their currencies took the biggest hit, with Russia (RSX) down 11% in a single day. Emerging markets (EEM) outperformed developed ones in the downside, as investors suddenly grew homesick and took their money with them. It seems that an economy downshifting from 6% growth to zero generates a more dramatic trip south than one slowing from 2% to zero. This is the usual pattern. Looking at the charts, the emerging markets are already deep into bear market territory.

-

Somebody has got this all completely wrong. I have never seen a greater disconnect between the financial markets and the real economy, which the data releases show is continuing to improve. Even on takedown Thursday, the leading economic indicators for August showed a surprisingly strong 0.3%.

This all means that October is shaping up to be a very interesting month, as one of two things has to happen. The data will catch up with reality and show a dramatic decline with the September releases, in which case the recent collapse of asset prices has been fully justified. Or the data continues their modest rate of improvement, meaning that traders have just laid a huge egg. That would trigger a huge short covering rally that could take us into year end, possibly tacking on up to 27% in the S&P 500.

I vote for the latter. Watch those weekly jobless claims, which come out every.? Thursday morning at 9:30 EST!

The good news is that I finally got my computer working. Now, if I can only get everything to shift 90 degrees to the right. Maybe I'm supposed to lie on my side? And, oh, I think that I'm engaged to someone in India. Abhishek in technical support seemed like such a wonderful person, I thought why not.

-

-

-

-

Suddenly, Everyone Loves Uncle Buck