September 29, 2010 - The Leveraged Upside Play in Silver

(SPECIAL MONGOLIAN ISSUE)

Featured Trades: (SILVER), (SLW), (SLV)

iShares Silver Trust

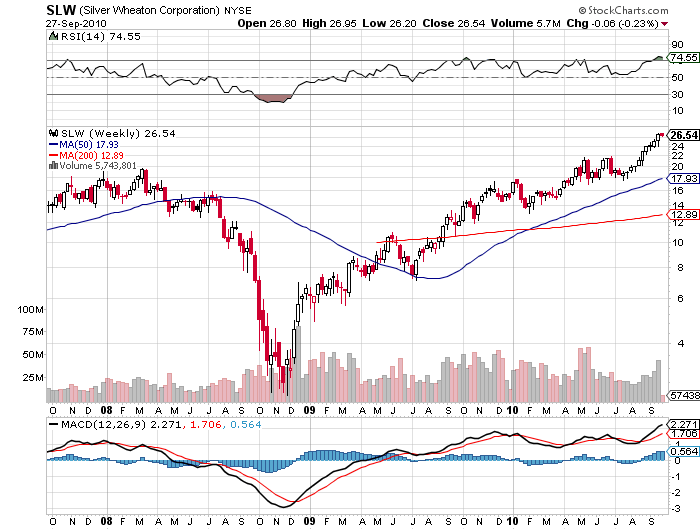

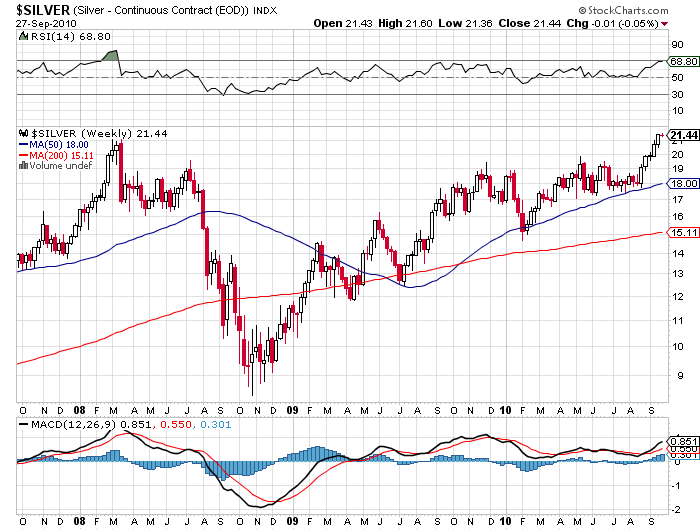

2) The Leveraged Upside Play in Silver. Silver really seems to have the bit between its teeth, not pausing at all after blasting through $21/ounce to a new 30 year high. If you think the move will continue, you better take a look at Silver Wheaton (SLW), a stock I have been recommending for a year, and has clocked a gain of 104% (click here for the call).

The great thing about this company is that it is a silver royalty stock. I'll spare you the legal details. Suffice it to say that it has a locked in cost of silver at $4/ounce, and current earnings forecasts are based on $17. With the white metal last trading at $21.40, any gains drop straight to the bottom line. Furthermore, the opening of new mines will see production soar from 23 million ounces a year to 40 million by 2013, giving you a double leveraged effect to the upside.

The only caveat I would ad is that this is not exactly a new trade, and that there is certainly more risk at $26.30/share than there was at $14. If silver turns, this will definitely be your E-ticket ride to the downside.