September 3, 2009

September 3, 2009 Featured Trades: (FNM), (FRE), (UNP)

1) The hedge fund industry is emerging from the ashes of 2008, and will inevitably grab a larger share of the investing public?s assets. Low interest rates and hero status made it way too easy for inexperienced, untested, and sometimes unscrupulous managers to raise new funds that charged management fees as high as 3% with a 50% performance bonus. Behind every ?liar loan? was a bond manager happy to soak it up through securitized Fannie Mae (FNM), Freddie Mac (FRE), or bank debt, shorting Treasuries against them, and then leveraging the 40 basis point spread by 50 times to generate a highly marketable 20% gross return. Never minds the risks. It was easy money, as long as there were lots of liars, which mortgage brokers herded in by droves, and as long as spreads narrowed, which they did for most of the 21st century. By the beginning of 2008, assets under management soared to $2 trillion. The melt down that followed wiped out large numbers of funds, and raised gates for the survivors, making investors wonder if they would ever get their money back. Total assets plunged to $1 trillion in the blink of an eye through a combination of redemptions and market losses. The new era that is emerging will be populated with humbled and chastened managers offering more disclosure, lower fees, no gates, and thanks to Madoff, oodles of third party oversight. Their portfolios will have less leverage, be invested in more liquid securities, and bring in lower returns. But the new generation will also offer investors battle tested strategies that survived the 100 year flood. Bridgewater, with $37 billion in assets, is now the largest hedge fund, followed by JP Morgan with $36 billion, Paulson & Co. at $27 billion, DE Shaw showing $26 billion, and Soros still at a hefty $24 billion. Long track records and a Gucci cachet will assure that these will prosper. Fees settling down to the 1%/20% range. For the rest of us this means more capital bunching up in the most successful trades, as we have already seen this year in financials, China, oil, and copper. It is also going to be much harder to get new funds off the ground.

2) While the month of October has the reputation as the neighborhood slut, it is in fact September that does the real damage to your pocketbook. Yes, that September, the one that started yesterday. Since 1929, the average September has dropped by 1.3%, compared to an average rise of all months of 0.5%. Remember, Lehman went bust in that month last year, and with lead market Shanghai suffering a diabolical August, you have to wonder if history will repeat itself once again. For a more comprehensive analysis of calendar stock market trends, please read William Patalon III?s piece by clicking here

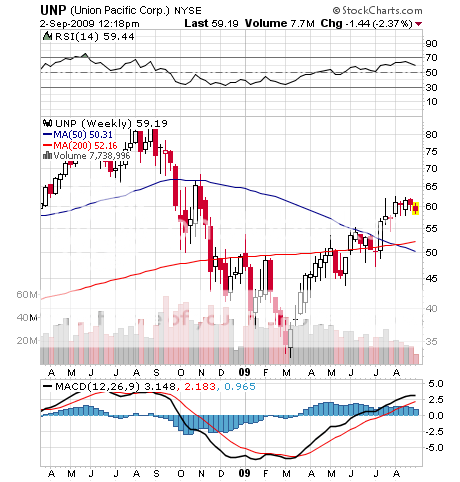

3) I took some time off yesterday to watch a piece of economic history roll through town. The Union Pacific Railway?s (UNP) engine no. 844 roared past, hauling a trainload of retired union members and railroad buffs in its trademark yellow observation cars. The 4-8-4 steam engine was built in 1944 to haul the massive freight trains demanded by a wartime economy. The company has since spent a fortune maintaining the crown jewel of the great age of steam in perfect operating condition. Normally based in Cheyenne, Wyoming, it hurtled over the Rockies and the Sierras to visit us on a heritage tour. Progress of the belching 500 ton behemoth was updated every ten minutes through Twitter?s tweets, which garnered 481 followers by the time it made it to the San Francisco Bay Area. It barreled through the station like a freight train, blasting its whistle, and singing with heat the faces of the enthralled kids. For video of this piece of romantic transportation history, play the video above, or visit my website by clicking here . Sure, I know the train was videoed every 100 feet all the way from Wyoming to here, including by the four guys standing next to me who posted their work on YouTube. Some even chased the train over the Sierras to get multiple shots and put up montages. This is a community of over the top fanatics. But what the hell, it was fun anyway. By the way, UNP shares nearly doubled off the lows this year as it discounted a full blown recovery of the US economy.

?It?s only the stock market that believes laying off 500,000 people in a reporting period is good news,? said Wilber Ross, CEO of Wilber Ross and Co., a distressed asset investor.

?