September 4, 2009

September 4, 2009

SPECIAL NON-FARM PAYROLL ISSUE

Featured Trades: (CRUDE), ($WTIC),(DXO)

(GOLD), (GLD), (KGC), (JAG), (RGLD)

1) So who was the dummy that waited until August to lay off their workers? Fire the bastard! Apparently, there are a large number of managers out there who don't read newspapers, watch TV, or talk to anyone, and waited until the Great Depression was nearly two years old to cut costs. That is one of many conclusions I am forced to draw on the news that the August non-farm payroll showed a further hemorrhage of 216,000 jobs, better than the 230,000 consensus, and a big improvement over the 273,000 July figure. But it included downward revisions of 50,000 in June and July, not good. The unemployment rate came in at 9.7%, continuing its relentless march towards double digits. The net net is that the economy has jumped off the top of the Empire State Building, but is now plummeting towards 5th Avenue and the meat wagon at a slower rate. The usual culprits were there; 65,000 jobs lost in construction, 63,000 in manufacturing, and 27,000 in finance. What was truly amazing to me was to see losses in education at the start of the school season. And what is going to happen to the 1.5 million who will exhaust their unemployment benefits by year end? The figures are all proof that there will be no economic recovery without bank lending. Running a business without credit is like trying to complete a marathon while holding your breath. Bring on the 'L.' My many US Navy readers should seriously consider re-upping, as the economy will not see net hiring for a very long time. Just hope we don't invade anyone new.

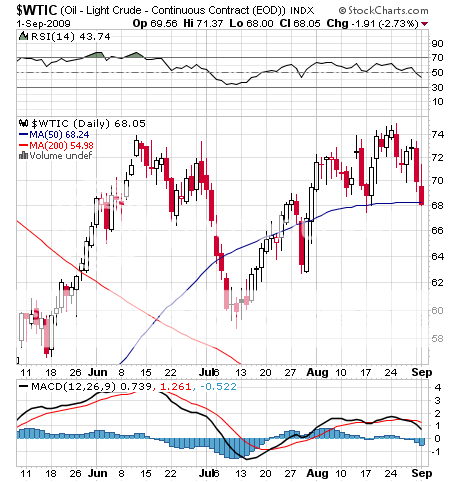

2) Crude has been trading like a 3X short dollar ETF. If you look at pure supply/demand considerations, oil should be trading in the $40-$50 range, not the $65-$75 range that we have seen. That means that a $25 speculative premium can be laid purely at the door of the big hedge funds. The big oil producing countries, seeing Obama's policies leading to a weak dollar for as far as the eye can see, are also ditching their bucks as fast as they get their hands on them. That is why the Gulf sheikdoms were one of the biggest buyers of crude near last year's $148 peak. This leaves industry insiders clueless about the price direction of their products, not an easy way to run a business. They understand rig counts, tanker deliveries, and depletion rates, not commitment of traders reports, Bollinger bands, and Fibonaccis. No doubt it was their carping that brought regulators to pressure Deutsche Bank to shut down its double long oil ETN (DXO). Of course, this all means the consumer is getting shafted, paying $3.39/gallon at the pump, instead of $2. This premium is causing a drag on the economic recovery as well. Europeans and Japanese who are paying up to $10/gallon are wondering what we are bitching about. Bring on a 'W' recession and poof!, that premium disappears, as it did last year.

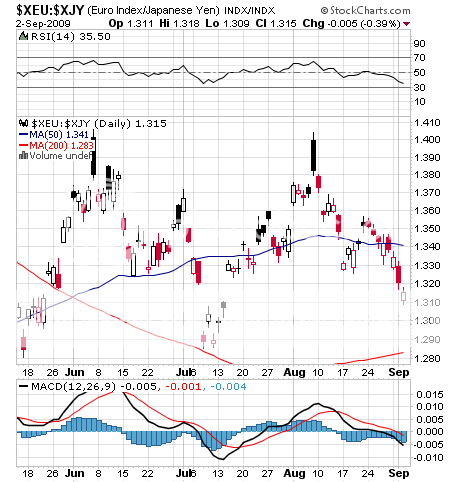

3) Just as it is prudent to top up your flood insurance ahead of the hurricane season, investors are loading up on gold ahead of the treacherous September-October stock trading period. Yesterday's $22 move up shows that attempt number six to run the yellow metal up to a new high has begun. Silver happily tagged along for the ride, tacking on 70 cents to $15.49. Historically, September is the best month of the year to own the barbaric relic, showing an average 3.5% gain over the last 20 years. The onset of the Indian wedding season, Ramadan, and the run up to the Christmas and the Chinese New Year jewelry buying binge are all conspiring to give gold a boost.?? A tip off this was coming was the big put selling seen for the shares of the gold ETF (GLD), and Kinross (KGC). One good way to play gold at this late stage might be the shares of highly leveraged unhedged producers like Rangold resources (GOLD), Jaguar Mining (JAG), and royal Gold (RGLD). Confirmation that the markets are moving towards risk aversion can be found in the euroyen chart, which hit a one month low at 131, after double topping at 140.50. If gold does break, it could tack on 20% very quickly to $1,200. Load up on those American gold eagles. If you want to know where to find them in size, check with the experts at http://www.millenniummetals.net by clicking here.

QUOTE OF THE DAY

'Making money on a trade is like getting applause, but you are the only one who hears it,' said Jon Najarian, an ex Chicago bears linebacker who now runs optionmonster.com.