September 8, 2009

September 8, 2009Featured Trades: (NATURAL GAS), (UNG),

(EL NINO), (AGU), (MON), (MOO), (WHEAT), (WZ09)

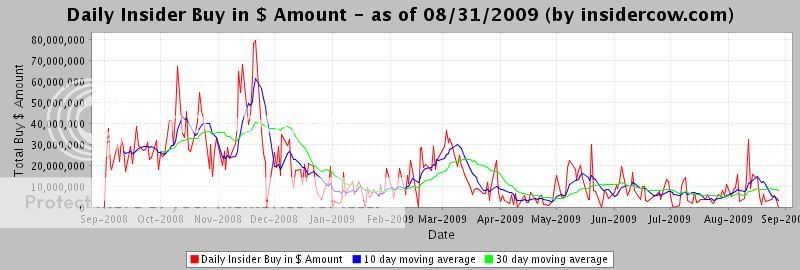

1)Everyday, I make an effort to speak to a maker, miner, driller, or provider of a service in the real economy. If you keep your head in the financial markets too long, it is easy to lose touch with reality. Yesterday, I spoke to a friend whose company produces large format copies of blue prints, making him a great leading indicator of building trends. His fall in sales has leveled off 40% down from the peak, and layoffs at client developers and architects seem to have dried up. There are some signs of life in shovel ready city and state projects directly benefiting from the stimulus package. A few small private remodels and additions are coming through, but there are absolutely no big projects on the horizon. He is hoping that his business will maintain this low level at least until the first few quarters of 2010. The scary thing is that I get exactly the same answer from everyone I talk to in every industry, be they the butcher, the baker, or the candlestick maker. This is not the stuff that economic recoveries or bull markets are made of. Perhaps this explains why the recent stock market rally has been absolutely devoid of insider buying, unlike previous upturns, as the two year daily chart below attests. When corporate managers and owners don?t want to eat their own cooking, neither do you.

2) Just when I get comfortable with my view on Natural Gas, I get a scratchy, reverberating cell phone call from one of the major formations telling me that I?m being way too bullish. Gas won?t bottom at $2. The free fall will continue until it hits $1. National storage will be completely full imminently top out, and when it does, the producers will have to shut down completely. Since these guys are leveraged up the wazoo, this will trigger a string of bankruptcies, and the majors will fall like dominoes. A hedge fund bust won?t define this bottom, as these guys are all playing from the short side. UNG can?t step in as a buyer of last resort, as the SEC won?t let it issue more stock, and the current shares are trading at a ridiculous 20% premium. One thing we do agree on is that the bottom will look ugly, whatever the spark is. You often get Armageddon type views near market bottoms, but this guy has been dead on right until now. Well, it takes two to make a market. Conclusion: keep NG nailed to your screen, as the widow maker is where the volatility lives.

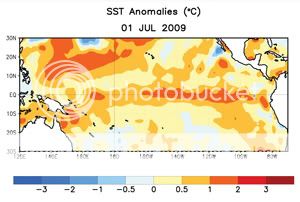

3)? I stopped by to visit some old friends at the National Oceanic and Atmospheric Administration (NOAA) in Tiburon, California, located at the abandoned Navy base that was home to the Golden Gate Bridge?s antisubmarine net during WWII.? They warned me that we could be headed for an El Ni??o winter (check their site ).So named because all of the fish disappeared off the coast of Chile one Christmas, El Ni??o?s are caused by a sudden warming of ocean temperatures in the Central and Eastern Pacific, which lead to unusual weather patterns. During the last El Ni??o in 1998, the rainfall in San Francisco soared from 20 inches to 100 inches, the American River dykes broke, railroads were destroyed beyond repair, the Sierras got 40 feet of snow, and species of fish like mahi mahi normally found in Hawaii suddenly hit the hooks of happy fishermen in San Francisco Bay. Australia endured a terrible drought. This could all be great for wheat prices and bad for insurance companies, and no doubt many will claim it is all caused by global warming.

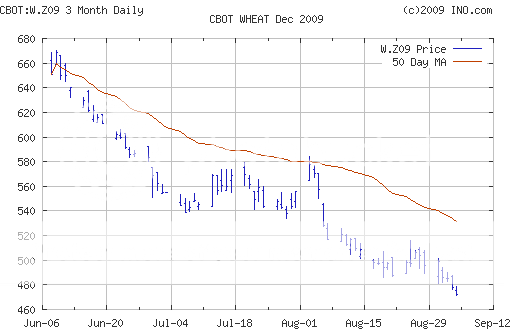

4) Fortune magazine ran an excellent article about the flood of institutional money pouring into agricultural land, a sector I have been harping on for some time (see earlier piece ).The amount of arable land per person has fallen precipitously since1960, from 1.1 acres to 0.6 acres, and that could halve again by 2050.Water is about to become even more scarce than land. Productivity gains from new seed types are hitting a wall. Rising incomes in emerging markets is producing more meat eaters, another huge call on grain and water supplies. To produce one pound of beef, you need 16 pounds of grain and over 2,000 gallons of water. China, especially, is in a pickle because it has 20% of the world?s population, but only 7% of the arable land, and it has committed $5 billion to agricultural land in Africa. Similarly, South Korea has leased half the arable land in Madagascar to insure their food supplies. George Soros has snatched up 650,000 acres of land in Argentina and Brazil on the cheap, an area half the size of Rhode Island, and has become the largest shareholder in Potash (POT). Even hedge funds are getting into the game, quietly building portfolios of farms in the Midwest and the South.?? Time to take another look at Agrium (AGU), Monsanto (MON), Wheat (WZ09) and the ag ETF (MOO). Email me at madhedgefundtrader@yahoo.com if you need to know how to execute on any of these.

JOKE OF THE DAY

On Martha?s Vineyard, where President Obama is vacationing, they?ve introduced a new drink, the ?Obamarita.? After knocking down three Obamaritas, the $12 trillion deficit doesn?t look so bad.