September 8, 2010 - Everything is Working

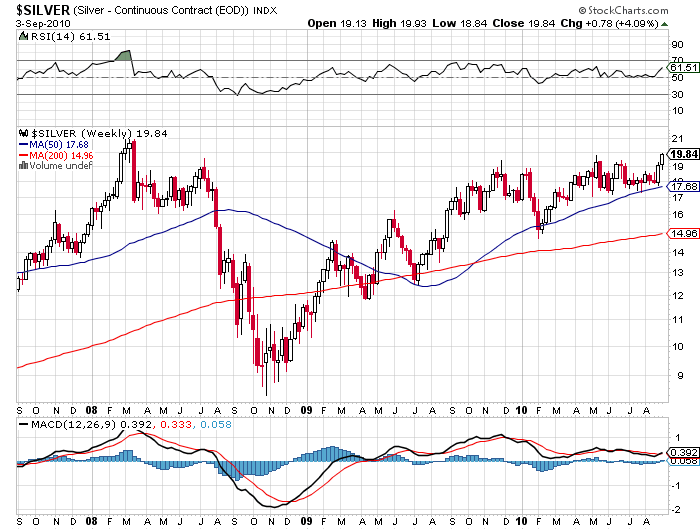

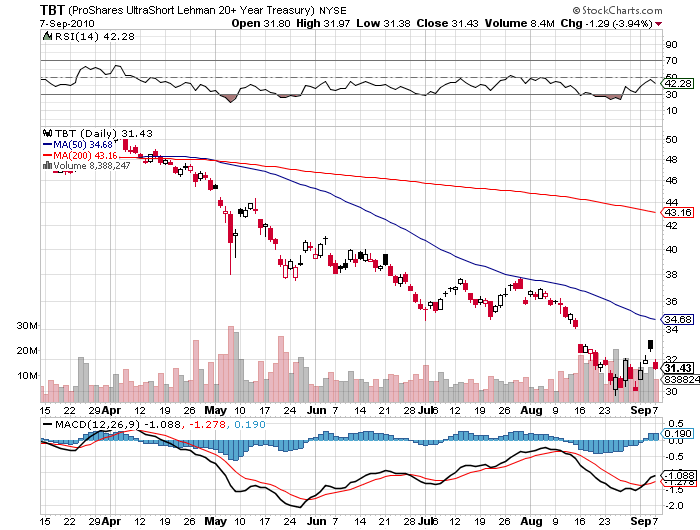

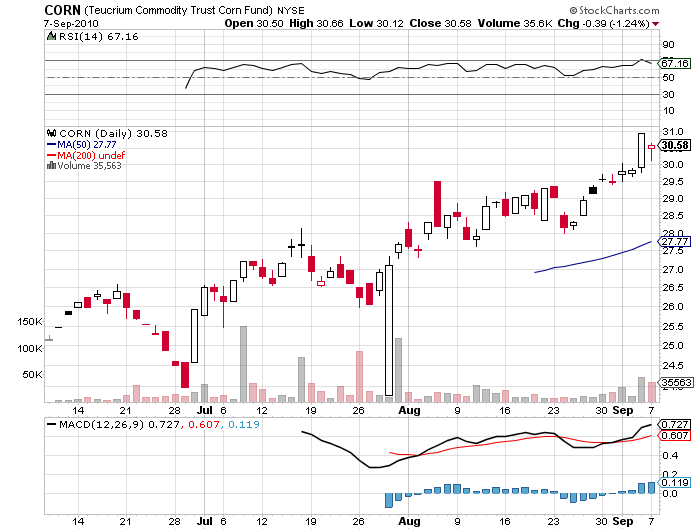

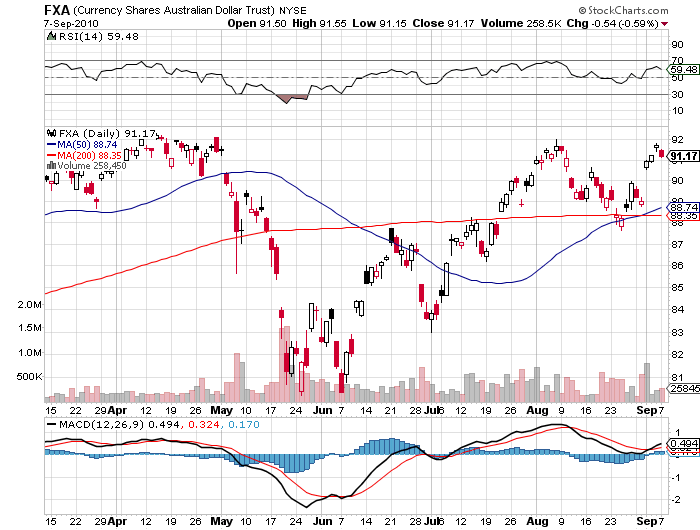

Featured Trades: (GOLD), (GLD), (SILVER), (SLV), (PPLT), (PALL), (TBT), (SPX), (CORN), (FXA)

SPDR Gold Trust Shares ETF

iShares Silver Trust ETF

ETFS Physical Palladaium Shares ETF

ETFS Physical Platimum Shares ETF

Currency Shares Australian Dollar Trust ETF

Teucrium Commodity Trust Corn ETF

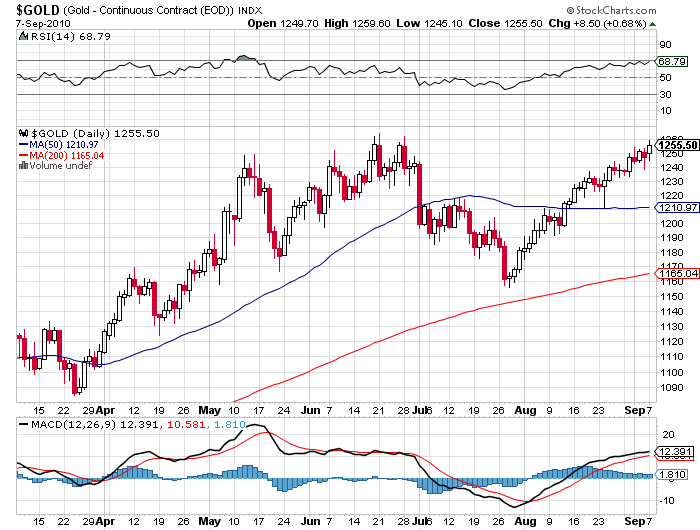

2) Everything is Working. So far, the markets are welcoming me back from vacation with open arms. Gold, which I have been relentless flogging for the last 18 months (click here for the last piece), ground up to a new all time high of $1,260. Silver continues to outperform, threatening a multiyear high at $21 (click here for that piece). The industrial white metals, platinum (PPLT) and palladium (PALL), have been rallying hard. Treasury bonds have been selling off, taking the short play TBT up 10% from its low. And the ags have been positively on fire, with the corn ETF (CORN) adding 25% in little more than two months (click here for that call). Even the resource backed Australian dollar has been virile at 92 cents, a currency I have promoted so much that I am developing that seductive down under accent.

The metals and the ags have been soaring, partly because their long term fundamentals are so strong, and because those for paper stock and bond alternatives are so dreadful. The markets I have been avoiding, likes equities generally and the US specifically, are reassuringly going absolutely nowhere.

It appears that the market is catching up on its overdo homework, reading the research reports which I put out three months ago. Seeing investors coming around to my views is even more warming than my High Sierra campfire stoked with the most pitch bearing pine. I've had a great year so far, and it seems to be getting better by the day. Maybe I should go back on vacation.

Looking for More Australian Dollars