September 8, 2011 - Is the Second Shoe About to Drop on the Euro?

Featured Trades: (IS THE SECOND SHOE ABOUT TO DROP ON THE EURO?),

(FXE), (FXF)

1) Is the Second Shoe About to Drop on the Euro? There were two pieces of news today that enabled the Euro (FXE) to benefit from a much needed relief rally. First, the German Supreme Court ruled in favor of the legality of the Greek bailout package. Then the Italian Senate approved a $70 billion austerity package that is a prerequisite for the rolling over of the country's existing debt.

With news this dramatic, you would expect the Euro to launch a major rally of three, four, or even five cents. But the best the damaged and suspect currency managed was a feeble one cent rally.

It is an old trader's nostrum that if you throw good news on a stock and it fails to go up, then you sell it. The European currency is starting to meet that qualification.

It's not like there is a shortage of reasons to dump the Euro. The sovereign debt crisis and the conjoined banking crisis have sent Europe's economy into a tailspin. GDP forecasts for the continent are rapidly crash landing down to zero.

It is only a matter of time before European Central Bank President Jean Claude Trichet admits that he committed a major policy error by raising interest rates for the Euro twice in the first half of the year. The inflationary fears that prompted him to stumble badly have proven to be a phantom. Oil alone has fallen by $25 since the last rate hike, and many other key commodities are now showing losses for the year.

The next move on interest rates has to be down, possibly as far as to zero. American interest rates are already at zero and can't go any lower. This is all hugely Euro negative and dollar positive.

Now that the Swiss franc (FXF) is out of the picture as a viable short, hedge fund traders are trolling for fresh meat to kill. Newly invigorated by the overnight fortune they made on the Swiss franc, the focus now has to be shifting to the Euro.

The break of the 50 moving average on the charts is signaling to technicians that we may be about to break out of the $1.40-$1.46 range that has prevailed all year to a new, lower $1.36-$1.40 range. Demolish that, and we could be eventually headed towards $1.17, and even parity against the buck.

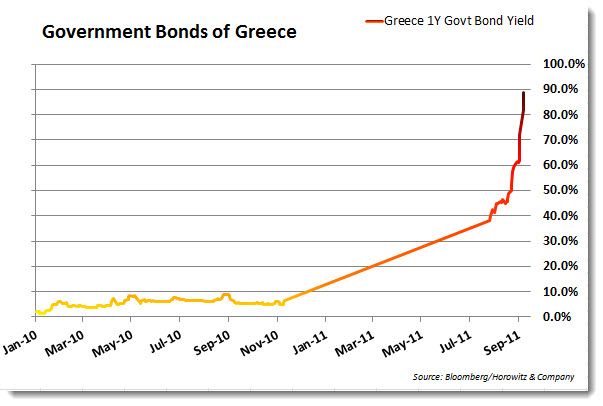

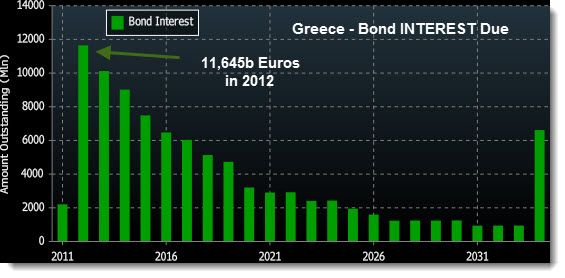

What will be the headline that finally blows down the European house of cards? The inevitable default of Greece, which after looking at the charts below, could happen at any time, with or without a bailout.

-

-

Brussels, We Have a Problem