September 9, 2009

September 9, 2009 Featured Trades: (COPPER), (TBT), (FCX), (EUROPE), (DOLLAR)

1) Well, you certainly don?t need my help anymore. With everything in the world going up but the greenback, you certainly don?t need the advice of financial advisors, brokers, pundits, or sadly, even this humble online columnist. I never thought I?d see the day when stocks, bonds, gold, silver, oil, natural gas, copper and collectable beany babies were all up in unison. Not only is the punchbowl ubiquitous, but the Kool-Aide is spiked with ecstasy, and it is so large, that there is a risk we might fall in and drown. Industry analysts are now putting out forecasts for their individual companies implying a 5% GDP growth rate next year, but macroeconomists at those very same houses see 2% as a stretch. All of this in the face of a catatonic consumer, $3.40/ gallon gasoline, and banks maintaining a death grip on lending to any but the primest of borrowers. I guess this is what happens when the Fed is determined to keep interest rates at zero, for as far as the eye can see, and the printing presses in Washington DC are running so fast that I can hear them here in San Francisco. With $4 trillion in cash sitting on the sidelines there is a risk that the faith based rally will continue. Is the Fed trying to cure a burst bubble with a profusion of? bubbles?

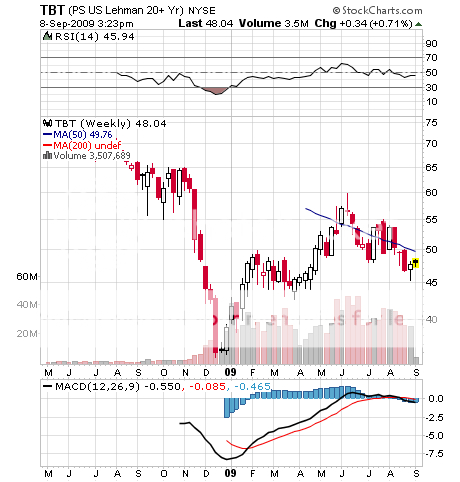

2) It?s time to take another look at the short US Treasury bond ETF (TBT). I first recommended this 200% leveraged bet that long dated bonds were going down big time in January at $35, catching a near double to $60 (click here for report) . We have now retrenched back to $45, and it?s time to reload the boat. The US government has now committed to $9.1 trillion in debt issuance over the next ten years. Foreign governments will need to borrow as much to fund their own bail out/stimulus programs. Did I mention inflation? There is absolutely no way the ten year can maintain a 3.40% yield in the face of this onslaught.?? It is clear that zero short rates are driving investors, many of whom will only buy Treasuries, into making terrible investments. This is what the awesome bid to cover ratio of 3.2X for today?s three year auction is telling you. The dollar clearly sees this and is hitting a new one year low. It?s just a matter of time before bond investors put on their bifocals and see the locomotive that is about to run over them.

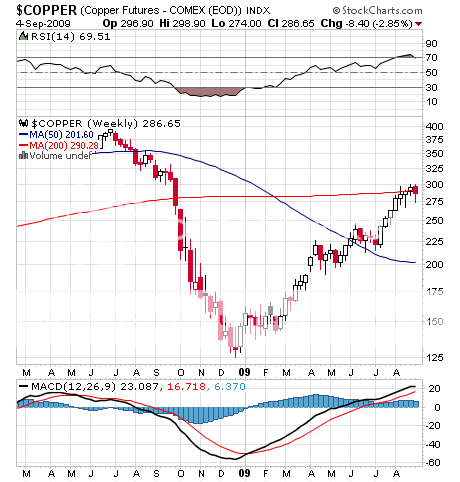

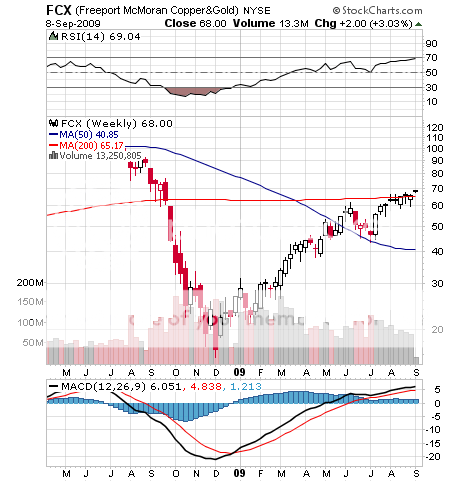

3) Lack of a pure copper ETF is stampeding hedge funds into the shares of Freeport McMoRan (FCX), the world?s largest copper and gold producer, no doubt spurred by the red metal?s recent run at a new 2009 high.?? FCX is one of my favorite stocks, and one of the great ?tells? on the state of the global economy.?? CEO, Richard Adkerson, says it?s all about ?China, China, China?, which has been frenetically stimulating its economy with a $586 billion reflationary package, and rebuilding stockpiles of the copper at a furious pace. The ongoing lifestyle upgrade in other emerging markets is adding to demand, as is the switch to hybrid cars in industrialized countries, which use two to three times more copper than conventional cars. Last year, FCX mined 102 billion pounds of copper, 40 million ounces of gold, and 266 million ounces of silver. Talk about being in the sweet spot. A doubling of copper prices since January enabled FCX to announce blowout earnings. The stock has more than quadrupled since my New Year recommendation . Did you know that this is the number two performing stock in the S&P 500 this year? If you want a core holding that is in many right places at the right time, use dips to back up the truck for FCX. If you need any help on how to building a position in physical copper, please e-mail me at madhedgefundtrader@yahoo.com

4) The US is turning into Europe. Think high taxes, chronic high unemployment, more government involvement in everything, less innovation, and much lower growth, in exchange for a social safety net and better coffee. That is the message the markets told us by retreating to the 6,000 handle in March, levels not seen since 1996, and down 54% from the 2007 peak. Equity prices will shrink to multiples, in line with permanently lower long term growth rates of maybe 1%-2%, a shadow of the 5% rate seen for much of this decade. Hint: that?s a lot lower than here. Perhaps this is what mature economies are supposed to look like. If someone is holding a gun to your head and you must buy American stocks, only select names that get the bulk of their earnings from overseas. Microsoft (MSFT), Intel (INTC), Oracle, (ORCL), Cisco (CSCO) all get 60%-70% of their profits from overseas, where up to 90% of the real economic growth will come from for the next decade. Commodity, agricultural companies,?? and their ETF?s also fit this picture. As for me, I think I?ll move to Tahiti and live off of coconuts and freshly speared fish, wearing only a loin cloth. Anything is better than becoming French.

?When the fools are dancing, the greater fools are watching,? according to an old Japanese proverb.