September 9, 2011 - Hedge Funds Ramp Up Market Shorts

Featured Trades: (HEDGE FUNDS RAMP UP MARKET SHORTS), (SPX), (SPY)

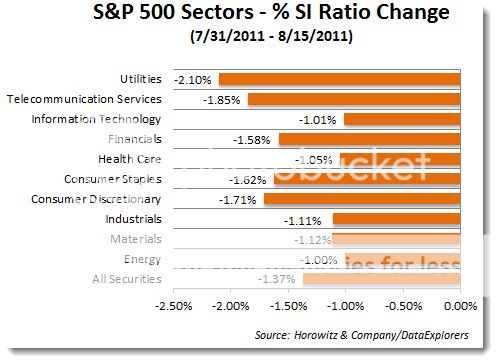

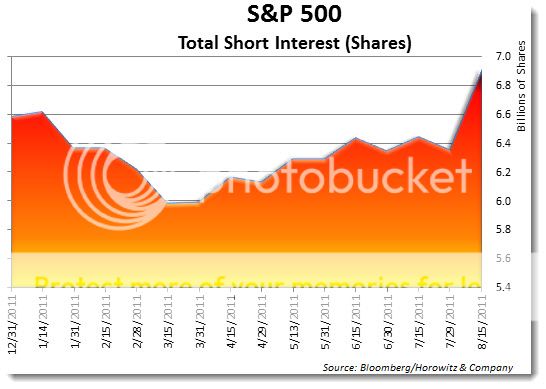

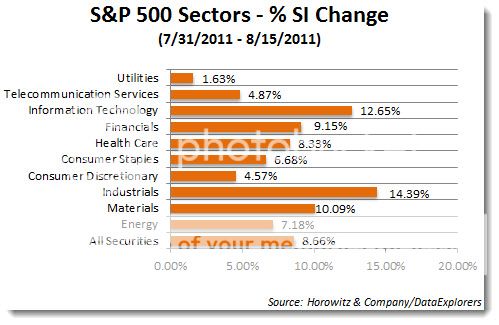

2) Hedge Funds Ramp Up Market Shorts. Hedge funds have gotten much more aggressive on the short side, as recent data show, with enviable results. According to Data Explorers, and independent research boutique, emboldened market timers and macro players increased their shorts in industrial stocks by 14.39% from July 31 to August 15, information technology by 12.65%, and materials by 10.09%. Industrials' share of total stock market capitalization fell by 1.11% during the same time frame, information technology dropped by 1.01%, and materials pared 1.11%.

This large scale selling, driven by an economic outlook that is fading fast, no doubt was a major contributor to the hellacious volatility we saw in August. Freshly sated, traders will no doubt come back to this well again, keeping volatility high. This is creating the enormous swings we are seeing in the market on an almost daily basis. The bad news for the rest of us is that hedge fund short positions are still only a tiny fraction of what we saw in 2008. There is plenty of dry powder to ramp them up much more from here.

I continue to believe that we will see some sort of 'RISK ON' rally in the Autumn, which might take us up 10%-20% from the August 8 low. There is at least a 50% chance that the bottom is in for this move, and that we rally from here, but in a highly choppy stop and start fashion. If I'm wrong, it will be by only a few dozen points into the 1,000 handle for the S&P 500 (SPX), (SPY). For the big crash, you are going to have to wait until next year.

What will be the driver for the next leg up? Corporations will once again deliver outstanding quarterly earnings for the season that begins at the end of September. The Fed will pour another gallon of gasoline on risk assets in some form, such as a 'twist' policy towards the debt markets. The esteemed government agency always seems to have some new tricks up its sleeve these days, so we may see some of those too. Finally, the bulked up shorts themselves will provide some ample tinder to get this fire going to the upside.

The longer term view, whether this rally lasts for weeks or months, is that this will be the last chance you have to unload equities before a much larger sell off in 2012. No matter how you cut it, the presidential election is not shaping up to be an equity friendly event, and it promises to drag out for another tortuous 14 months.

-

-

-

Hedge Fund Traders Are Getting More Aggressive With Their Shorts