September 9, 2013 - MDT - Equity Indices & Emerging Markets

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

The ones that were beaten up the most are the least risky to buy.

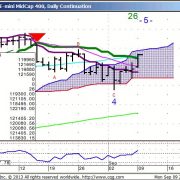

Midcap 400 and Russell have room on the upside.

Spu's

...are just starting to pick up on a daily and weekly chart.

One more day closing around today's current highs is needed to confirm.

Not all markets are the same. Japan, Mexico, Brazil, Thailand, India and China have already had significant runs over the past 2 weeks.

The current rallies in India,Brazil and Mexico have all lined up with their currencies coming off massively oversold levels from 2 weeks ago, and are closing in on their first upside tgt's.

With the Real having rallied 20 figures with a little Central Bank Intervention, there is still room for another 4 figures before resistance. The rally in Brazilian equities is maturing and needs time to digest.

Spain, Germany and Indonesia have room to play catch up.

Focus your attention on the ones that haven't taken off yet.

You should be looking to buy hard breaks mid week.

FYI...Nikkei Futures are breaking out to the upside on a daily and weekly chart.

This has the same technical look as the S&P 500. One more day up here to confirm.

Stay on John...he's been smoking hot with the Yen trade!

For Glossary of terms and abbreviations click here.