The Real Rules of Tech

Northern Californian tech companies stopped innovating because of the monopolistic nature of current business models that nestle nicely in unfettered capitalism.

They only go by one principle these days – to crush anything remotely resembling competition and they are damn good at doing it.

This has been going on in Silicon Valley for years and the government has turned a blind eye since the beginning of it.

The end result is the absence of competition.

At a higher tech level, the strong get stronger by stockpiling cash and resources, all while taking advantage of historically low rates to finance their growth models.

Why does the U.S. government largely sit on the sidelines and act if nothing has really happened?

If I deploy the concept of Occam's razor to this situation, a philosophical rule that entities should not be multiplied unnecessarily which is interpreted as requiring that the simplest of competing theories be preferred, my bet is that most of U.S. Congress own stock portfolios, even if they are the index variety, and these portfolios are spearheaded by the likes of Apple (AAPL), Facebook (FB), Amazon (AMZN), Google (GOOGL), Microsoft (MSFT), Netflix (NFLX), and of course Tesla (TSLA).

This has come into the open frequently with members of Congress even front-running the March 2020 sell-off with their own portfolios like U.S. senator Kelly Loeffler from Georgia selling $20 million in stock after attending special intelligence briefings in the weeks building up to the coronavirus pandemic.

We definitely don’t get invites to those special intelligence briefings, but Loeffler getting off scot-free by mainly just playing down what she did proves the immunity that politicians accrue from their lofty positions.

It’s a direct conflict of interest, but that's not surprising for politics in 2021 and I would say it epitomizes the era we are in.

It’s also why Congress hasn’t acted on Silicon Valley’s excessive abuse of power, which is so glaringly blatant that excuses must be crafted just to make it seem they aren’t as bad as they are.

The government likes to jawbone to the public saying they will make competition a level playing field, but actions show they are doing the opposite.

Ultimately, Silicon Valley whispers in the ear of Congress and they listen.

Well, what now?

Tech has now turned mostly into a digital marketing lovefest harnessed around the smartphone and tablet with cheap shortcuts which is partly why the efficacy of the internet has dropped greatly.

The advent of 5G has also been a bust because these titans don’t feel the need to reinvest to make that killer 5G app when they don’t need to.

The truth is Silicon Valley couldn’t be more complacent in 2021.

They are the ultimate corporate entity and more monolithic than ever.

Smart CFO’s are continuing the gravy train by diving deep into stock buybacks to boost stock prices and the dividends are the extra kicker.

The iPhone maker repurchased $19 billion of stock in the first quarter, bringing the total for the past fourth quarters to $77 billion.

GOOGL repurchased a record $11.4 billion of stock in the first quarter, up from $8.5 billion a year earlier, and FB bought back $3.9 billion, triple the total a year ago.

Now, they even got the White House to do their dirty work.

Huawei, the Chinese telecom company, has been the punching bag for the White House’s tech war with China.

In remarks to reporters in March 2019, Chinese politician Guo Ping said, “The U.S. government has a loser’s attitude. They want to smear Huawei because they can’t compete with us.”

Let’s get this straight, U.S. tech was never behind China and still isn’t, but I do believe the U.S. should simply outcompete with Huawei because I know they can and have the capacity to do so.

China hasn’t done much with 5G as well aside from amassing the patents, but they haven’t made it quite practical to the Chinese public as a use case for consumer products.

Instead of competing, we have Facebook tapping the political back channels to encourage the U.S. government to ban TikTok, not because it threatens Facebook’s model but because Facebook is concerned about national security.

This is from the same Mark Zuckerberg that has been attempting to destroy Snapchat (SNAP) for years after SNAP’s CEO Evan Spiegel refused to sell it to Zuckerberg.

So why innovate? Why deploy capital into research and development when you can just nick a crown jewel and make it your own?

Exactly, so innovation does not happen and will not happen.

We, as consumers, have been thrust into the cluster of ever-degrading smartphone apps that offer less and less utility.

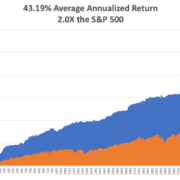

But ultimately, even if you hate Silicon Valley at a personal level, it is literally impossible to bet against them, because all this posturing behind the scenes does boost the share price and that’s what this technology letter is about.

As we are whipsawed into this muddling world of partially vaccinated economies, tech will consolidate after they deliver earnings only to prepare for the next leg up in shares.

Sure, this year’s growth and EPS estimates have been priced perfectly, but we will start to move onto next years’ bounty and these models have never been more profitable.

Don’t fight the trend.