SPECIAL RISK ALERT!

Special Note: I?m sending out the Monday letter early today because this content won?t wait.

Sorry to throw up at your Christmas party, but there have been a number of developments that have occurred over the last two days that I think you should know about.

It won?t wait until the Monday newsletter.

The Third Avenue Fund closed its leveraged junk fund to redemptions this morning, highlighting the disappearance of liquidity in the fixed income market.

Then the International Energy Agency (IEA) announced that they see the oil (USO) glut continuing for all of 2016. Crude dove another dollar to a new seven year low.

But they already said exactly the same thing a few weeks ago. Which means the financial markets are really worrying about far bigger things that we just can?t see yet.

Other than that, how was the play Mrs. Lincoln?

Sure, these are one off?s. I?ll tell you what really bothered me.

I watch the Volatility Index (VIX), (XIV) like a hawk.

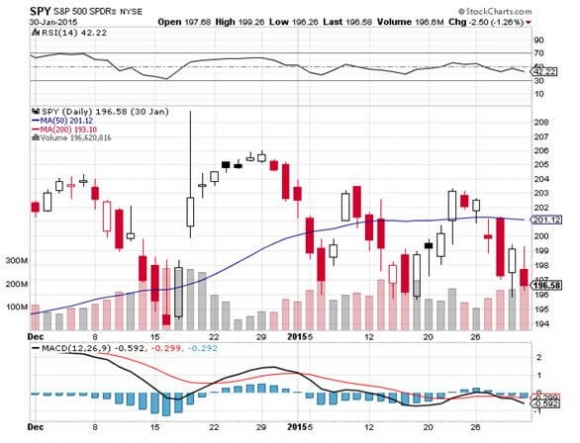

On Thursday, The S&P 500 (SPY) closed up on the day, but the (VIX) kept gaining as well, closing at its highs. This is never a sign of good things to come.

On Thursday, the Federal Reserve should hike interest rates for the first time in a decade. My concern is that a 25 basis point move has become so widely expected and discounted that the only possible market reaction is a bad one.

What if Janet doesn?t raise? What if she raises by 50 basis points? What if she raises by 25 basis points, but then makes excessively hawkish or dovish comments afterwards? In either case, you can expect the market to drop 5% very quickly.

In other words, we are setting up for an asymmetric move. The possible upside gains are incremental, but the downside risks are huge. That is not a scenario you want to walk into with a big ?RISK ON? portfolio.

Cast all this against a backdrop of the (SPY) decisively breaking both the 50 and the 200-day moving averages this morning, and all of a sudden the sidelines are looking very alluring.

You can tell by the way that the market has been flip flopping every day for a month now that both traders and investors have the daylights scared out of them.

There have been 27 days in a row when we have not seen two consecutive UP days in the (SPY), the longest since 1970.

Everyone is on a hair trigger.

IT GETS WORSE!

On Friday next week, we will see the biggest S&P 500 options expirations in history, some $1.1 trillion worth. More than $670 billion of these are puts, and $215 billion are close to the money.

To see this kind of mega volume unwind two days after the Fed announcement is somewhat unnerving.

This is the time when a lot of annual hedges get rolled over by big hedge and mutual funds. This is going to take place in waning December liquidity. The net effect will be to put a turbocharger on any move that unfolds next week, WHATEVER IT IS!

All of this put my slow grind up into yearend scenario at risk. This is why I just booted out 60% of my model trading portfolio, much at close to cost.

Oil can reverse at anytime and launch one of those screaming, rip-your-face-off $5 short covering rallies. Then everything will be Hunky-Dory and stocks will rally again. There is just no way of knowing. There are too many random variables. It is, in fact, unknowable.

But I am not willing to bet a quarter of my 2015 performance to find out. Your money either.

Sorry, but eight years into the newsletter business, I still think like an actual hedge fund manager. Part of my motivation is to protect my 40% profit this year, which with the indexes all down, is a performance for the ages.

If you are a medium to long-term investor, you can ignore all of this.

We are not entering a recession. We are not launching into a new bear market. Stocks are on track to produce single digit returns in the US next year, and double digit ones in Europe (HEDJ) and Japan (DXJ).

This is just a trading call. I just want to have more cash to take advantage of any extreme price movements headed our way in the near future. High on the list will be buying technology and financials on any big dip, and selling short the (VIX).

After all, I am the Mad Hedge Fund Trader, not the Mad Long Term Investor.

So it might be a good year to take a long Christmas cruise. The balmy climes of the Caribbean are pleasant this time of year, especially if you have kids. You can let them have the run of this ship and not be concerned. There?s nothing like listening to Christmas carols on steel drums. I hear Norwegian Cruise Lines is still offering some great packages (click here for their site).

For a preview of how stock markets behave ahead of single digit years, look at the chart below for the (SPY) for December and January exactly a year ago.

It amounts to a whole lot of nothing, tedious trading in a very narrow range. That?s why I was buying very deep-in-the-money vertical bull debit spreads until three days ago.

Enjoy the cruise!