Stock Traders Discover Interest Rates

Finally, finally, the stock market noticed that interest rates are rising, although they have been doing so unrelentingly since July. Call stock traders slow learners. All I can say is that no one here at the Mad Hedge Fund Trader is surprised, not even the furniture.

At the peak today, the ten-year Treasury yield (TLT) hit 2.855%, a four-year high, up a steep 45 basis points since December 31. My 2018 target of a 3.0%-3.50% range beckons.

I think we are either AT the bottom of this move down in the S&P 500 (SPY), or within a day of the final bottom.

Right here we have a 3.5% correction in the (SPY) and 3.7% in the Dow Average from the January 28 top.

I just don't see a true crash happening in the face of the 14% corporate earnings growth we are seeing in the current quarter.

To get a crash you would have to believe that the recently passed tax cut will have no net effect on the economy, with the short term benefits offset by rising interest rates, labor, and commodity costs.

Ooops!

Ironically, I think that the rising rates that triggered this week's debacle may be about to take a rest. That's why I covered all by bonds shorts. Will the coming rally in bonds bring a rally in stocks? We shall see.

When you look at the entirety of the big tech earnings announced last week, you have to be dazzled, astonished, stupefied, and absolutely gob smacked.

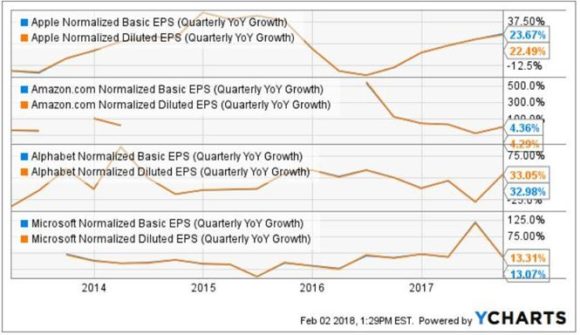

The diluted earnings per share for Alphabet (GOOGL) soared by 33.05% Apple by 22.49%, and Microsoft by 13.31%. The dollar value of these profit increases are the largest in the history of global capitalism.

Not only were the high double-digit figures more than impressive, these are gigantic half trillion or nearly one trillion dollar companies that are showing the growth rates of small caps.

The Department of Labor Bureau of Labor Statistics added fuel to the fire today dropped their monthly bombshell with the January Nonfarm Payroll report at 200,000. Headline unemployment rate stayed steady at 4.1%. The reports for November and December were revised down 24,000.

Construction was the big gainer at up +36,000, followed by Food Services, up +31,000, and Health Care, up +21,000. The only losses came with Information Technology at -6,000. The U-6 "discouraged worker" unemployment rate is at 8.2%.

All that is fine and good. What really set the cat among the pigeons was the

Average Hourly Earnings growth at 0.3%. This is the first real sign of wage inflation we have seen in decades and immediately triggered a selloff in the bond market for the ages.

The ten-year US Treasury bond yield spiked up to 2.85%, prompting a gut churning $400 plunge in the Dow Average. Of course, your gut WASN'T churned if you were running a double short in bonds and a double long in gold (GLD) as I begged, pleaded, and beseeched you to do. A loss of a limb for others means only a mosquito bite for you.

As for the Mad Hedge Fund Trader Alert Service, we keep grinding up from one new all-time high to the next. We were up +4.09% in January, +0.96% so far In February, with a trailing 12 month return of +53.16%. Our eight-year profit stacks up to +281.52%.

I have been going pedal to the metal on the debt explosion theme, with a double short in Treasury bonds (TLT), double longs in gold (GLD), (NEM), and a long in commodities (FCX).

we are rolling out our new Mad Hedge Technology Letter in the coming week to take up the slack.

This week will be all about jobs data, which rolls out in rapid succession from Wednesday morning.

We are now into Q4 earnings season so those should be the dominant data points of the coming weeks.

On Monday, February 5, at 10:00 AM, the week kicks off with the January ISM Non-Manufacturing Index, a survey of 375 private firms across the country. Cirrus Logic (CRUS) reports earnings.

On Tuesday, February 6 the jobs data parade starts with the JOLTS Report of Job openings for January. Walt Disney (DIS) and SNAP (SNAP) reports earnings.

On Wednesday, February 7, at 7:00 AM EST, we get MBA Mortgage Applications for the previous week, which should be down because of sharply higher rates. Rio Tinto (RIO) Reports earnings.

Thursday, February 8 leads with the 8:30 EST release of the Weekly Jobless Claims. Cyber software company FireEye (FEYE) reports earnings.

On Friday, February 9 at 1:00 PM we receive the Baker-Hughes Rig Count, which should keep ticking up thanks to high oil prices.