Global Market Comments

February 1, 2023

Fiat Lux

Featured Trade:

(FRIDAY, FEBRUARY 17, 2023 HONOLULU, HAWAII STRATEGY LUNCHEON)

(TRADING THE NEW APPLE IN 2023)

(AAPL)

CLICK HERE to download today's position sheet.

Global Market Comments

February 1, 2023

Fiat Lux

Featured Trade:

(FRIDAY, FEBRUARY 17, 2023 HONOLULU, HAWAII STRATEGY LUNCHEON)

(TRADING THE NEW APPLE IN 2023)

(AAPL)

CLICK HERE to download today's position sheet.

Not a day goes by when someone doesn’t ask me about what to do about Apple (AAPL).

After all, it is the world's largest publicly traded company at a $2.28 trillion market capitalization. It is the planet’s second widely owned stock after Tesla. Almost everyone uses their products in some form or another.

It buys back more of its own stock than any other company on the planet. Oh yes, it is also one of Warren Buffet’s favorite picks and one of his biggest holdings, with 10% of his funds thus committed.

So, the widespread adulation is totally understandable.

Apple is a company with which I have a very long relationship. During the early 1980s, I was ordered by Morgan Stanley to take a young Steve Jobs around to the big New York institutional investors to pitch a secondary share offering for the sole reason that I was one of three people who worked for the firm who was then from California.

They thought one West Coast hippy would easily get along with another. Boy, were they wrong, me in my three-piece navy blue pinstripe suit and Gucci shoes and Steve in his battered Levi’s.

It was the worst day of my life. Steve was not a guy who palled around with anyone. He especially hated investment bankers, like me.

I last got into Apple with my personal account when the company only had four weeks of cash flow remaining and was on the verge of bankruptcy. I got in at $7, which on a split-adjusted basis today is 25 cents. I still have them, mostly to avoid the tax bill incurred from selling. In fact, my cost basis in Apple is one-third less the 92-cent annual dividend.

Today, some 200 Apple employees subscribe to the Diary of a Mad Hedge Fund Trader looking to diversify their substantial holdings. Many own Apple stock with an adjusted cost basis of under $5. Suffice it to say, they all drive really nice Priuses. And boy, do I get great technical support on Apple products.

So I get a lot of information about the firm far above and beyond the normal effluent of the media and stock analysts. That’s why Apple has become a favorite target of my Trade Alerts over the years, both on the long and short side.

And here is a great irony: Nobody would touch the stock with a ten-foot pole at the end of 2022 at $125. Since then, Apple has rallied an impressive $19, or 15.2%, not bad for the world’s largest company.

Here’s why.

Apple was all about the iPhone which then accounted for 50% of its total earnings. The TV, watch, car, iPods, iMac, and Ap store pay were all a waste of time and consumed far more coverage than they are collectively worth.

The good news is that iPhone sales are subject to a fairly predictable cycle. Apple launches a major new iPhone every other fall. The last one came out in the fall of 2022, the iPhone 14. The 16 model is due out in 18 months. The share price peaks shortly after that. The odd years see minor upgrades, not generational changes.

Just like you see a big pullback in the tide before a tsunami hits, iPhone sales are flattening out between major upgrades. This is because consumers start delaying purchases in expectation of the introduction of the new iPhones 16, with more power, a better camera, and new gadgets, and gizmos.

So during those in-between years, the stock performance was disappointing. 2022 certainly followed this script with Apple down a horrific 31.3% at the lows.

But Apple is a much bigger company this time around, and well-established cycles tend to bring in diminishing returns. It’s like watching the declining peaks of a bouncing rubber ball.

This is not your father’s Apple anymore. Services like iTunes and the new Apple+ streaming service are accounting for every larger share of the company’s profits. And guess what? Services companies command much higher multiples than boring old hardware ones. It’s the old question of linear versus exponential growth.

Here’s the next new play. Autonomous driving looks to be a huge business for Apple, possibly a $1 trillion a year business. After all, Tesla is already charging $15,000 for the street-to-street autopilot. My bet is that they don’t build their own car but sell autonomous consoles to legacy Ford (F) and General Motors (GM), who desperately need it to compete with Tesla.

An easing of trade relations with China under a new Biden administration will bring a new spring to Apple’s step, where sales have recently been in free fall. To cut costs and diversify risk, they are moving one-third of their iPhone manufacturing to India, and someday, perhaps all of it.

Their new membership lease program promises to deliver a faster upgrade cycle that will allow higher premium prices for their products. That will bring larger profits.

A decade ago, I ran into a local school teacher who after 30 years of slaving away with your brats was unable to retire because with only $100,000 saved, she was too poor to do so. All her money went to expensive California rent and to Blue Cross since her district had no health insurance plan.

I told her to place her entire life savings into Apple. Her financial advisor told her she was nuts. Her friends told her she was crazy. Her mother said she should disown me.

Where is that school teacher today? She just bought a $3 million beachfront home on Hawaii’s Kona Coast. She sold her Apple shares for $7.3 million. I know because I just received a nice Christmas card from her attached to a two-pound box of Hawaiian Host chocolate-covered macadamia nuts, my favorite.

Who said teaching didn’t pay?

It all adds up to keeping a Apple as a core to any long-term portfolio.

Just thought you’d like to know.

My Real Apple Dividend

I Heard They are Diversifying

Global Market Comments

January 31, 2023

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(A BUY WRITE PRIMER)

(AAPL)

CLICK HERE to download today's position sheet.

Global Market Comments

January 30, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MY NEW THEORY OF EQUITIES)

(TSLA), (SPY), (TLT), (TSLA), (OXY), (UUP), (AAPL), ($VIX)

CLICK HERE to download today's position sheet.

After 54 years of trading, and 60 if you count my paper boy days, I have never seen the conventional wisdom be so wrong about the markets.

There was near universal sentiment that we would crash come January. Instead, with have only seen four down days this year. The shorts got slaughtered.

So it’s clear that something brand new is going on here in the markets. I call it “My New Theory of Equities.”

I always have a new theory of equities. That’s the only way to stay ahead of the unwashed masses and live on the cutting edge. After all, I don’t have to run faster than the bear, just faster than the competition to keep you making money.

So here is my new theory.

Many strategists are bemoaning the loss of the free money that zero interest rates made available for the last decade. They are convinced that we will never see zero interest rates again.

But guess what? Markets are acting like free money is about to return, and a lot faster than you think. Free money isn’t gone forever, it is just taking a much-needed vacation.

What if free money comes from somewhere else? You can forget about free money from the government. Fear of inflation has ended that source, unless we get another pandemic, which is at least a decade off.

No, I found another source of free money, and that would be exponentially growing technology profits. Those who don’t live in Silicon Valley are ignorant of the fact that technology here is hyper accelerating and tech companies are becoming much more profitable.

You know those 80,000 tech workers who just got laid off? They all averaged two job offers each from the thousands of startup companies operating from garages and extra bedrooms all around the Bay Area. As a result, the Silicon Valley unemployment rate is well under 2%, nearly half the national average.

I bet you didn’t know that there are over 100 industrial agricultural startups here growing food in indoor ultraviolet lit lowers. It turns out that these use one tenth of the inputs of a conventional input, like water and fertilizer in half the time.

There are hundreds of solar startups in play, many venture capital financed by Saudi Arabia. While the kingdom has a lot of oil, they have even more sunshine. And what are they going to do with all that oil? Use solar generated electricity to convert it to hydrogen to sell to us as “green” energy.

Solar itself will just be a bridge technology to fusion, which you may have heard about lately. What happens when energy becomes free? It boggles the mind. This appears to be a distant goal now. But remember that we went from atomic bombs to nuclear power plants in only 12 years, the first commercially viable one supplying electricity to Pittsburgh in 1957 (click here for the link).

The future happens fast, far faster than we realize. Always.

Here is another anomaly for you. While these massive tech layoffs have been occurring, Weekly Jobless Claims have plunged to a two-year low from 240,000 to only 186,000.

That is because tech workers aren’t like you and me. When they get laid off the first thing, they do is cheer, then take a trip to Europe. They are too wealthy to qualify for unemployment benefits, so they never apply. When they get home, they immediately get new jobs that pay more money with extra stock options.

I know because I have three kids working in Silicon Valley and enjoy a never-ending stream of inside dope.

This means that you need to be loading the boat with tech stocks on every major dip for the rest of your life, or at least my life. The profit opportunities are exponential.

This creates a new dilemma.

You can pick up the easy doubles and triples now just though buying listed companies. But many of the hundred and thousand baggers haven’t even been created yet. That’s where newly unemployed tech workers are flocking to. That’s where you’ll find the next Tesla (TSLA) at $2 trade.

How will you find those? Don’t worry, that’s my job. After all, I found the last Tesla at $2, minting many new millionaires along the way.

My trading performance certainly shows the possibilities of this My New Theory of Equities, which so far in January has tacked on a robust +19.94%. My 2023 year-to-date performance is the same at +19.94%, a spectacular new high. The S&P 500 (SPY) is up +7.32% so far in 2023.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 15 years ago. My trailing one-year return maintains a sky-high +95.09%.

That brings my 15-year total return to +617.13%, some 2.66 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +46.87%, easily the highest in the industry.

Last week, I took profits on my longs in Tesla (TSLA) and Occidental Petroleum (OXY). That leaves me 90% in cash, with one lonely 10% short in the (QQQ). Markets are wildly overextended here; the Volatility Index ($VIX) is at a two-year low at $18, and my own Mad Hedge Market Timing Index is well into “SELL” territory at 70.

My invitation on the long side is wearing thin.

And while I’m at it, let me introduce one of my favorite secret economic indicators.

I call it the “Flat Tire Indicator”.

It goes something like this. The stronger the economy, the more trucks you have driving to new construction sites to build factories and homes. That means more trucks wearing out the roads, creating more potholes, and bouncing more nails out the back.

Tadah! You get more flat tires.

I am not citing this as some Ivory Tower, pie-in-the-sky academic theory. I spent the morning getting a flat tire on my Tesla Model X fixed. This wasn’t just any old tire I could pick up on sale at Big O Tires. It was a Pirelli Scorpion Zero 265/35 R22 All Season staggered racing tire.

Still, Tesla did well. From the time I typed in my request on the Tesla app on my smartphone to the time the repair was completed at my home, only 45 minutes had elapsed.

Still, $500 for a tire Elon? Really?

Elon Musk Ambushed the shorts, with a Massive Short Squeeze Hitting Tesla, up 80% in three weeks and far and away the top-performing major stock of 2023. Tesla now accounts for an incredible 7% of the entire options market. Bearish hedge funds are panicking. It’s dragging the rest of big tech with it. I think we are due for a rest around the Fed interest rates decision in three days. I warned you about an onslaught of good news coming out about Tesla. It has arrived!

Will This Week See the Last Interest Rate Hike, in this cycle on February 1? That’s what stocks seem to be discounting now, with the major indexes up almost every day this year. And even next week may only deliver a 25-basis point hike.

The Fed’s Favorite Inflation Indicator Fell in December, Core PCE up only 4.4% YOY. It’s fanned the tech flames for a few more days. The University of Michigan is calling for only 3.9%.

Q4 GDP is Up 2.9%, far higher than expected. This is becoming the recession that may not show. New car sales went ballistic and there were huge orders for Boeing. Bonds sold off on the news.

Recession Risk Falls, from a 98% probability to only 73% according to an advanced model from JP Morgan Bank. Other models say it’s dropped to only 50%. A soft landing is now becoming the conventional view. The view is most clearly seen in high-yield bonds which have recently seen interest rates plunge. This may become the recession that never happens.

Tech Layoffs Top 75,000, or 2% of the tech workforce. Most get two job offers on hitting the street from the thousands of garage startups percolating in San Francisco Bay Area garages, taking the Silicon Valley unemployment rate below 2%. All tech is losing is the froth it picked up during the pandemic. As I tell my kids, you want to work in the industry where 2% of the US population spin off 35% of America’s profits. Buy big tech on the coming dips.

Tesla Price Cuts Crush the EV Industry, in a clear grab by Elon for market share, already at 65% globally. Teslas are now the cheapest EVs in the world on a per mile basis, and with the new federal subsidies they now qualify for the discount rises to 35%. (GM), (F), and Volkswagen can’t match the cuts because they are already hemorrhaging money on EVs and lack the parts to appreciably boost production. Keep buying (TSLA) on dips, which is up $8 this morning.

Tesla Beats, on both earnings and guidance. It’s looking for 1.8 million vehicles sold in 2023 versus 2022 sales of 1.31 million. Elon is still planning on 50% annual growth over the foreseeable future. The shares jumped an incredible 12% on the news. The Cybertruck will roll out at the end of this year, and I am on the list. The recent price cuts were hugely successful, killing the EV competition, and could take 2023 production to 2 million. It all makes (TSLA) a strong buy and long-term hold on the next $20 dip.

China is Taking Over the Auto World and is the only country that outsold the US in EVs. The Middle Kingdom exported more than 2.5 million cars last year, taking it just behind Germany. The country is targeting 8 million exports by 2030, double Japan’s. What is not said is that most of these will go to low waged emerging countries without auto regulations, safety standards, or even laws. No Chinese cars were sold in the US, far and away the world’s largest market at 15 million units last year in a global market of 67.6 million.

Pending Home Sales Jump in December, up 2.5%, providing more green shoots for the real estate market. This is on a signed contracts-only basis, the best in 14 months. The January numbers will get a huge boost from dramatically lower mortgage rates.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, January 30 a6 7:30 AM EST, the Dallas Fed Manufacturing Index is announced. NXP Semiconductor (NXPI) reports.

On Tuesday, January 31 at 6:00 AM, the S&P Case Shiller National Home Price Index is updated. Caterpillar (CAT) reports.

On Wednesday, February 1 at 7:00 AM EST, the JOLTS Private Sector Job Openings are released. The Fed Interest Rate Decision is disclosed. Meta (META) reports.

On Thursday, February 2 at 8:30 AM EST, the Weekly Jobless Claims are announced. Apple (AAPL), Amazon (AMZN), and Alphabet (GOOGL) report.

On Friday, February 3 at 8:30 AM EST, the January Nonfarm Payroll Report is printed. Regeneron (REGN) reports.

At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, when Anne Wijcicki founded 23andMe in 2007, I was not surprised. As a DNA sequencing pioneer at UCLA, I had been expecting it for 35 years. It just came 70 years sooner than I expected.

For a mere $99 back then they could analyze your DNA, learn your family history, and be apprised of your genetic medical risks. But there were also risks. Some early customers learned that their father wasn’t their real father, learned of unknown brothers and sisters, that they had over 100 brothers and sisters (gotta love that Berkeley water polo team!) and other dark family secrets.

So, when someone finally gave me a kit as a birthday present, I proceeded with some foreboding. My mother spent 40 years tracing our family back 1,000 years all the way back to the 1086 English Domesday Book (click here).

I thought it would be interesting to learn how much was actually fact and how much fiction. Suffice it to say that while many questions were answered, alarming new ones were raised.

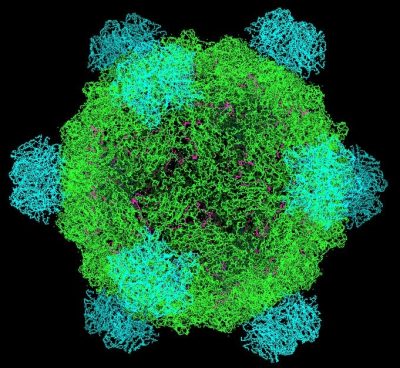

It turns out that I am descended from a man who lived in Africa 275,000 years ago. I have 311 genes that came from a Neanderthal. I am descended from a woman who lived in the Caucuses 30,000 year ago, which became the foundation of the European race.

I am 13.7% French and German, 13.4% British and Irish, and 1.4% North African (the Moors occupied Sicily for 200 years). Oh, and I am 50% less likely to be a vegetarian (I grew up on a cattle ranch).

I am related to King Louis XVI of France, who was beheaded during the French Revolution, thus explaining my love of Bordeaux wines, Chanel dresses, and pate foie gras.

Although both my grandparents were Italian, making me 50% Italian, I learned there is no such thing as a pure Italian. I come it at only 40.7% Italian. That’s because a DNA test captures not only my Italian roots, plus everyone who has invaded Italy over the past 250,000 years, which is pretty much everyone.

The real question arose over my native American roots. I am one sixteenth Cherokee Indian according to family lore, so my DNA reading should have come in at 6.25%. Instead. It showed only 3.25% and that launched a prolonged and determined search.

I discovered that my French ancestors in Carondelet, MO, now a suburb of Saint Louis, learned of rich farmland and easy pickings of gold in California and joined a wagon train headed there in 1866. The train was massacred in Kansas. The adults were massacred, and all the young children adopted into the tribe, including my great X 5 Grandfather Alf Carlat and his brother, then aged four and five.

When the Indian Wars ended in the 1870s, all captives were returned. Alf was taken in by a missionary and sent to an eastern seminary to become a minister. He then returned to the Cherokees to convert them to Christianity. By then Alf was in his late twenties so he married a Cherokee woman, baptized her, and gave her the name of Minto, as was the practice of the day.

After a great effort, my mother found a picture of Alf & Minto Carlat taken shortly after. You can see that Alf is wearing a tie pin with the letter “C” for his last name of Carlat. We puzzled over the picture for decades. Was Minto French or Cherokee? You can decide yourself.

Then 23andMe delivered the answer. Aha! She was both French and Cherokee, descended from a mountain man who roamed the western wilderness in the 1840s. That is what diluted my own Cherokee DNA from 6.50% to 3.25%. And thus, the mystery was solved.

The story has a happy ending. During the 1904 World’s Fair in St. Louis (of Meet me in St. Louis fame), Alf, then 46 placed an ad in the newspaper looking for anyone missing a brother from the 1866 Kansas massacre. He ran the ad for three months and on the very last day his brother answered and the two were reunited, both families in tow.

Today, it costs $169 to get you DNA analyzed, but with a much larger data base it is far more thorough. To do so click here at https://www.23andme.com

My DNA has Gotten Around

It All Started in East Africa

1880 Alf & Minto Carlat, Great X 5 Grandparents

My New Coincident Economic Indicator

Global Market Comments

January 27, 2023

Fiat Lux

Featured Trade:

(JANUARY 25 BIWEEKLY STRATEGY WEBINAR Q&A),

(RIVN), ($VIX), (SPX), (UUP), (NVDA), (TLT), (LLY), (AAPL), (RTX), (LMT), (USO), (OXY), (TSLA), (UNG), (MSFT)

CLICK HERE to download today's position sheet.

Below please find subscribers’ Q&A for the January 25 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: What do you think about LEAPS on Rivian (RIVN)?

A: Yes, I would do those, but a smaller position with closer strike prices. Go to the maximum maturity 2 years out and be conservative—bet on only a 50% rise in the stock. I’m sure it’ll double, but with the LEAPS you’ll have tremendous upside leverage, like 10 to 1, so don’t get greedy. Go for the 500% profit in 2 years rather than the 1,000%, because it is still a startup, and we need economic recovery for startups to get traction. If anything, Tesla (TSLA) will drag this stock back up as it dragged it down. They all move together.

Q: What’s the number of contracts on your $100,000 model portfolio?

A: Our model portfolio basically assumes we have 10 positions of $10,000 each totaling $100,000 in value. You can then change the number of contracts to suit your own private portfolio—take on as much or as little risk as you want. If you’re new. I recommend trading on paper first to make sure you can make money before you use the real thing.

Q: I’m new to this service. What’s the difference between the long-term portfolio and the short-term portfolio?

A: A long term portfolio is a buy-and-forget portfolio, with maybe a 5- or 10-year view. We only change it and make adjustments twice a year so we can average back into the new positions and take profits on the old ones. The main part of this service is usually front-month, and that’s where we take advantage of anomalies in the options market and market timing to make profits 95% of the time. And a big part of the short-term portfolio is cash; we often go 100% cash when there are no trades to be had. It’s actually more valuable knowing when not to trade than when to trade. If you have any more questions, just email customer support at support@madhedgefundtrader.com and we’ll address them individually.

Q: Is it time for a CBOE Volatility Index ($VIX) trade?

A: I hate trading ($VIX). I only do it from the short side; when you get down to these low levels it can flatline for several months, and the time decay eats you to death. I only do it from the short side, and then only the 5% of the time that we’re peaking in ($VIX). The big money is made on the short side, that’s how virtually the entire options trading industry trades this.

Q: Would you be loading up with LEAPS in February?

A: No, it’s the worst time to do LEAPS. You do LEAPS at long-term market bottoms like we had in October, and then we issued 12 different LEAPS. If you get a smaller pullback, there may be LEAPS opportunities, but only in sectors that are near all-time lows, like gold or silver. It depends on the industry and where we are in the market, but basically, you’re looking to do LEAPS at lows for the year because the leverage is so enormous, and so are the potential profits.

Q: Is the increasing good performance a result of your artificial intelligence? Learning from past mistakes?

A: Partly yes, and partly my own intelligence is improving. Believe it or not, when you go from year 54 to 55 in experience in the markets, you understand a lot more about the markets. Sometimes you just get lucky being on the right side of black swan events. Of course, knowing when the market is especially sensitive and prone to black swans is also a handy skill to have.

Q: Is it too late to get into Freeport McMoRan (FCX)?

A: Yes, I wouldn’t touch (FCX) until we get at least a $10 selloff, which we may get in February, so I think the long term target for (FCX) is $100. The stock has nearly doubled since the LEAPS went out in October from $25 a share to almost $50, so that train has left the station. Better off to wait for the next train or find another stock, there are a lot of them.

Q: Where do you park cash in the holding pattern?

A: Very professional hedge fund managers buy 90-day T-bills, because if you keep your cash in your brokerage account—their cash account—and they go bankrupt, it’ll take you 3 years to get your money back in a bankruptcy proceeding. If you own 90-day T-bills and your broker goes bankrupt, they’re required by law to just hand over the T-bills to you immediately. You take delivery of the T-bills, you park them at another brokerage house, and you keep them there. There is no loss of the use of funds.

Q: What about Long term US dollar (UUP)?

A: We go down for 10 years. Falling interest rates are poison for a currency; our rates are probably going to be falling for the next several years.

Q: Thoughts on Tesla (TSLA)?

A: Short term way overbought, we almost got up 60% from the low in weeks, but that’s Tesla, that’s just how it trades. It is the best performing major stock in the market this year. I wouldn’t be looking to go back into it until we drop back, give up half of that gain, get back down to about $135—then it would be a good options trade and a good LEAPS.

Q: Would you be taking profits in Nvidia (NVDA)?

A: I would take like half here and look to buy it back on the next dip because I think Nvidia’s got higher highs ahead of it.

Q: I can’t get a password for the website.

A: Please contact customer support on the homepage and they will set you up immediately. If not, you can call them at (347) 480-1034.

Q: Would you be selling long term positions?

A: No I would not, because if you sell a long term position they’re very hard to get back into; and I’m expecting $4,800 in the (SPX) by the end of the year. Everything goes up by the end of the year, even things you hate. So no, selling is what you did a year ago, now you’re basically looking for chances to get back in.

Q: Would you hold Tesla (TSLA) over this earnings report?

A: No, I sold my position yesterday, at 70% of its maximum potential profit. I don't need substantial selloff; I’m just going to go right back in again.

Q: Have you heard anything about Tesla silicon roof tiles tending to catch fire?

A: No I have not, but if your house got struck by lightning or if someone fired a bullet at it, that might do the trick. Otherwise, you need a huge input of energy to get silicon to catch on fire as it’s a pretty stable element. And if it was already happening on a large scale, you know the media would be absolutely all over it—the media loves to hate Tesla and loves to hate Elon Musk. That certainly would draw attention if it were happening; what's more likely is that fake news is spreading rumors that are not true. That's been a constant problem with Tesla from the very beginning.

Q: Would you open the occidental spread here today?

A: I would, but I would use strike prices $5 lower. I'd be doing the February $50-$55 vertical bull call spread to give yourself some extra protection, given that the general market itself is so high.

Q: Should I be shorting Apple (APPL) here?

A: No, but the smart thing to do is to sell the $160 calls because I don’t think we’ll get up to $160. You could take any extra premium income, and if you don’t get hit this month, keep doing it every month until you are hit, and then you can take in quite a lot of premium income by the time we get to new highs in Apple, possibly as much as $10 or $15. So, that would be a smart thing to do with Apple.

Q: What's your favorite in biotech and big pharma?

A: Eli Lilly (LLY), which just doesn't seem to let anybody in.

Q: If China were to shut down again, would it hurt the stock market?

A: Yes, but not much. The much bigger falls would be in Chinese stocks (which have already doubled since October) not ours.

Q: Thoughts on biotech?

A: Biotech is the new safety trade that will continue. Also, they’re having their secular ramp-up in technology and new drugs so that is also a good long-term bull call on biotech.

Q: What’s the dip in iShares 20+ Year Treasury Bond ETF (TLT)?

A: $4 points at a minimum, $5 is a nice one, $6 would be fantastic if you can get it.

Q: Could we get a trade-up in oil (USO)?

A: Yes, maybe $5 or $10 a barrel. But it’s just that, a trade. Long term, oil still goes to zero. Short term, China recovery gives a move up in oil and that's why we went long (OXY).

Q: You talk about California NatGas being dead, but California gets 51% of its electricity from natural gas, up from 48% in 2018.

A: Yes, but that counts all of the natural gas that gets brought in from other states. In fact, if you look at the longer-term trend over the last 20 years, coal has gone to zero, nuclear is going to zero, hydro has remained the same at about 10%. NatGas has been falling and green sources like wind and solar, have been rising quite substantially. And now, approximately 25% of all the homes in California get solar energy, or 8.4 million homes, and it is now illegal to put gas piping into any new construction. New York is doing the same. That means it will be illegal to do new natural gas installations in a third of the country. So, I think that points to lower natural gas consumption, and in fact, the 22-year target is to take it to zero, which might be optimistic but you never know. All they need is a smallish improvement in solar technology, and that 100% from green sources is doable by 2045, not only for California but for everybody. All energy plays are a trade only, not an investment.

Q: Any thoughts on the implications for the US and Germany providing tanks to Ukraine?

A: You can throw Poland in there, which is also contributing a tank division—so a total of 58 M1 Abrams tanks are going to Ukraine. By the way, I did command a Marine Corps tank battalion for two weeks on my reserve duty, so I know them really well inside and out. They are powered by a turbine engine, have a suspension as soft as a Cadillac, a laser targeting system accurate to three miles even for beginners, and fire recycled uranium shells that can cut through anything like a knife through butter. The answer is the war gets prolonged, and eventually forces Russia into a retreat or a negotiation. Even though the M1 is an ancient 47-year-old design, its track record against the Russian T72 is pretty lopsided. In the first Gulf War, the US destroyed 5,000 T72s and the US lost one M1 tank because he parked on a horizon, which you should never do with a tank. And every driver of a T72 knows that track record. So that explains why Russian tanks have been running out of gas, sugaring their gas tanks, sabotaging their diesel engines, and doing everything they can to avoid combat because of massive fatal design flaws in the T72. We only need to provide about 50 or 60 of the M1 tanks as a symbolic gesture to basically scare the entire Russian tank force away.

Q: Why do you think Elon kept selling Tesla? Did he think it would go lower?

A: Elon thinks the stock’s going to $10,000, but he needed up-front cash to build out six remaining Tesla factories, and for that, he needed about $40 billion, which is why he sold $40 billion worth of stocks last year when it was peaking. He also is sensitive to selling at tops; it’s better to sell stock in with Tesla at an all-time high than at an all-time low, so he clearly times the market to meet his own cash flows.

Q: What about military contractors?

A: I know Raytheon (RTX) and Lockheed Martin (LMT) have a two-year backlog in orders for javelin missiles and stingers, which are now 47-year-old technology that has to be redesigned from scratch. The US just placed an order for a 600% increase in artillery shells for the 155 mm howitzer. I thought we’d never use these again, which is why US stocks for ammunition got so low. But it looks like we have more or less a long term or even permanent customer in Ukraine for everything we can produce, in old Vietnam-era style technologies. How about that? I’m telling the military to give them everything we’ve got because everything we’ve got is obsolete.

Q: When should we buy Microsoft (MSFT)?

A: On the next 10% dip. It’s the quality stock in the US.

Q: Do you place an order to close the spread at profit as soon as you have filled in the trade?

A: You can do that, but it’s kind of a waste of time. Wait until we get close to the strikes; most of the big companies we deal in, you don't get overnight 10% or 20% moves, although it does happen occasionally.

Q: Natural Gas (UNG) prices are collapsing.

A: Correct, because the winter energy crisis in Europe never showed and spring is just around the corner.

Q: On the Tesla (TSLA) LEAPS, what about the January 2025 $600-$610 vertical bull call spread

A: That is way too far out of the money now. I would write that off and go back into it but do something like a January 2025 $180-$190. It has a much higher probability of going in the money, and still an extremely high return. It would be something like 500% if you get in down at these levels.

Q: How do you see Bitcoin short term/long term?

A: I think the loss of confidence in the asset has been so damaging that it may not come back in my lifetime. It could be another Tokyo situation where it takes 30 years to recover, or only recovers when the entire sector gets taken over by the big banks. So, I don’t see any merit in the crypto trade, probably forever. Once you lose confidence in the financial markets, it’s impossible to get it back. And it turns out that every one of these mainline trading platforms was stealing from the customers. No one ever comes back from that in the financial markets.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

At 29 Palms in my M1 Abrams Tank in 2000

Global Market Comments

January 20, 2023

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

CLICK HERE to download today's position sheet.

Some 50 years ago, when I was a biotechnology student at UCLA, a handful of graduate students speculated about how dangerous our work really was.

It only took us an hour to figure out how to synthesize a microbe that had a 99% fatality rate, was immune to antibiotics and was so simple it could be produced in your home kitchen.

Basically, a bunch of bored students discovered a way to destroy the world.

We voiced our concerns to our professors, who immediately convened a national conference of leaders in the field. Science had outpaced regulation, as it always does. They adopted standards and implemented safeguards to keep this genie from getting out of the bottle.

Four decades later scientists have been successful at preventing a “doomsday” bug from accidentally escaping a lab and wiping out the world’s population.

That is, until now.

In 2010, Dr. Craig Venter created the first completely synthetic life form able to reproduce on its own. Named “Phi X174,” the simple virus was produced from a string of DNA composed entirely on a computer. Thus was invented the field of synthetic biology, better known as “Synbio.”

Venter’s homemade creature was your basic entry-level organism. Its DNA was composed of only 1 million base pairs of nucleic acids (adenine, thymine, cytosine, guanine, and uracil), compared to the 3 billion pairs in a human genome. Shortly thereafter, Venter one-upped himself by manufacturing the world’s first synthetic bacteria.

The work was hailed as the beginning of a brave new world that will enable biology to make the same dramatic advances in technology that computer science did in the 20th century. Dr. Drew Endy of Stanford University says that Synbio already accounts for 2% of US GDP and is growing at a breakneck 12% a year. He predicts that Synbio will eventually do more for the economy than the Internet and social media combined.

You may recall Craig Venter as the man who first decoded the human genome in 2003. The effort demanded the labor of thousands of scientists and cost $3 billion. We later learned that the DNA that was decoded was Craig’s own. Some five years later, the late Steve Jobs spent $1 million to decode his own genes in a vain attempt to find a cure for pancreatic cancer.

Today, you can get the job done for $1,000 in less than 24 hours. That’s what movie star Angelina Jolie did, who endured a voluntary double mastectomy when she learned her genes guaranteed a future case of terminal breast cancer.

The decoding industry is now moving to low-cost China, where giant warehouses have been built to decode the DNA of a substantial part of humanity. That should soon drop the price to $100. It’s all about full automation and economies of scale.

This technology is already spreading far faster than most realize. In 2004, MIT started the International Genetically Engineered Machine Contest where college students competed to construct new life forms. Recently, a high school division was opened, attracting 194 entries from kids in 34 countries. Gee, when I went to wood shop in high school, it was a big deal when I finished my table lamp.

This will make possible “big data” approaches to medical research that will lead to cures of every major human disease, such as cancer, heart disease, diabetes, and more within our lifetimes. This is why the healthcare (XLV), biotechnology (XBI), and pharmaceutical (XPH) sectors have been top performers in the stock market for the past two years. It’s not just about Obamacare.

The implications spread far beyond healthcare. IBM (IBM) is experimenting with using DNA-based computer code to replace the present simple but hugely inefficient binary system of 0’s and 1’s. “DNA-based computation” is prompting computer scientists to become biochemists and biochemists to evolve into computer scientists to create “living circuit boards.” Google (GOOG), Apple (AAPL), and Cisco (CSCO) have all taken notice.

We are probably only a couple of years away from enterprising hobbyists downloading DNA sequences from the Internet and building new bugs at home with a 3D printer. Simple organisms, like viruses, would need a file size no larger than one needed for a high-definition photo taken with your iPhone. They can then download other genes from the net, creating their own customized microbes at will.

This is all great news for investors of every stripe, and will no doubt accelerate America’s economic growth. But it is also causing governments and scientists around the world to wring their hands, seeing the opening of a potential Pandora’s box. What if other scientists lack Venter’s ethics, who went straight to President Obama for security clearance before he made his findings public?

If we can’t trust our kids to drink, drive, or vote, then how responsibly will they behave when they get their hands on potential bioterror weapons? How many are familiar with Bio Safety Level 4 (BSL) standards? None, I hope.

In fact, the race is already on to weaponize synbio. In 2002, scientists at SUNY Stonybrook synthesized a poliovirus for the first time. In 2005, another group managed to recreate the notorious H1N1 virus that caused the 1918 Spanish Flu epidemic. Some 50-100 million died in that pandemic within 2 years.

Then in 2011, Ron Fouchier of the Erasmus Medical Center in Holland announced that he had found a way to convert the H5N1 bird flu virus, which in nature is only transmitted from birds to people, into a human to human virus. Of the 565 who have come down with bird flu so far, which originates in China, 59% have died.

It didn’t take long for the Chinese to get involved. They have taken Fouchier’s work several steps further, creating over 127 H5N1 flu varieties, five of which can be transmitted through the air, such as from a sneeze. The attributes of one of these just showed up in the latest natural strain of bird flu, the H7N9.

The World Health Organization (WHO) and the Center for Disease Control (CDC) in Atlanta, Georgia are charged with protecting us from outbreaks like this. But getting the WHO, a giant global bureaucracy, to agree on anything is almost impossible unless there is already a major outbreak underway. The CDC has seen its budget cut by 25% since 2010 and has lost another 5% due to the US government sequester.

The problem is that the international organizations charged with monitoring all of this are still stuck in the Stone Age. Current regulations revolve around known pathogens, like smallpox and the Ebola virus, that date back to the 1960s when the concern was about moving lethal pathogens across borders via test tubes.

That is, oh so 20th century. Thanks to the Internet, controlling information flow is impossible. Just ask Muammar Gaddafi and Bashar Al Assad. Al Qaida has used messages embedded in online porn to send orders to terrorists.

Getting international cooperation isn’t that easy. Only 35 countries are currently complying with the safety, surveillance, and research standards laid out by the WHO. Indonesia refused to part with H5N1 virus samples spreading there because it did want to make rich the western pharmaceutical companies that would develop a vaccine. African countries say they are too poor to participate, even they are the most likely victims of future epidemics.

Scientists have proposed a number of safeguards to keep these new superbugs under control. One would be a dedicated sequence of nucleic acid base pairs inserted into the genes that would identify its origin, much like a bar code at the supermarket. This is already being used by Monsanto (MON) with its genetically modified seeds. Another would be a “suicide sequence” that would cause the germ to self-destruct if it ever got out of a lab.

One can expect the National Security Agency to get involved, if they haven’t done so already. If they can screen our phone calls for metadata, why not high-risk DNA sequences sent by email?

But this assumes that the creators want to be found. The bioweapon labs of some countries are thought to be creating new pathogens so they can stockpile vaccines and antigens in advance of any future conflict.

There are also the real terrorists to consider. When the Mubarak regime in Egypt was overthrown in 2011, demonstrators sacked the country’s public health labs that had been storing H5N1 virus. Egypt has one of the world’s worst bird flu problems, due to the population’s widespread contact with chickens.

It is hoped that the looters were only in search of valuable electronics they could resell, and tossed the problem test tubes. But that is only just a hope.

I have done a lot of research on this area over the decades. I even chased down the infamous Unit 731 of the Japanese Imperial Army that parachuted plagued infected rats into China during WWII, after first experimenting on American POWs.

The answer to the probability of biowarfare always comes back the same. Countries never use this last resort for fear of it coming back on their own population. It really is an Armageddon weapon. Only a nut case would want to try it.

Back in 1976, I was one of the fortunate few to see in person the last living cases of smallpox. As I walked through a 15th century village high in the Himalayas in Nepal, two dozen smiling children leaned out of second-story windows to wave at me. The face of everyone was covered with bleeding sores. And these were the survivors. Believe me, you don’t want to catch it yourself.

Sure, I know this doesn’t directly relate to what the stock market is going to do today. But if a virus escaped from a rogue lab and killed everyone on the planet, it would be bad for prices, wouldn’t it?

I really hope one of the kids competing in the MIT contest doesn’t suffer from the same sort of mental problems as the boy in Newton, Connecticut did.

Global Market Comments

January 11, 2023

Fiat Lux

Featured Trades:

(TESTIMONIAL)

(A BUY WRITE PRIMER)

(AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: